Form M-45 Instructions For Making Estimated Tax Payment

ADVERTISEMENT

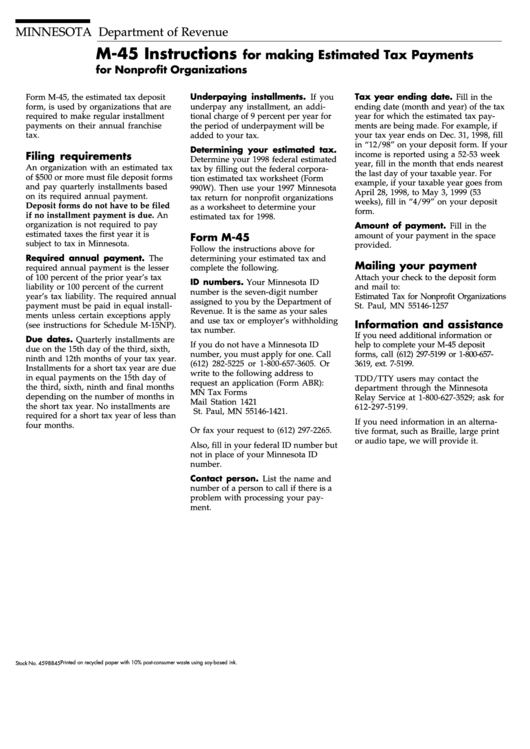

MINNESOTA Department of Revenue

M-45 Instructions

for making Estimated Tax Payments

for Nonprofit Organizations

Underpaying installments. If you

Tax year ending date. Fill in the

Form M-45, the estimated tax deposit

form, is used by organizations that are

underpay any installment, an addi-

ending date (month and year) of the tax

required to make regular installment

tional charge of 9 percent per year for

year for which the estimated tax pay-

ments are being made. For example, if

payments on their annual franchise

the period of underpayment will be

tax.

added to your tax.

your tax year ends on Dec. 31, 1998, fill

in “12/98” on your deposit form. If your

Determining your estimated tax.

Filing requirements

income is reported using a 52-53 week

Determine your 1998 federal estimated

year, fill in the month that ends nearest

An organization with an estimated tax

tax by filling out the federal corpora-

the last day of your taxable year. For

of $500 or more must file deposit forms

tion estimated tax worksheet (Form

example, if your taxable year goes from

and pay quarterly installments based

990W). Then use your 1997 Minnesota

April 28, 1998, to May 3, 1999 (53

on its required annual payment.

tax return for nonprofit organizations

weeks), fill in “4/99” on your deposit

Deposit forms do not have to be filed

as a worksheet to determine your

form.

if no installment payment is due. An

estimated tax for 1998.

organization is not required to pay

Amount of payment. Fill in the

estimated taxes the first year it is

Form M-45

amount of your payment in the space

subject to tax in Minnesota.

provided.

Follow the instructions above for

Required annual payment. The

determining your estimated tax and

Mailing your payment

required annual payment is the lesser

complete the following.

of 100 percent of the prior year’s tax

Attach your check to the deposit form

ID numbers. Your Minnesota ID

liability or 100 percent of the current

and mail to:

number is the seven-digit number

year’s tax liability. The required annual

Estimated Tax for Nonprofit Organizations

assigned to you by the Department of

payment must be paid in equal install-

St. Paul, MN 55146-1257

Revenue. It is the same as your sales

ments unless certain exceptions apply

and use tax or employer’s withholding

Information and assistance

(see instructions for Schedule M-15NP).

tax number.

If you need additional information or

Due dates. Quarterly installments are

If you do not have a Minnesota ID

help to complete your M-45 deposit

due on the 15th day of the third, sixth,

number, you must apply for one. Call

forms, call (612) 297-5199 or 1-800-657-

ninth and 12th months of your tax year.

(612) 282-5225 or 1-800-657-3605. Or

3619, ext. 7-5199.

Installments for a short tax year are due

write to the following address to

in equal payments on the 15th day of

TDD/TTY users may contact the

request an application (Form ABR):

the third, sixth, ninth and final months

department through the Minnesota

MN Tax Forms

depending on the number of months in

Relay Service at 1-800-627-3529; ask for

Mail Station 1421

the short tax year. No installments are

612-297-5199.

St. Paul, MN 55146-1421.

required for a short tax year of less than

If you need information in an alterna-

four months.

Or fax your request to (612) 297-2265.

tive format, such as Braille, large print

or audio tape, we will provide it.

Also, fill in your federal ID number but

not in place of your Minnesota ID

number.

Contact person. List the name and

number of a person to call if there is a

problem with processing your pay-

ment.

Printed on recycled paper with 10% post-consumer waste using soy-based ink.

Stock No. 4598845

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1