BOE-501-PS (S3B) REV. 5 (7-07)

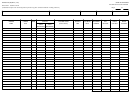

Preparation of the Tax Computation Worksheet

The Tax Computation Worksheet is provided to assist you in calculating the tax due and completing your return. (This

worksheet should be kept with your records. Do not send the worksheet with your return.) All other motor vehicle fuel

(gasoline, gasoline blendstocks, and gasohol) and aviation gasoline, must be reported separately in columns A and B,

respectively on the worksheet. Add the totals from column 11 on each of the schedules for all other motor vehicle fuel and

aviation gasoline to determine the total gallons to be included in each column of the worksheet.

A. Taxable Transactions

Line 1. Enter the total gallons of motor vehicle fuel removed from California terminal racks that were subject to tax during

the reporting period by adding the totals from column 11 for each disbursement schedule coded 5.

Line 2. Enter the total gallons of motor vehicle fuel sold above the rack to unlicensed parties that were subject to tax

during the reporting period by adding the totals from column 11 for each disbursement schedule coded 5A.

Line 3. Enter the total gallons of untaxed products blended with or added to motor vehicle fuel resulting in a product

which is used as or usable as motor vehicle fuel by adding the totals from column 11 for each disbursement

schedule coded 5W.

Line 4. Enter the total gallons of ex-tax blendstocks entered, removed from a California terminal rack, or purchased with

an exemption certificate and resold to a person not furnishing an exemption certificate by adding the totals from

column 11 for each disbursement schedule coded 5V.

Line 5. Enter the total gallons of ex-tax motor vehicle fuel imported into California below the terminal rack by adding the

totals from column 11 for each receipt schedule coded 3X for taxable products. Refer to forms BOE-810-FTA or

BOE-810-FTB for a list of taxable products.

Line 6. Enter the total gallons of miscellaneous motor vehicle fuel transactions that are subject to tax by adding the

totals from column 11 for each disbursement schedule coded S02A.

Line 7. Enter the subtotal of gallons of motor vehicle fuel transactions subject to tax by adding lines 1 through 6 for

columns A and B.

Line 8. Enter the total gallons of motor vehicle fuel transactions that were subject to tax during the reporting period by

adding line 7, columns A and B. Also enter this total on line 1 of section C of the worksheet.

B. Tax-Paid Credits

Line 1. Enter the total gallons of tax-paid motor vehicle fuel exported below the California terminal racks by adding the

totals from column 11 for each disbursement schedule coded 13A.

Line 2. Enter the total gallons of tax-paid motor vehicle fuel sold to a consulate officer or employee by credit card by

adding the totals from column 11 for each disbursement schedule coded 13B.

Line 3. Enter the total gallons of tax-paid aviation fuel sold to the Armed Forces of the United States for use in ships or

aircraft by adding the totals from column 11 for each disbursement schedule coded 13C.

Line 4. Enter the total gallons of tax-paid motor vehicle fuel allowed to be taken as a tax-paid credit by adding the totals

from column 11 for each summary schedule coded S03A.

Line 5. Enter the subtotal of tax-paid credits by adding lines 1 through 4 for columns A and B.

Line 6. Enter the total gallons that were subject to a credit during the reporting period by adding line 5, columns A and

B. Also enter this total on line 2 of section C on the worksheet.

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9