INSTRUCTIONS

General information

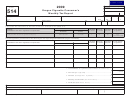

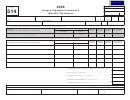

• Line 1. Enter the total number of untaxed cigarettes purchased during the

reporting period (add numbers in column G).

If you have purchased cigarettes over the Internet, by telephone, mail order, or

• Line 3. Tax due. Multiply the number of cigarettes entered on line 1 by 0.059.

any other source, you are responsible for paying the tax. If the distributor does

Example:

not pay the tax, the consumer or user of the cigarettes must file a report and

remit the tax due. You must file a separate Form 514 for each month you made

Total number of cigarettes

Tax per cigarette

Tax due

purchases. The report is due on or before the 20th day of the month following

200

x

$0.059

=

$11.80

receipt of the cigarettes for the preceding calendar month. If the 20th falls on a

400

x

$0.059

=

$23.60

Saturday, Sunday, or legal holiday, the report is due the next business day. The

1,000

x

$0.059

=

$59.00

report must show the number of cigarettes received by the consumer or user in

• Line 4. Penalty and interest. A penalty is imposed if you mail your report and

the preceding calendar month. The tax is $0.059 per cigarette, which calculates

pay the tax after the tax due date. The report is due on or before the 20th day of

to $1.18 per package of 20.

the month following receipt of the cigarettes for the preceding calendar month.

What is the applicable law? This publication is not a complete statement of

The penalty is 5 percent of the unpaid tax. If you file more than thirty days after

Oregon laws. For more information, refer to the laws and rules, Oregon Revised

the due date, add an additional penalty of 20 percent of the unpaid tax.

Statutes (ORS) 323.005 through 323.995.

Interest is imposed on any unpaid tax from the due date until the date pay-

ment in full is received. The interest rate as of January 1, 2007, is 9 percent

Reporting instructions

annually, or 0.7500 percent (0.007500) per month, or 0.0247 percent (0.000247)

• Use a separate Form 514 for each month you made purchases.

per day. The interest rate may change once a calendar year.

• Please use blue or black ink when filling out this form.

• Line 5. Total due (add lines 3 and 4).

• Enter information in the boxes at the top as follows:

• Declaration. Sign and date your report, and include your telephone number.

— Reporting period / Month: Enter the month that you received the cigarettes

Please do not use red ink or staple your check or money order to this report.

(January, February, March, etc.).

• Mail this report with your check payable to: Cigarette Tax

— Social Security number (SSN): If purchases were for personal use, enter

Oregon Department of Revenue

your SSN.

PO Box 14110

— Oregon business identification number (BIN): If you are a business, enter

Salem OR 97309-0910

your BIN.

• Please keep a copy of your completed form with your records.

— Period: Enter “1” for January, “2” for February, etc., through December.

• Enter your name, mailing address, city, state, and ZIP code.

Taxpayer assistance

• Column A. Enter distributor name from whom you purchased cigarettes.

General tax information ....................................................

• Column B. Enter the invoice number received with your shipment.

Tax Services ...........................................................................................503-378-4988

• Column C. Enter the invoice date.

Tax Services: Toll-free from an Oregon prefix ..............................1-800-356-4222

• Column D. Enter total number of cartons ordered from distributor.

Salem Tobacco Compliance Unit .......................................................503-945-8120

• Column E. Enter number of packs in each carton.

Salem tip line ........................................................................................503-947-2106

• Column F. Enter number of cigarettes in each pack.

Toll-free tip line .................................................................................1-866-840-2740

• Column G. Enter the total of column D x column E x column F. Example:

Asistencia en español: Salem .............................................................503-378-4988

D. Number

E. Packs per

F. Cigarettes

G. Total number

Gratis de prefijo de Oregon .....................1-800-356-4222

of cartons

carton

per pack

of cigarettes

1

x

10

x

20

=

200

TTY (hearing or speech impaired; machine only):

2

x

10

x

20

=

400

Salem .....................................................................................................503-945-8617

5

x

10

x

20

=

1,000

Toll-free from an Oregon prefix ......................................................1-800-886-7204

Americans with Disabilities Act (ADA): Call one of the help numbers for in-

formation in alternative formats.

150-105-013 (12-07)

1

1 2

2