Reset Form

Print Form

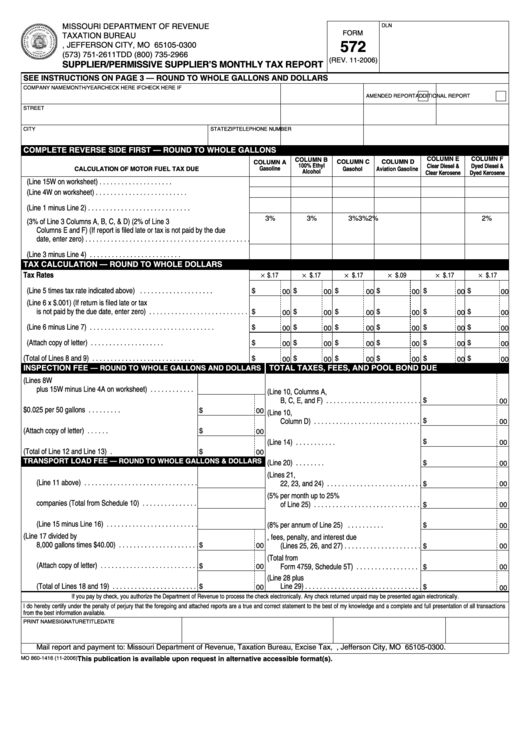

MISSOURI DEPARTMENT OF REVENUE

DLN

FORM

TAXATION BUREAU

572

P.O. BOX 300, JEFFERSON CITY, MO 65105-0300

(573) 751-2611

TDD (800) 735-2966

(REV. 11-2006)

SUPPLIER/PERMISSIVE SUPPLIER’S MONTHLY TAX REPORT

SEE INSTRUCTIONS ON PAGE 3 — ROUND TO WHOLE GALLONS AND DOLLARS

COMPANY NAME

MONTH/YEAR

CHECK HERE IF

CHECK HERE IF

AMENDED REPORT

ADDITIONAL REPORT

STREET ADDRESS

P.O. BOX

LICENSE NUMBER

FEIN

CITY

STATE

ZIP

TELEPHONE NUMBER

COMPLETE REVERSE SIDE FIRST — ROUND TO WHOLE GALLONS

COLUMN E

COLUMN F

COLUMN B

COLUMN C

COLUMN D

COLUMN A

100% Ethyl

Clear Diesel &

Dyed Diesel &

Gasoline

CALCULATION OF MOTOR FUEL TAX DUE

Gasohol

Aviation Gasoline

Alcohol

Clear Kerosene

Dyed Kerosene

1. Gross taxable gallons (Line 15W on worksheet) . . . . . . . . . . . . . . . . . . . .

2. Tax adjustments (Line 4W on worksheet) . . . . . . . . . . . . . . . . . . . . . . . . .

3. Taxable gallons (Line 1 minus Line 2) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3%

3%

3%

3%

2%

2%

4. Allowance (3% of Line 3 Columns A, B, C, & D) (2% of Line 3

Columns E and F) (If report is filed late or tax is not paid by the due

date, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5. Net taxable gallons (Line 3 minus Line 4) . . . . . . . . . . . . . . . . . . . . . . . . .

TAX CALCULATION — ROUND TO WHOLE DOLLARS

× $.17

× $.17

× $.17

× $.09

× $.17

× $.17

Tax Rates

6. Tax due (Line 5 times tax rate indicated above) . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

$

00

00

00

00

00

00

7. Supplier credit (Line 6 x $.001) (If return is filed late or tax

is not paid by the due date, enter zero) . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

$

00

00

00

00

00

00

8. Tax due (Line 6 minus Line 7) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

$

00

00

00

00

00

00

9. Credit/debit authorization (Attach copy of letter) . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

$

00

00

00

00

00

00

10. Total tax due (Total of Lines 8 and 9) . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

$

$

$

$

$

00

00

00

00

00

00

INSPECTION FEE

— ROUND TO WHOLE GALLONS AND DOLLARS

TOTAL TAXES, FEES, AND POOL BOND DUE

11. Gallons subject to inspection fee (Lines 8W

plus 15W minus Line 4A on worksheet) . . . . . . . . . . . .

21. Total fuel taxes due (Line 10, Columns A,

$

B, C, E, and F) . . . . . . . . . . . . . . . . . . . . . . . . . .

00

12. Inspection fee due at $0.025 per 50 gallons . . . . . . . . .

$

00

22. Total aviation gasoline tax due (Line 10,

$

Column D) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

00

13. Credit/debit authorization (Attach copy of letter) . . . . . .

$

00

23. Total inspection fee due (Line 14) . . . . . . . . . . .

$

00

14. Total inspection fee due (Total of Line 12 and Line 13) .

$

00

TRANSPORT LOAD FEE

— ROUND TO WHOLE GALLONS & DOLLARS

24. Total transport load fee due (Line 20) . . . . . . . .

$

00

15. Gallons subject to transport load fee

25. Total tax and fees due (Lines 21,

(Line 11 above) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

22, 23, and 24) . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

16. Gallons sold to railroad corporations and airline

26. Penalty (5% per month up to 25%

companies (Total from Schedule 10) . . . . . . . . . . . . . . .

of Line 25) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

17. Total gallons subject to transport load fee

(Line 15 minus Line 16) . . . . . . . . . . . . . . . . . . . . . . . . .

27. Interest (8% per annum of Line 25) . . . . . . . . . .

$

00

18. Transport load fee (Line 17 divided by

28. Total taxes, fees, penalty, and interest due

8,000 gallons times $40.00) . . . . . . . . . . . . . . . . . . . . . .

$

(Lines 25, 26, and 27) . . . . . . . . . . . . . . . . . . . . .

00

$

00

19. Credit/debit authorization

29. Pool bond collections (Total from

(Attach copy of letter) . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

Form 4759, Schedule 5T) . . . . . . . . . . . . . . . . .

$

00

20. Total transport load fee due

30. Total amount remitted (Line 28 plus

(Total of Lines 18 and 19) . . . . . . . . . . . . . . . . . . . . . . .

Line 29) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

00

$

00

If you pay by check, you authorize the Department of Revenue to process the check electronically. Any check returned unpaid may be presented again electronically.

I do hereby certify under the penalty of perjury that the foregoing and attached reports are a true and correct statement to the best of my knowledge and a complete and full presentation of all transactions

from the best information available.

PRINT NAME

SIGNATURE

TITLE

DATE

Mail report and payment to: Missouri Department of Revenue, Taxation Bureau, Excise Tax, P.O. Box 300, Jefferson City, MO 65105-0300.

MO 860-1416 (11-2006)

This publication is available upon request in alternative accessible format(s).

1

1 2

2 3

3 4

4