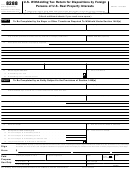

BOE-501-WG (S1B) REV. 11 (7-07)

SCHEDULE A

SUMMARY OF WINE IN BOND

(TRANSFERRED, EXPORTED, AND IN INVENTORY)

STILL WINE

C

A

B

BULK WINES

OVER 14 PERCENT

SPARKLING WINE

NOT OVER 14 PERCENT

(Gallons)

(Gallons)

(Gallons)

Within California

1a.

Transferred to

1.

other wine cellars

Without California

1b.

2. In bond wine exported

2.

3. Inventory on hand at end of reporting report 3.

STILL WINE

A

B

C

BOTTLED WINES

OVER 14 PERCENT

NOT OVER 14 PERCENT

SPARKLING WINE

(Gallons)

(Gallons)

(Gallons)

Within California

4a.

Transferred to

4.

other wine cellars

Without California

4b.

5. In bond wine exported

5.

6. Inventory on hand at end of reporting report 6.

INSTRUCTIONS - WINEGROWER TAX RETURN

Credit Card Payments. You can use a Discover/Novus, MasterCard, VISA, or American Express credit card to pay your taxes.

Other credit cards cannot be accepted. EFT accounts are not eligible for credit card payments. Credit card payments can be

made by calling 800-272-9829 or through our website at After authorizing your payment, check the box on

your return indicating you have paid with a credit card. Be sure to sign and mail your return.

GENERAL

The California State Board of Equalization (Board) administers the California Alcoholic Beverage Tax Law, which includes the

state excise tax on wine. The tax rates as they relate to wine are shown on this return.

Report all alcoholic beverages in wine gallons. To convert liters to wine gallons, multiply the quantity in liters by 0.264172.

Round the resulting figure(s) to the nearest gallon.

FILING REQUIREMENTS

Every licensed winegrower or wine blender shall, on or before the fifteenth day of each month, or on or before the fifteenth day

of the month following the close of such other reporting period authorized by the Board, file a tax return of all sales of wine for

the reporting period. A return must be filed each reporting period regardless of whether any tax is due. The report must be

completed in every detail and supported by the necessary supplemental report on form BOE-269-A. A remittance for the

amount due as shown must accompany the return. A duplicate of the return should be retained on the licensed premises for

verification by Board auditors.

INTEREST AND PENALTY FOR LATE FILING

California law imposes a penalty for the late filing of this return regardless of whether any tax is due. The penalty for late payment

of tax is 10 percent (0.10) of the amount of tax due together with interest on the tax from the date on which the tax is due and

payable until the date of payment. The penalty for the late filing of this return is $50.00. The penalties imposed shall be limited to

either $50.00, or 10 percent (0.10) of the amount of tax due, whichever is greater. The Board is authorized by law, for good

cause, to extend the time for the filing of this return not to exceed one month. Any request for an extension should be made in

writing addressed to the Board in Sacramento.

CLEAR

PRINT

1

1 2

2 3

3