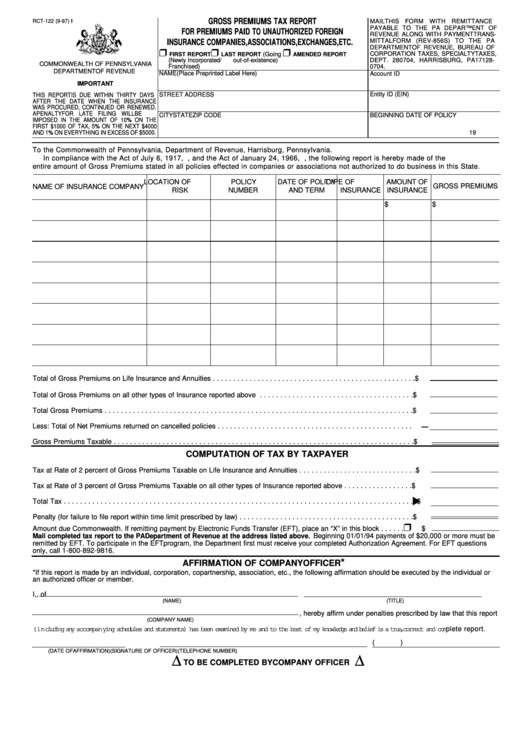

GROSS PREMIUMS TAX REPORT

RCT-122 (9-97) I

MAIL THIS FORM WITH REMITTANCE

PAYABLE TO THE PA DEPARTMENT OF

FOR PREMIUMS PAID TO UNAUTHORIZED FOREIGN

REVENUE ALONG WITH PAYMENT TRANS-

MITTAL FORM (REV-856S) TO THE PA

INSURANCE COMPANIES, ASSOCIATIONS, EXCHANGES, ETC.

DEPARTMENT OF REVENUE, BUREAU OF

CORPORATION TAXES, SPECIALTY TAXES,

FIRST REPORT

LAST REPORT

(Going

AMENDED REPORT

(Newly Incorporated/

out-of-existence)

DEPT. 280704, HARRISBURG, PA 17128-

COMMONWEALTH OF PENNSYLVANIA

Franchised)

0704.

DEPARTMENT OF REVENUE

NAME

(Place Preprinted Label Here)

Account ID

IMPORTANT

Entity ID (EIN)

STREET ADDRESS

THIS REPORT IS DUE WITHIN THIRTY DAYS

AFTER THE DATE WHEN THE INSURANCE

WAS PROCURED, CONTINUED OR RENEWED.

A PENALTY FOR LATE FILING WILL BE

CITY

STATE

ZIP CODE

BEGINNING DATE OF POLICY

IMPOSED IN THE AMOUNT OF 10% ON THE

FIRST $1000 OF TAX, 5% ON THE NEXT $4000

AND 1% ON EVERYTHING IN EXCESS OF $5000.

19

To the Commonwealth of Pennsylvania, Department of Revenue, Harrisburg, Pennsylvania.

In compliance with the Act of July 6, 1917, P.L. 723, and the Act of January 24, 1966, P.L. 1509, the following report is hereby made of the

entire amount of Gross Premiums stated in all policies effected in companies or associations not authorized to do business in this State.

LOCATION OF

POLICY

DATE OF POLICY

TYPE OF

AMOUNT OF

GROSS PREMIUMS

NAME OF INSURANCE COMPANY

RISK

NUMBER

AND TERM

INSURANCE

INSURANCE

$

$

Total of Gross Premiums on Life Insurance and Annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Total of Gross Premiums on all other types of Insurance reported above . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Total Gross Premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Less: Total of Net Premiums returned on cancelled policies . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross Premiums Taxable . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

COMPUTATION OF TAX BY TAXPAYER

Tax at Rate of 2 percent of Gross Premiums Taxable on Life Insurance and Annuities . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Tax at Rate of 3 percent of Gross Premiums Taxable on all other types of Insurance reported above . . . . . . . . . . . . . . . . .

$

Total Tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Penalty (for failure to file report within time limit prescribed by law) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

Amount due Commonwealth. If remitting payment by Electronic Funds Transfer (EFT), place an “X” in this block . . . . . .

$

Mail completed tax report to the PA Department of Revenue at the address listed above. Beginning 01/01/94 payments of $20,000 or more must be

remitted by EFT. To participate in the EFT program, the Department first must receive your completed Authorization Agreement. For EFT questions

only, call 1-800-892-9816.

*

AFFIRMATION OF COMPANY OFFICER

* If this report is made by an individual, corporation, copartnership, association, etc., the following affirmation should be executed by the individual or

an authorized officer or member.

I,

, of

(NAME)

(TITLE)

, hereby affirm under penalties prescribed by law that this report

(COMPANY NAME)

( i n cl u d i n g a ny accompany i n g s c h e d u l e s a n d s t atements) has been examined by me and to the best of my know l e d g e a n d b e l i e f i s a t r u e , correct and complete report.

(

)

(DATE OF AFFIRMATION)

(SIGNATURE OF OFFICER)

(TELEPHONE NUMBER)

∆

∆

TO BE COMPLETED BY COMPANY OFFICER

1

1 2

2