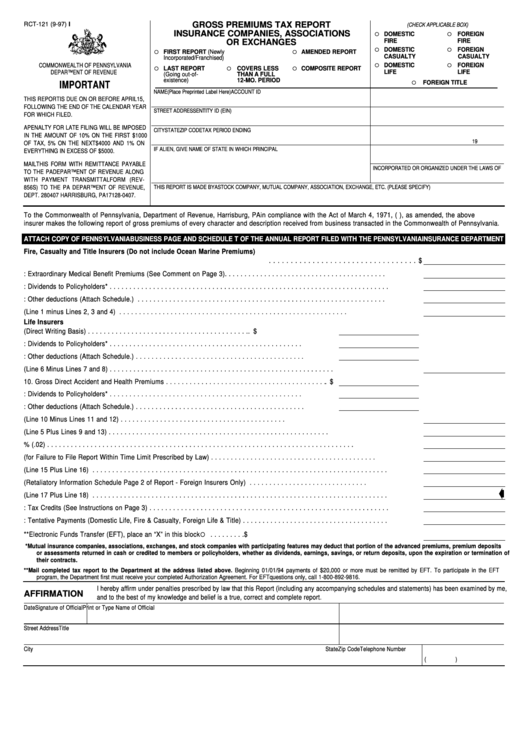

RCT-121 (9-97) I

GROSS PREMIUMS TAX REPORT

(CHECK APPLICABLE BOX)

INSURANCE COMPANIES, ASSOCIATIONS

o

o

DOMESTIC

FOREIGN

OR EXCHANGES

FIRE

FIRE

o

o

DOMESTIC

FOREIGN

o

o

FIRST REPORT (Newly

AMENDED REPORT

CASUALTY

CASUALTY

Incorporated/Franchised)

o

o

DOMESTIC

FOREIGN

COMMONWEALTH OF PENNSYLVANIA

o

o

o

LAST REPORT

COVERS LESS

COMPOSITE REPORT

LIFE

LIFE

DEPARTMENT OF REVENUE

(Going out-of-

THAN A FULL

existence)

12-MO. PERIOD

o

n

FOREIGN TITLE

IMPORTANT

NAME

(Place Preprinted Label Here)

ACCOUNT ID

THIS REPORT IS DUE ON OR BEFORE APRIL 15,

FOLLOWING THE END OF THE CALENDAR YEAR

STREET ADDRESS

ENTITY ID (EIN)

FOR WHICH FILED.

A PENALTY FOR LATE FILING WILL BE IMPOSED

CITY

STATE

ZIP CODE

TAX PERIOD ENDING

IN THE AMOUNT OF 10% ON THE FIRST $1000

19

OF TAX, 5% ON THE NEXT $4000 AND 1% ON

IF ALIEN, GIVE NAME OF STATE IN WHICH PRINCIPAL U.S. OFFICE IS LOCATED

DATE BUSINESS COMMENCED IN PENNSYLVANIA

EVERYTHING IN EXCESS OF $5000.

MAIL THIS FORM WITH REMITTANCE PAYABLE

INCORPORATED OR ORGANIZED UNDER THE LAWS OF

TO THE PA DEPARTMENT OF REVENUE ALONG

WITH PAYMENT TRANSMITTAL FORM (REV-

856S) TO THE PA DEPARTMENT OF REVENUE,

THIS REPORT IS MADE BY A STOCK COMPANY, MUTUAL COMPANY, ASSOCIATION, EXCHANGE, ETC. (PLEASE SPECIFY)

DEPT. 280407 HARRISBURG, PA 17128-0407.

To the Commonwealth of Pennsylvania, Department of Revenue, Harrisburg, PA in compliance with the Act of March 4, 1971, (P.L. 6 No.2), as amended, the above

insurer makes the following report of gross premiums of every character and description received from business transacted in the Commonwealth of Pennsylvania.

ATTACH COPY OF PENNSYLVANIA BUSINESS PAGE AND SCHEDULE T OF THE ANNUAL REPORT FILED WITH THE PENNSYLVANIA INSURANCE

DEPARTMENT.

Fire, Casualty and Title Insurers (Do not include Ocean Marine Premiums)

1.

Gross Direct Premiums Received Less Cancellations and Premiums Returned . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

2.

Less: Extraordinary Medical Benefit Premiums (See Comment on Page 3). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

Less: Dividends to Policyholders* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

4.

Less: Other deductions (Attach Schedule.)

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

5.

Premiums Taxable (Line 1 minus Lines 2, 3 and 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Life Insurers

6.

Gross Life Premiums (Direct Writing Basis) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

7.

Less: Dividends to Policyholders* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

8.

Less: Other deductions (Attach Schedule.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

9.

Life Premiums Taxable (Line 6 Minus Lines 7 and 8) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

10. Gross Direct Accident and Health Premiums . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $

11. Less: Dividends to Policyholders* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

12. Less: Other deductions (Attach Schedule.) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

13. Accident and Health Premiums Taxable (Line 10 Minus Lines 11 and 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

14. Total Taxable Premiums (Line 5 Plus Lines 9 and 13) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

15. Tax at Rate of 2% (.02) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

16. Penalty (for Failure to File Report Within Time Limit Prescribed by Law) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

17. Total (Line 15 Plus Line 16) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18. Retaliatory (Retaliatory Information Schedule Page 2 of Report - Foreign Insurers Only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

19. Total (Line 17 Plus Line 18) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

20. Less: Tax Credits (See Instructions on Page 3) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

21. Less: Tentative Payments (Domestic Life, Fire & Casualty, Foreign Life & Title) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

o

22. Amount due Commonwealth. If remitting payment by **Electronic Funds Transfer (EFT), place an “X” in this block

. . . . . . . . . $

*

Mutual insurance companies, associations, exchanges, and stock companies with participating features may deduct that portion of the advanced premiums, premium deposits

or assessments returned in cash or credited to members or policyholders, whether as dividends, earnings, savings, or return deposits, upon the expiration or termination of

their contracts.

**

Mail completed tax report to the Department at the address listed above. Beginning 01/01/94 payments of $20,000 or more must be remitted by EFT. To participate in the EFT

program, the Department first must receive your completed Authorization Agreement. For EFT questions only, call 1-800-892-9816.

I hereby affirm under penalties prescribed by law that this Report (including any accompanying schedules and statements) has been examined by me,

AFFIRMATION

and to the best of my knowledge and belief is a true, correct and complete report.

Date

Signature of Official

Print or Type Name of Official

Street Address

Title

City

State

Zip Code

Telephone Number

(

)

1

1 2

2 3

3 4

4