Form Sc1065 - Instructions For Partnership Return

ADVERTISEMENT

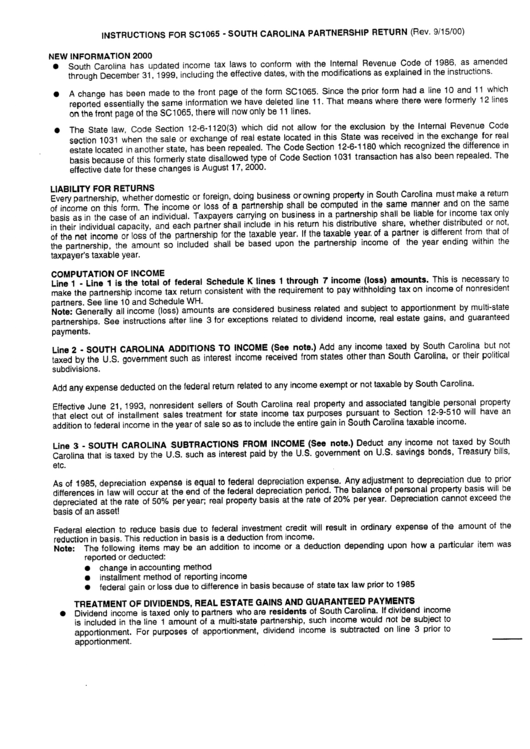

INSTRUCTIONS FOR SC1065 -SOUTH CAROLINA PARTNERSHIP RETURN (Rev. 9/15/00)

NEW INFORMATION 2000

•

South Carolina has updated income tax laws to conform with the Internal Revenue Code of 1986, as amended

through December 31, 1999, including the effective dates, with the modifications as explained in the instructions.

•

A change has been made to the front page of the form SC1065. Since the prior form had a line 10 and 11 which

reported essentially the same information we have deleted line 11. That means where there were formerly 12 lines

on the front page of the SC1065, there will now only be 11 lines.

•

The State law, Code Section 12-6-1120(3) which did not allow for the exclusion by the Internal Revenue Code

section 1031 when the sale or exchange of real estate located in this State was received in the exchange for real

estate located in another state, has been repealed. The Code Section 12-6-1180 which recognized the difference in

basis because of this formerly state disallowed type of Code Section 1031 transaction has also been repealed. The

effective date for these changes is August 17, 2000.

LIABILITY FOR RETURNS

Every partnership, whether domestic or foreign, doing business or owning property in South Carolina must make a return

of income on this form. The income or loss of a partnership shall be computed in the same manner and on the same

basis as in the case of an individual. Taxpayers carrying on business in a partnership shall be liable for income tax only

in their individual capacity, and each partner shall include in his return his distributive share, whether distributed or not,

of the net income or loss of the partnership for the taxable year. If the taxable year. of a partner is different from that of

the partnership, the amount so included shall be based upon the partnership income of the year ending within the

taxpayer's taxable year.

COMPUTATION OF INCOME

Line 1 - Line 1 is the total of federal Schedule K lines 1 through 7 income (loss) amounts. This is necessary to

make the partnership income tax return consistent with the requirement to pay withholding tax on income of nonresident

partners. See line 10 and Schedule WH.

Note: Generally all income (loss) amounts are considered business related and subject to apportionment by multi-state

partnerships. See instructions after line 3 for exceptions related to dividend income, real estate gains, and guaranteed

payments.

Line 2 - SOUTH CAROLINA ADDITIONS TO INCOME (See note.) Add any income taxed by South Carolina but not

taxed by the U.S. government such as interest income received from states other than South Carolina, or their political

subdivisions.

Add any expense deducted on the federal return related to any income exempt or not taxable by South Carolina.

Effective June 21, 1993, nonresident sellers of South Carolina real property and associated tangible personal property

that elect out of installment sales treatment for state income tax purposes pursuant to Section 12-9-510 will have an

addition to federal income in the year of sale so as to include the entire gain in South Carolina taxable income.

Line 3 - SOUTH CAROLINA SUBTRACTIONS FROM INCOME (See note.) Deduct any income not taxed by South

Carolina that is taxed by the U.S. such as interest paid by the U.S. government on U.S. savings bonds, Treasury bills,

etc.

As of 1985, depreciation expense is equal to federal depreciation expense. Any adjustment to depreciation due to prior

differences in law will occur at the end of the federal depreciation period. The balance of personal property basis will be

depreciated at the rate of 50% per year; real property basis at the rate of 20% per year. Depreciation cannot exceed the

basis of an asset!

Federal election to reduce basis clue to federal investment credit will result in ordinary expense of the amount of the

reduction in basis. This reduction in basis is a deduction from income.

Note:

The following items may be an addition to income or a deduction depending upon how a particular item was

reported or deducted:

•

change in accounting method

•

installment method of reporting income

•

federal gain or loss clue to difference in basis because of state tax law prior to 1985

TREATMENT OF DIVIDENDS, REAL ESTATE GAINS AND GUARANTEED PAYMENTS

•

Dividend income is taxed only to partners who are residents of South Carolina. If dividend income

is included in the line 1 amount of a multi-state partnership, such income would not be subject to

apportionment. For purposes of apportionment, dividend income is subtracted on line 3 prior to

apportionment.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3