Form 70-001-10-8-1-000 - Registration Application Form - State Of Missisippi Page 2

ADVERTISEMENT

Page 2

Form 70-001-10-8-2-000 (Rev.06/10)

SECTION D: Sales/Use Tax

16. Enter Previous Owner Name, Trade Name & Account Number:

17. Where will records be maintained? (Check One)

Headquarters

Physical

Other

18.

Date business began at this location:

(Returns will be required from this date forward.)

19.

Check one of the following to describe your business location:

Owner Occupied Retail Space

Leased Retail Space

Owner's Home

Other (explain)

20.

Is your business located inside or outside the city limits?

Inside

Outside

Unknown

21.

Do you already have a use tax number?

Use Tax Number

Yes

No

22.

Have you qualified for any tax incentives?

Yes

No

If yes, please provide approved documentation from Mississippi Development Authority.

SECTION E: Withholding Tax

23. Date Mississippi taxable wages first paid

24.

Estimated monthly liability

25. Number of Mississippi Employees

26.

Are you an employee leasing company?

Yes

No

If yes, contact your District Service Office for more information.

Headquarters

27. Where will records be maintained? (Check One)

Physical

Other

SECTION F: Applicant Signature

I hereby certify that the above statements are true and correct to the best of my knowledge and belief. As indicated on this completed form,

I hereby apply for the appropriate permit(s) to engage in business. I agree to pay any and all taxes due the State of Mississippi and to

comply fully in all respects with the applicable Mississippi Tax Laws and any corresponding rules and regulations.

Title

Date

Print Name of Owner or Officer of Corporation Only

Signature of Owner or Officer of

Signature of Owner or Officer of

Signature of Owner or Officer of

Corporation

Corporation

Corporation

Listed in #15

Listed in #15

Listed in #15

If General Partnership, all General Partners must sign or if a partnership agreement is attached, only one (1) signature is required.

If limited Partnership, Managing Partner must sign. Attach sheet, if needed.

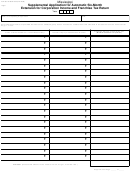

For Office Use Only - Do Not Write in this Section

Cash Bond Amt $

Date Issued

SIC Code

City Number

Also Responsible for:

M Q

A

Norms

Tax Acct No.

Tupelo Tax

Sales Tax.............................

Special City/County Tax

Occupancy Tax

Use Tax...............................

Motor Vehicle Rental Tax

Withholding Tax...................

Waste Tire Disposal Fee

Master File No.

Additional Account to be included in Master File Number:

Yes

No

Approved:

Agent's Number

Master File Agent's Signature

Agent's Signature

Date

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2

![Form 72-440-10-8-1-000 - Rider (sales, Use, Income, Franchise, Withholding, And Special Fuel [diesel Fuel] Tax Bond) Form Form 72-440-10-8-1-000 - Rider (sales, Use, Income, Franchise, Withholding, And Special Fuel [diesel Fuel] Tax Bond) Form](https://data.formsbank.com/pdf_docs_html/244/2440/244084/page_1_thumb.png)