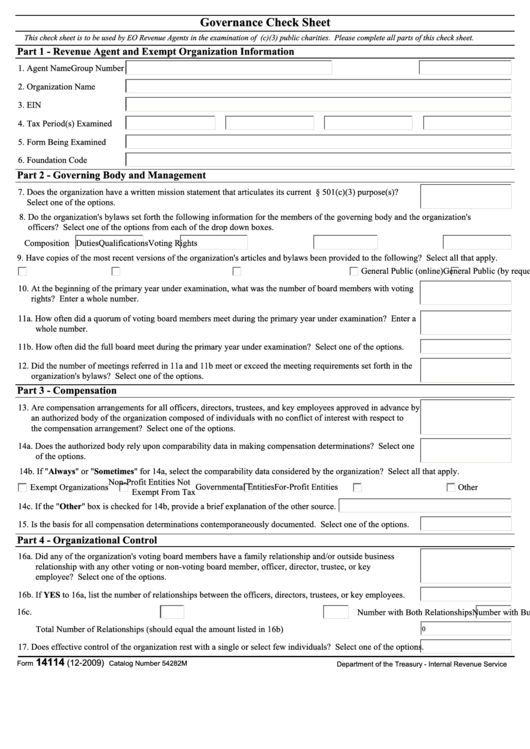

Governance Check Sheet

This check sheet is to be used by EO Revenue Agents in the examination of I.R.C. 501(c)(3) public charities. Please complete all parts of this check sheet.

Part 1 - Revenue Agent and Exempt Organization Information

1. Agent Name

Group Number

2. Organization Name

3. EIN

4. Tax Period(s) Examined

5. Form Being Examined

6. Foundation Code

Part 2 - Governing Body and Management

7. Does the organization have a written mission statement that articulates its current I.R.C. § 501(c)(3) purpose(s)?

Select one of the options.

8. Do the organization's bylaws set forth the following information for the members of the governing body and the organization's

officers? Select one of the options from each of the drop down boxes.

Composition

Duties

Qualifications

Voting Rights

9. Have copies of the most recent versions of the organization's articles and bylaws been provided to the following? Select all that apply.

All Board Members

Only Voting Board Members

General Public (by request)

General Public (online)

Not Provided

10. At the beginning of the primary year under examination, what was the number of board members with voting

rights? Enter a whole number.

11a. How often did a quorum of voting board members meet during the primary year under examination? Enter a

whole number.

11b. How often did the full board meet during the primary year under examination? Select one of the options.

12. Did the number of meetings referred in 11a and 11b meet or exceed the meeting requirements set forth in the

organization's bylaws? Select one of the options.

Part 3 - Compensation

13. Are compensation arrangements for all officers, directors, trustees, and key employees approved in advance by

an authorized body of the organization composed of individuals with no conflict of interest with respect to

the compensation arrangement? Select one of the options.

14a. Does the authorized body rely upon comparability data in making compensation determinations? Select one

of the options.

14b. If "Always" or "Sometimes" for 14a, select the comparability data considered by the organization? Select all that apply.

Non-Profit Entities Not

Exempt Organizations

Governmental Entities

For-Profit Entities

Other

Exempt From Tax

14c. If the "Other" box is checked for 14b, provide a brief explanation of the other source.

15. Is the basis for all compensation determinations contemporaneously documented. Select one of the options.

Part 4 - Organizational Control

16a. Did any of the organization's voting board members have a family relationship and/or outside business

relationship with any other voting or non-voting board member, officer, director, trustee, or key

employee? Select one of the options.

16b. If YES to 16a, list the number of relationships between the officers, directors, trustees, or key employees.

16c.

Number with Family Relationships

Number with Business Relationships

Number with Both Relationships

Total Number of Relationships (should equal the amount listed in 16b)

0

17. Does effective control of the organization rest with a single or select few individuals? Select one of the options.

14114

(12-2009)

Form

Catalog Number 54282M

publish.no.irs.gov

Department of the Treasury - Internal Revenue Service

1

1 2

2