Clear Form

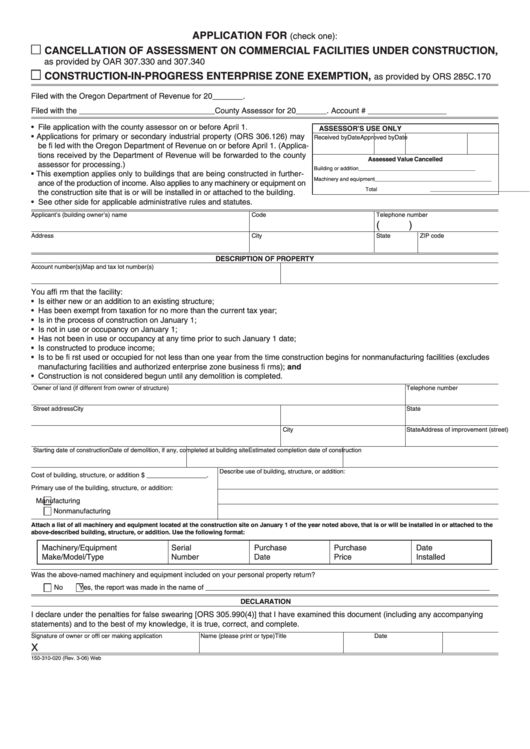

APPLICATION FOR

(check one):

c

CANCELLATION OF ASSESSMENT ON COMMERCIAL FACILITIES UNDER CONSTRUCTION,

as provided by OAR 307.330 and 307.340

c

CONSTRUCTION-IN-PROGRESS ENTERPRISE ZONE EXEMPTION,

as provided by ORS 285C.170

Filed with the Oregon Department of Revenue for 20_______.

Filed with the _______________________________County Assessor for 20_______.

Account # __________________

• File application with the county assessor on or before April 1.

ASSESSOR’S USE ONLY

• Applications for primary or secondary industrial property (ORS 306.126) may

Received by

Date

Approved by

Date

be fi led with the Oregon Department of Revenue on or before April 1. (Applica-

tions received by the Department of Revenue will be forwarded to the county

Assessed Value Cancelled

assessor for processing.)

Building or addition ________________________________________

• This exemption applies only to buildings that are being constructed in further-

Machinery and equipment ________________________________________

ance of the production of income. Also applies to any machinery or equipment on

Total ________________________________________

the construction site that is or will be installed in or attached to the building.

• See other side for applicable administrative rules and statutes.

Applicant’s (building owner’s) name

Code

Telephone number

(

)

Address

City

State

ZIP code

DESCRIPTION OF PROPERTY

Account number(s)

Map and tax lot number(s)

You affi rm that the facility:

• Is either new or an addition to an existing structure;

• Has been exempt from taxation for no more than the current tax year;

• Is in the process of construction on January 1;

• Is not in use or occupancy on January 1;

• Has not been in use or occupancy at any time prior to such January 1 date;

• Is constructed to produce income;

• Is to be fi rst used or occupied for not less than one year from the time construction begins for nonmanufacturing facilities (excludes

manufacturing facilities and authorized enterprise zone business fi rms); and

• Construction is not considered begun until any demolition is completed.

Owner of land (if different from owner of structure)

Telephone number

Street address

City

State

Address of improvement (street)

City

State

Starting date of construction

Date of demolition, if any, completed at building site

Estimated completion date of construction

Describe use of building, structure, or addition:

Cost of building, structure, or addition $ _________________.

Primary use of the building, structure, or addition:

Manufacturing

Nonmanufacturing

Attach a list of all machinery and equipment located at the construction site on January 1 of the year noted above, that is or will be installed in or attached to the

above-described building, structure, or addition. Use the following format:

Machinery/Equipment

Serial

Purchase

Purchase

Date

Make/Model/Type

Number

Date

Price

Installed

Was the above-named machinery and equipment included on your personal property return?

No

Yes, the report was made in the name of _________________________________________________________________________

DECLARATION

I declare under the penalties for false swearing [ORS 305.990(4)] that I have examined this document (including any accompanying

statements) and to the best of my knowledge, it is true, correct, and complete.

Signature of owner or offi cer making application

Name (please print or type)

Title

Date

X

150-310-020 (Rev. 3-06) Web

1

1 2

2