Form Tc106ins - Application For Correction Of Assessment On Grounds Other Than, Or In Addition To, Overvaluation, Including Exemption Or Classification Claims - 2011

ADVERTISEMENT

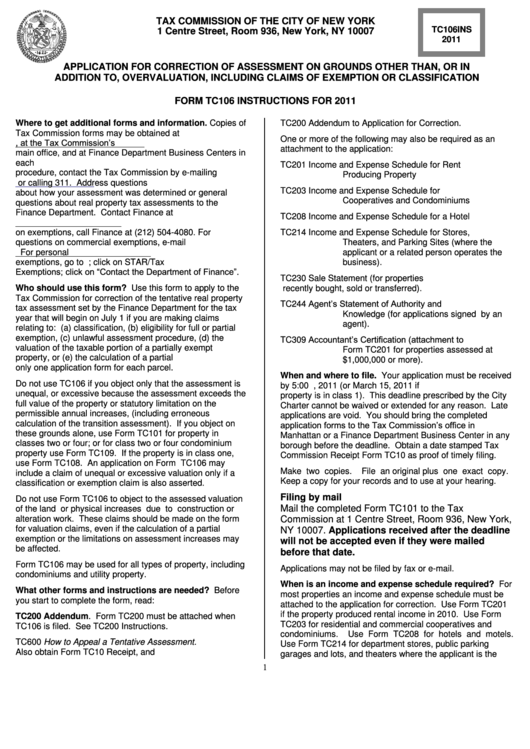

TAX COMMISSION OF THE CITY OF NEW YORK

TC106INS

1 Centre Street, Room 936, New York, NY 10007

2011

APPLICATION FOR CORRECTION OF ASSESSMENT ON GROUNDS OTHER THAN, OR IN

ADDITION TO, OVERVALUATION, INCLUDING CLAIMS OF EXEMPTION OR CLASSIFICATION

FORM TC106 INSTRUCTIONS FOR 2011

Where to get additional forms and information. Copies of

TC200 Addendum to Application for Correction.

Tax

Commission

forms

may

be

obtained

at

One or more of the following may also be required as an

, at the Tax Commission’s

attachment to the application:

main office, and at Finance Department Business Centers in

each borough. If you have questions about the application

TC201

Income and Expense Schedule for Rent

procedure, contact the Tax Commission by e-mailing

Producing Property

tcinfo@oata.nyc.gov

or calling 311.

Address questions

TC203

Income

and

Expense

Schedule

for

about how your assessment was determined or general

Cooperatives and Condominiums

questions about real property tax assessments to the

Finance

Department.

Contact

Finance

at

TC208

Income and Expense Schedule for a Hotel

or by calling 311. For questions

on exemptions, call Finance at (212) 504-4080. For

TC214

Income and Expense Schedule for Stores,

questions

on

commercial

exemptions,

e-mail

Theaters, and Parking Sites (where the

exemptionspolicy@finance.nyc.gov.

For

personal

applicant or a related person operates the

exemptions, go to nyc.gov/finance; click on STAR/Tax

business).

Exemptions; click on “Contact the Department of Finance”.

TC230

Sale Statement (for properties

Who should use this form? Use this form to apply to the

recently bought, sold or transferred).

Tax Commission for correction of the tentative real property

Agent’s

Statement

of

Authority

and

TC244

tax assessment set by the Finance Department for the tax

Knowledge (for applications signed by an

year that will begin on July 1 if you are making claims

agent).

relating to: (a) classification, (b) eligibility for full or partial

exemption, (c) unlawful assessment procedure, (d) the

Accountant’s Certification (attachment to

TC309

valuation of the taxable portion of a partially exempt

Form TC201 for properties assessed at

property, or (e) the calculation of a partial exemption. Use

$1,000,000 or more).

only one application form for each parcel.

When and where to file. Your application must be received

Do not use TC106 if you object only that the assessment is

by 5:00 p.m. on March 1, 2011 (or March 15, 2011 if

unequal, or excessive because the assessment exceeds the

property is in class 1). This deadline prescribed by the City

full value of the property or statutory limitation on the

Charter cannot be waived or extended for any reason. Late

permissible

annual

increases,

(including

erroneous

applications are void.

You should bring the completed

calculation of the transition assessment). If you object on

application forms to the Tax Commission’s office in

these grounds alone, use Form TC101 for property in

Manhattan or a Finance Department Business Center in any

classes two or four; or for class two or four condominium

borough before the deadline. Obtain a date stamped Tax

property use Form TC109. If the property is in class one,

Commission Receipt Form TC10 as proof of timely filing.

use Form TC108.

An application on Form TC106 may

Make two copies.

File an original plus one exact copy.

include a claim of unequal or excessive valuation only if a

Keep a copy for your records and to use at your hearing.

classification or exemption claim is also asserted.

Filing by mail

Do not use Form TC106 to object to the assessed valuation

Mail

the

completed

Form

TC101

to

the

Tax

of the land or physical increases due to construction or

alteration work. These claims should be made on the form

Commission at 1 Centre Street, Room 936, New York,

for valuation claims, even if the calculation of a partial

NY 10007. Applications received after the deadline

exemption or the limitations on assessment increases may

will not be accepted even if they were mailed

be affected.

before that date.

Form TC106 may be used for all types of property, including

Applications may not be filed by fax or e-mail.

condominiums and utility property.

When is an income and expense schedule required? For

What other forms and instructions are needed? Before

most properties an income and expense schedule must be

you start to complete the form, read:

attached to the application for correction. Use Form TC201

if the property produced rental income in 2010. Use Form

TC200 Addendum. Form TC200 must be attached when

TC203 for residential and commercial cooperatives and

TC106 is filed. See TC200 Instructions.

condominiums.

Use Form TC208 for hotels and motels.

TC600 How to Appeal a Tentative Assessment.

Use Form TC214 for department stores, public parking

Also obtain Form TC10 Receipt, and

garages and lots, and theaters where the applicant is the

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5