Instructions For Form 5227

ADVERTISEMENT

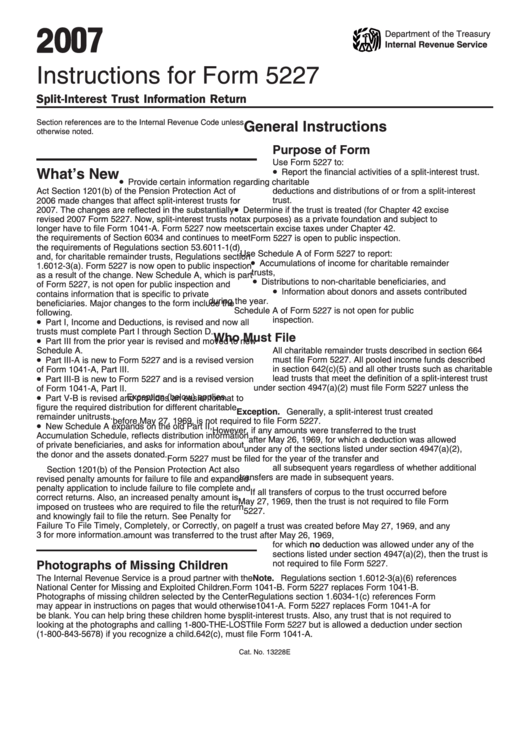

2 0 07

Department of the Treasury

Internal Revenue Service

Instructions for Form 5227

Split-Interest Trust Information Return

Section references are to the Internal Revenue Code unless

General Instructions

otherwise noted.

Purpose of Form

Use Form 5227 to:

•

What’s New

Report the financial activities of a split-interest trust.

•

Provide certain information regarding charitable

Act Section 1201(b) of the Pension Protection Act of

deductions and distributions of or from a split-interest

2006 made changes that affect split-interest trusts for

trust.

•

2007. The changes are reflected in the substantially

Determine if the trust is treated (for Chapter 42 excise

revised 2007 Form 5227. Now, split-interest trusts no

tax purposes) as a private foundation and subject to

longer have to file Form 1041-A. Form 5227 now meets

certain excise taxes under Chapter 42.

the requirements of Section 6034 and continues to meet

Form 5227 is open to public inspection.

the requirements of Regulations section 53.6011-1(d)

Use Schedule A of Form 5227 to report:

and, for charitable remainder trusts, Regulations section

•

Accumulations of income for charitable remainder

1.6012-3(a). Form 5227 is now open to public inspection

trusts,

as a result of the change. New Schedule A, which is part

•

Distributions to non-charitable beneficiaries, and

of Form 5227, is not open for public inspection and

•

Information about donors and assets contributed

contains information that is specific to private

during the year.

beneficiaries. Major changes to the form include the

Schedule A of Form 5227 is not open for public

following.

•

inspection.

Part I, Income and Deductions, is revised and now all

trusts must complete Part I through Section D.

Who Must File

•

Part III from the prior year is revised and moved to new

All charitable remainder trusts described in section 664

Schedule A.

•

must file Form 5227. All pooled income funds described

Part III-A is new to Form 5227 and is a revised version

in section 642(c)(5) and all other trusts such as charitable

of Form 1041-A, Part III.

•

lead trusts that meet the definition of a split-interest trust

Part III-B is new to Form 5227 and is a revised version

under section 4947(a)(2) must file Form 5227 unless the

of Form 1041-A, Part II.

•

Exception (below) applies.

Part V-B is revised and provides an easier format to

figure the required distribution for different charitable

Exception. Generally, a split-interest trust created

remainder unitrusts.

before May 27, 1969, is not required to file Form 5227.

•

New Schedule A expands on the old Part II,

However, if any amounts were transferred to the trust

Accumulation Schedule, reflects distribution information

after May 26, 1969, for which a deduction was allowed

of private beneficiaries, and asks for information about

under any of the sections listed under section 4947(a)(2),

the donor and the assets donated.

Form 5227 must be filed for the year of the transfer and

all subsequent years regardless of whether additional

Section 1201(b) of the Pension Protection Act also

transfers are made in subsequent years.

revised penalty amounts for failure to file and expanded

penalty application to include failure to file complete and

If all transfers of corpus to the trust occurred before

correct returns. Also, an increased penalty amount is

May 27, 1969, then the trust is not required to file Form

imposed on trustees who are required to file the return

5227.

and knowingly fail to file the return. See Penalty for

Failure To File Timely, Completely, or Correctly, on page

If a trust was created before May 27, 1969, and any

3 for more information.

amount was transferred to the trust after May 26, 1969,

for which no deduction was allowed under any of the

sections listed under section 4947(a)(2), then the trust is

not required to file Form 5227.

Photographs of Missing Children

The Internal Revenue Service is a proud partner with the

Note. Regulations section 1.6012-3(a)(6) references

National Center for Missing and Exploited Children.

Form 1041-B. Form 5227 replaces Form 1041-B.

Photographs of missing children selected by the Center

Regulations section 1.6034-1(c) references Form

may appear in instructions on pages that would otherwise

1041-A. Form 5227 replaces Form 1041-A for

be blank. You can help bring these children home by

split-interest trusts. Also, any trust that is not required to

looking at the photographs and calling 1-800-THE-LOST

file Form 5227 but is allowed a deduction under section

(1-800-843-5678) if you recognize a child.

642(c), must file Form 1041-A.

Cat. No. 13228E

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15