Form Pdr-1p - Minnesota Motor Vehicle Fuel Report

ADVERTISEMENT

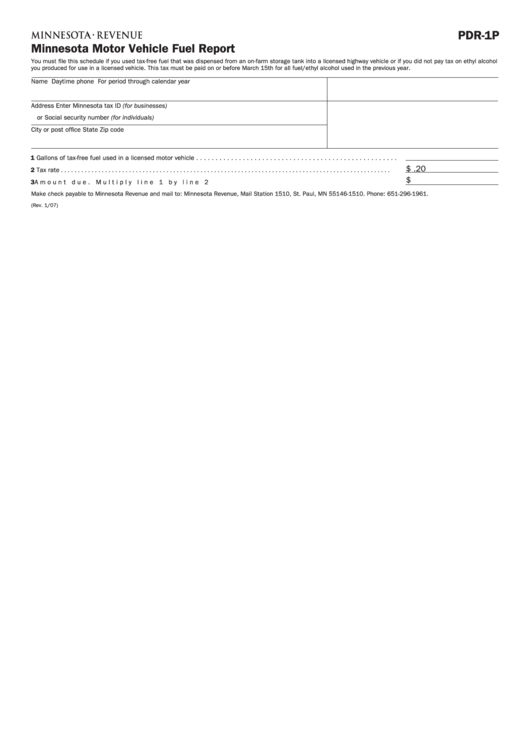

PDR-1P

Minnesota Motor Vehicle Fuel Report

You must file this schedule if you used tax-free fuel that was dispensed from an on-farm storage tank into a licensed highway vehicle or if you did not pay tax on ethyl alcohol

you produced for use in a licensed vehicle . This tax must be paid on or before March 15th for all fuel/ethyl alcohol used in the previous year .

Name

Daytime phone

For period

through

calendar year

Address

Enter Minnesota tax ID (for businesses)

or Social security number (for individuals)

City or post office

State

Zip code

1 Gallons of tax-free fuel used in a licensed motor vehicle . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

.20

2 Tax rate . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

$

3 Amount due . Multiply line 1 by line 2 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Make check payable to Minnesota Revenue and mail to: Minnesota Revenue, Mail Station 1510, St . Paul, MN 55146-1510 . Phone: 651-296-1961 .

(Rev . 1/07)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1