Form 25-100 - Instructions For Completing The Texas Annual Insurance Premium Tax Report

ADVERTISEMENT

Form 25-100 (Back)(Rev.11-00/9)

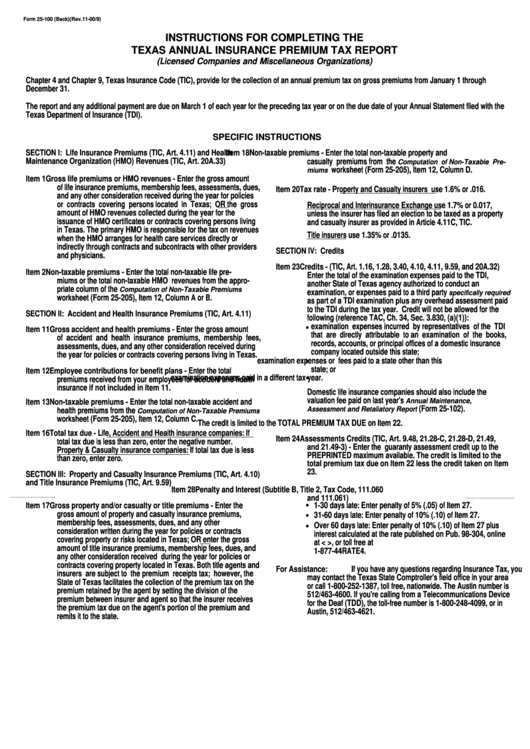

INSTRUCTIONS FOR COMPLETING THE

TEXAS ANNUAL INSURANCE PREMIUM TAX REPORT

(Licensed Companies and Miscellaneous Organizations)

Chapter 4 and Chapter 9, Texas Insurance Code (TIC), provide for the collection of an annual premium tax on gross premiums from January 1 through

December 31.

The report and any additional payment are due on March 1 of each year for the preceding tax year or on the due date of your Annual Statement filed with the

Texas Department of Insurance (TDI).

SPECIFIC INSTRUCTIONS

SECTION I:

Life Insurance Premiums (TIC, Art. 4.11) and Health

Item 18 Non-taxable premiums - Enter the total non-taxable property and

Maintenance Organization (HMO) Revenues (TIC, Art. 20A.33)

casualty premiums from the

Computation of Non-Taxable Pre-

miums

worksheet (Form 25-205), Item 12, Column D.

Item 1

Gross life premiums or HMO revenues - Enter the gross amount

of life insurance premiums, membership fees, assessments, dues,

Item 20 Tax rate - Property and Casualty insurers use 1.6% or .016.

and any other consideration received during the year for policies

or contracts covering persons located in Texas; OR the gross

Reciprocal and Interinsurance Exchange use 1.7% or 0.017,

amount of HMO revenues collected during the year for the

unless the insurer has filed an election to be taxed as a property

issuance of HMO certificates or contracts covering persons living

and casualty insurer as provided in Article 4.11C, TIC.

in Texas. The primary HMO is responsible for the tax on revenues

Title insurers use 1.35% or .0135.

when the HMO arranges for health care services directly or

indirectly through contracts and subcontracts with other providers

SECTION IV: Credits

and physicians.

Item 23 Credits - (TIC, Art. 1.16, 1.28, 3.40, 4.10, 4.11, 9.59, and 20A.32)

Item 2

Non-taxable premiums - Enter the total non-taxable life pre-

Enter the total of the examination expenses paid to the TDI,

miums or the total non-taxable HMO revenues from the appro-

another State of Texas agency authorized to conduct an

priate column of the

Computation of Non-Taxable Premiums

examination, or expenses paid to a third party

specifically required

worksheet (Form 25-205), Item 12, Column A or B.

as part of a TDI examination plus any overhead assessment paid

to the TDI during the tax year. Credit will not be allowed for the

SECTION II: Accident and Health Insurance Premiums (TIC, Art. 4.11)

following (reference TAC, Ch. 34, Sec. 3.830, (a)(1)):

examination expenses incurred by representatives of the TDI

Item 11 Gross accident and health premiums - Enter the gross amount

that are directly attributable to an examination of the books,

of accident and health insurance premiums, membership fees,

records, accounts, or principal offices of a domestic insurance

assessments, dues, and any other consideration received during

company located outside this state;

the year for policies or contracts covering persons living in Texas.

examination expenses or fees paid to a state other than this

state; or

Item 12 Employee contributions for benefit plans - Enter the total

examination expenses paid in a different tax year.

premiums received from your employees for accident and health

insurance if not included in Item 11.

Domestic life insurance companies should also include the

valuation fee paid on last year's

Annual

Maintenance,

Item 13 Non-taxable premiums - Enter the total non-taxable accident and

Assessment and Retaliatory Report

(Form 25-102).

health premiums from the

Computation of Non-Taxable Premiums

worksheet (Form 25-205), Item 12, Column C.

The credit is limited to the TOTAL PREMIUM TAX DUE on Item 22.

Item 16 Total tax due - Life, Accident and Health insurance companies: If

Item 24 Assessments Credits (TIC, Art. 9.48, 21.28-C, 21.28-D, 21.49,

total tax due is less than zero, enter the negative number.

and 21.49-3) - Enter the guaranty assessment credit up to the

Property & Casualty insurance companies: If total tax due is less

PREPRINTED maximum available. The credit is limited to the

than zero, enter zero.

total premium tax due on Item 22 less the credit taken on Item

23.

SECTION III: Property and Casualty Insurance Premiums (TIC, Art. 4.10)

and Title Insurance Premiums (TIC, Art. 9.59)

Item 28 Penalty and Interest (Subtitle B, Title 2, Tax Code, 111.060

and 111.061)

1-30 days late: Enter penalty of 5% (.05) of Item 27.

Item 17 Gross property and/or casualty or title premiums - Enter the

gross amount of property and casualty insurance premiums,

31-60 days late: Enter penalty of 10% (.10) of Item 27.

membership fees, assessments, dues, and any other

Over 60 days late: Enter penalty of 10% (.10) of Item 27 plus

consideration written during the year for policies or contracts

interest calculated at the rate published on Pub. 98-304, online

covering property or risks located in Texas; OR enter the gross

at

< ,

or

toll

free

at

amount of title insurance premiums, membership fees, dues, and

1-877-44RATE4.

any other consideration received during the year for policies or

contracts covering property located in Texas. Both title agents and

For Assistance:

If you have any questions regarding Insurance Tax, you

insurers are subject to the premium receipts tax; however, the

may contact the Texas State Comptroller's field office in your area

State of Texas facilitates the collection of the premium tax on the

or call 1-800-252-1387, toll free, nationwide. The Austin number is

premium retained by the agent by setting the division of the

512/463-4600. If you're calling from a Telecommunications Device

premium between insurer and agent so that the insurer receives

for the Deaf (TDD), the toll-free number is 1-800-248-4099, or in

the premium tax due on the agent's portion of the premium and

Austin, 512/463-4621.

remits it to the state.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1