Form 25-104 - Instructions For Completing The Texas Annual Insurance Tax Report

ADVERTISEMENT

Form 25-104 (Back)(Rev.12-00/7)

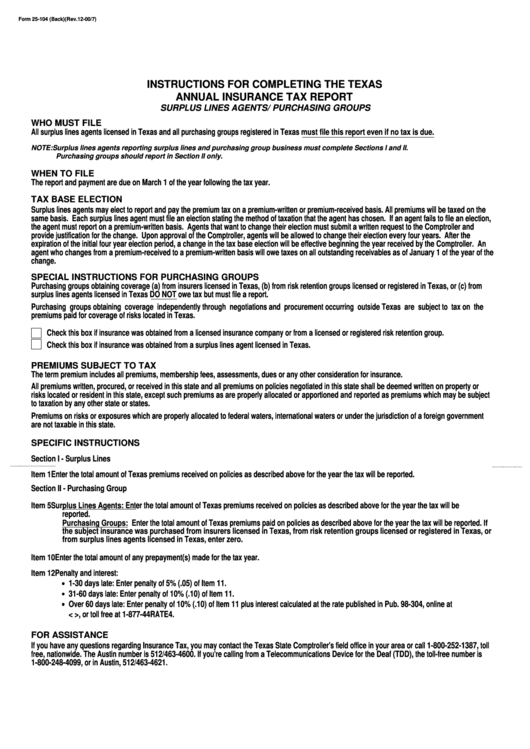

INSTRUCTIONS FOR COMPLETING THE TEXAS

ANNUAL INSURANCE TAX REPORT

SURPLUS LINES AGENTS/ PURCHASING GROUPS

WHO MUST FILE

All surplus lines agents licensed in Texas and all purchasing groups registered in Texas must file this report even if no tax is due.

NOTE: Surplus lines agents reporting surplus lines and purchasing group business must complete Sections I and II.

Purchasing groups should report in Section II only.

WHEN TO FILE

The report and payment are due on March 1 of the year following the tax year.

TAX BASE ELECTION

Surplus lines agents may elect to report and pay the premium tax on a premium-written or premium-received basis. All premiums will be taxed on the

same basis. Each surplus lines agent must file an election stating the method of taxation that the agent has chosen. If an agent fails to file an election,

the agent must report on a premium-written basis. Agents that want to change their election must submit a written request to the Comptroller and

provide justification for the change. Upon approval of the Comptroller, agents will be allowed to change their election every four years. After the

expiration of the initial four year election period, a change in the tax base election will be effective beginning the year received by the Comptroller. An

agent who changes from a premium-received to a premium-written basis will owe taxes on all outstanding receivables as of January 1 of the year of the

change.

SPECIAL INSTRUCTIONS FOR PURCHASING GROUPS

Purchasing groups obtaining coverage (a) from insurers licensed in Texas, (b) from risk retention groups licensed or registered in Texas, or (c) from

surplus lines agents licensed in Texas DO NOT owe tax but must file a report.

Purchasing groups obtaining coverage independently through negotiations and procurement occurring outside Texas are subject to tax on the

premiums paid for coverage of risks located in Texas.

Check this box if insurance was obtained from a licensed insurance company or from a licensed or registered risk retention group.

Check this box if insurance was obtained from a surplus lines agent licensed in Texas.

PREMIUMS SUBJECT TO TAX

The term premium includes all premiums, membership fees, assessments, dues or any other consideration for insurance.

All premiums written, procured, or received in this state and all premiums on policies negotiated in this state shall be deemed written on property or

risks located or resident in this state, except such premiums as are properly allocated or apportioned and reported as premiums which may be subject

to taxation by any other state or states.

Premiums on risks or exposures which are properly allocated to federal waters, international waters or under the jurisdiction of a foreign government

are not taxable in this state.

SPECIFIC INSTRUCTIONS

Section I - Surplus Lines

Item 1

Enter the total amount of Texas premiums received on policies as described above for the year the tax will be reported.

Section II - Purchasing Group

Item 5

Surplus Lines Agents: Enter the total amount of Texas premiums received on policies as described above for the year the tax will be

reported.

Purchasing Groups: Enter the total amount of Texas premiums paid on policies as described above for the year the tax will be reported. If

the subject insurance was purchased from insurers licensed in Texas, from risk retention groups licensed or registered in Texas, or

from surplus lines agents licensed in Texas, enter zero.

Item 10 Enter the total amount of any prepayment(s) made for the tax year.

Item 12 Penalty and interest:

1-30 days late: Enter penalty of 5% (.05) of Item 11.

31-60 days late: Enter penalty of 10% (.10) of Item 11.

Over 60 days late: Enter penalty of 10% (.10) of Item 11 plus interest calculated at the rate published in Pub. 98-304, online at

< , or toll free at 1-877-44RATE4.

FOR ASSISTANCE

If you have any questions regarding Insurance Tax, you may contact the Texas State Comptroller's field office in your area or call 1-800-252-1387, toll

free, nationwide. The Austin number is 512/463-4600. If you're calling from a Telecommunications Device for the Deaf (TDD), the toll-free number is

1-800-248-4099, or in Austin, 512/463-4621.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1