Eft-1 Instructions

ADVERTISEMENT

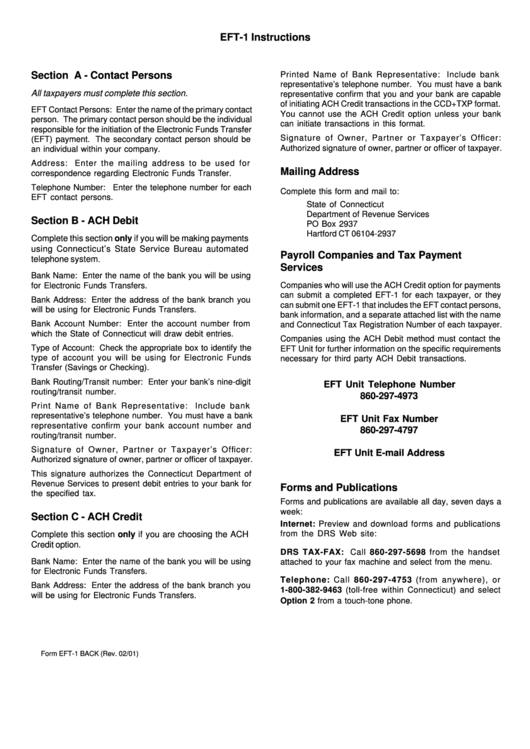

EFT-1 Instructions

Printed Name of Bank Representative: Include bank

Section A - Contact Persons

representative’s telephone number. You must have a bank

All taxpayers must complete this section.

representative confirm that you and your bank are capable

of initiating ACH Credit transactions in the CCD+TXP format.

EFT Contact Persons: Enter the name of the primary contact

You cannot use the ACH Credit option unless your bank

person. The primary contact person should be the individual

can initiate transactions in this format.

responsible for the initiation of the Electronic Funds Transfer

Signature of Owner, Partner or Taxpayer’s Officer:

(EFT) payment. The secondary contact person should be

Authorized signature of owner, partner or officer of taxpayer.

an individual within your company.

Address: Enter the mailing address to be used for

Mailing Address

correspondence regarding Electronic Funds Transfer.

Telephone Number: Enter the telephone number for each

Complete this form and mail to:

EFT contact persons.

State of Connecticut

Department of Revenue Services

Section B - ACH Debit

PO Box 2937

Hartford CT 06104-2937

Complete this section only if you will be making payments

using Connecticut’s State Service Bureau automated

Payroll Companies and Tax Payment

telephone system.

Services

Bank Name: Enter the name of the bank you will be using

for Electronic Funds Transfers.

Companies who will use the ACH Credit option for payments

can submit a completed EFT-1 for each taxpayer, or they

Bank Address: Enter the address of the bank branch you

can submit one EFT-1 that includes the EFT contact persons,

will be using for Electronic Funds Transfers.

bank information, and a separate attached list with the name

Bank Account Number: Enter the account number from

and Connecticut Tax Registration Number of each taxpayer.

which the State of Connecticut will draw debit entries.

Companies using the ACH Debit method must contact the

Type of Account: Check the appropriate box to identify the

EFT Unit for further information on the specific requirements

type of account you will be using for Electronic Funds

necessary for third party ACH Debit transactions.

Transfer (Savings or Checking).

Bank Routing/Transit number: Enter your bank’s nine-digit

EFT Unit Telephone Number

routing/transit number.

860-297-4973

Print Name of Bank Representative:

Include bank

representative’s telephone number. You must have a bank

EFT Unit Fax Number

representative confirm your bank account number and

860-297-4797

routing/transit number.

Signature of Owner, Partner or Taxpayer’s Officer:

EFT Unit E-mail Address

Authorized signature of owner, partner or officer of taxpayer.

ct.eft@po.state.ct.us

This signature authorizes the Connecticut Department of

Revenue Services to present debit entries to your bank for

Forms and Publications

the specified tax.

Forms and publications are available all day, seven days a

week:

Section C - ACH Credit

Internet: Preview and download forms and publications

from the DRS Web site:

Complete this section only if you are choosing the ACH

Credit option.

DRS TAX-FAX: Call 860-297-5698 from the handset

Bank Name: Enter the name of the bank you will be using

attached to your fax machine and select from the menu.

for Electronic Funds Transfers.

Telephone: Call 860-297-4753 (from anywhere), or

Bank Address: Enter the address of the bank branch you

1-800-382-9463 (toll-free within Connecticut) and select

will be using for Electronic Funds Transfers.

Option 2 from a touch-tone phone.

Form EFT-1 BACK (Rev. 02/01)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1