Eft-1 Instructions

ADVERTISEMENT

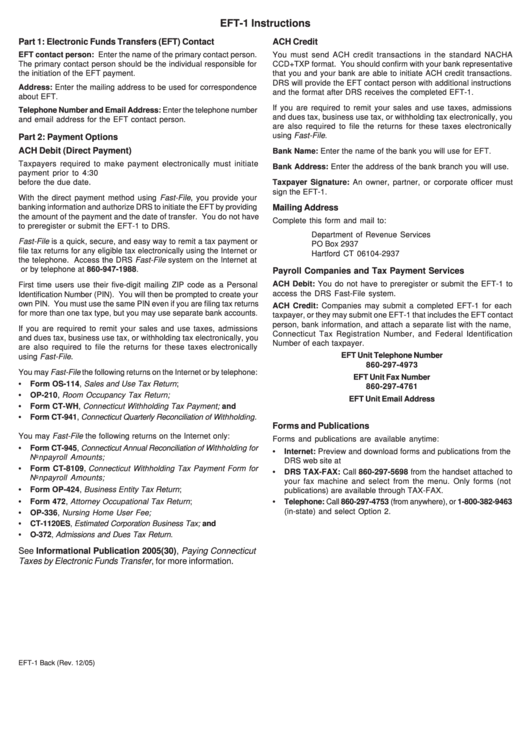

EFT-1 Instructions

Part 1: Electronic Funds Transfers (EFT) Contact

ACH Credit

EFT contact person: Enter the name of the primary contact person.

You must send ACH credit transactions in the standard NACHA

The primary contact person should be the individual responsible for

CCD+TXP format. You should confirm with your bank representative

the initiation of the EFT payment.

that you and your bank are able to initiate ACH credit transactions.

DRS will provide the EFT contact person with additional instructions

Address: Enter the mailing address to be used for correspondence

and the format after DRS receives the completed EFT-1.

about EFT.

If you are required to remit your sales and use taxes, admissions

Telephone Number and Email Address: Enter the telephone number

and dues tax, business use tax, or withholding tax electronically, you

and email address for the EFT contact person.

are also required to file the returns for these taxes electronically

using Fast-File.

Part 2: Payment Options

ACH Debit (Direct Payment)

Bank Name: Enter the name of the bank you will use for EFT.

Taxpayers required to make payment electronically must initiate

Bank Address: Enter the address of the bank branch you will use.

payment prior to 4:30 p.m. eastern time on the last banking day

before the due date.

Taxpayer Signature: An owner, partner, or corporate officer must

sign the EFT-1.

With the direct payment method using Fast-File, you provide your

banking information and authorize DRS to initiate the EFT by providing

Mailing Address

the amount of the payment and the date of transfer. You do not have

Complete this form and mail to:

to preregister or submit the EFT-1 to DRS.

Department of Revenue Services

Fast-File is a quick, secure, and easy way to remit a tax payment or

PO Box 2937

file tax returns for any eligible tax electronically using the Internet or

Hartford CT 06104-2937

the telephone. Access the DRS Fast-File system on the Internet at

or by telephone at 860-947-1988.

Payroll Companies and Tax Payment Services

ACH Debit: You do not have to preregister or submit the EFT-1 to

First time users use their five-digit mailing ZIP code as a Personal

access the DRS Fast-File system.

Identification Number (PIN). You will then be prompted to create your

own PIN. You must use the same PIN even if you are filing tax returns

ACH Credit: Companies may submit a completed EFT-1 for each

for more than one tax type, but you may use separate bank accounts.

taxpayer, or they may submit one EFT-1 that includes the EFT contact

person, bank information, and attach a separate list with the name,

If you are required to remit your sales and use taxes, admissions

Connecticut Tax Registration Number, and Federal Identification

and dues tax, business use tax, or withholding tax electronically, you

Number of each taxpayer.

are also required to file the returns for these taxes electronically

EFT Unit Telephone Number

using Fast-File.

860-297-4973

You may Fast-File the following returns on the Internet or by telephone:

EFT Unit Fax Number

Form OS-114, Sales and Use Tax Return;

•

860-297-4761

•

OP-210, Room Occupancy Tax Return;

EFT Unit Email Address

•

Form CT-WH, Connecticut Withholding Tax Payment; and

ct.eft@po.state.ct.us

•

Form CT-941, Connecticut Quarterly Reconciliation of Withholding.

Forms and Publications

You may Fast-File the following returns on the Internet only:

Forms and publications are available anytime:

•

Form CT-945, Connecticut Annual Reconciliation of Withholding for

Internet: Preview and download forms and publications from the

•

Nonpayroll Amounts;

DRS web site at

Form CT-8109, Connecticut Withholding Tax Payment Form for

•

DRS TAX-FAX: Call 860-297-5698 from the handset attached to

•

Nonpayroll Amounts;

your fax machine and select from the menu. Only forms (not

Form OP-424, Business Entity Tax Return;

•

publications) are available through TAX-FAX.

•

Form 472, Attorney Occupational Tax Return;

•

Telephone: Call 860-297-4753 (from anywhere), or 1-800-382-9463

(in-state) and select Option 2.

OP-336, Nursing Home User Fee;

•

CT-1120ES, Estimated Corporation Business Tax; and

•

O-372, Admissions and Dues Tax Return.

•

See Informational Publication 2005(30), Paying Connecticut

Taxes by Electronic Funds Transfer, for more information.

EFT-1 Back (Rev. 12/05)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Business

1

1