Form Eft-1 Instructions - 2009

ADVERTISEMENT

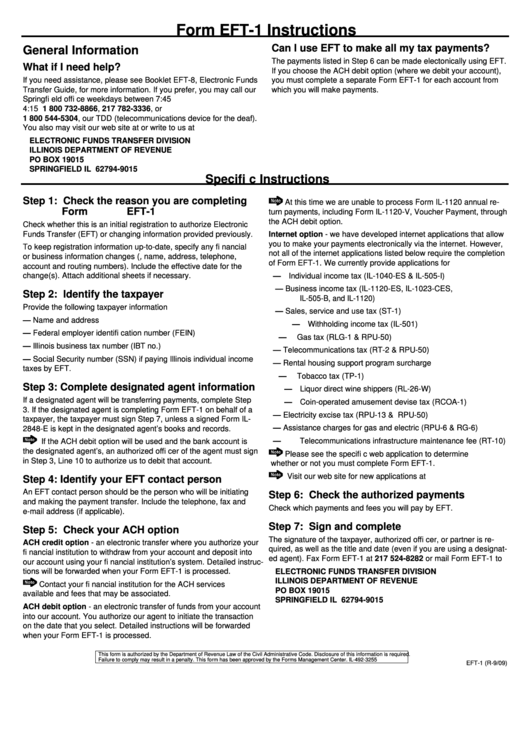

Form EFT-1 Instructions

Can I use EFT to make all my tax payments?

General Information

The payments listed in Step 6 can be made electonically using EFT.

What if I need help?

If you choose the ACH debit option (where we debit your account),

If you need assistance, please see Booklet EFT-8, Electronic Funds

you must complete a separate Form EFT-1 for each account from

Transfer Guide, for more information. If you prefer, you may call our

which you will make payments.

Springfi eld offi ce weekdays between 7:45 a.m. and

4:15 p.m. at 1 800 732-8866, 217 782-3336, or

1 800 544-5304, our TDD (telecommunications device for the deaf).

You also may visit our web site at tax.illinois.gov or write to us at

ELECTRONIC FUNDS TRANSFER DIVISION

ILLINOIS DEPARTMENT OF REVENUE

PO BOX 19015

SPRINGFIELD IL 62794-9015

Specifi c Instructions

Step 1: Check the reason you are completing

At this time we are unable to process Form IL-1120 annual re-

Form EFT-1

turn payments, including Form IL-1120-V, Voucher Payment, through

the ACH debit option.

Check whether this is an initial registration to authorize Electronic

Funds Transfer (EFT) or changing information provided previously.

Internet option - we have developed internet applications that allow

you to make your payments electronically via the internet. However,

To keep registration information up-to-date, specify any fi nancial

not all of the internet applications listed below require the completion

or business information changes (e.g., name, address, telephone,

of Form EFT-1. We currently provide applications for

account and routing numbers). Include the effective date for the

change(s). Attach additional sheets if necessary.

—

Individual income tax (IL-1040-ES & IL-505-I)

—

Business income tax (IL-1120-ES, IL-1023-CES,

Step 2: Identify the taxpayer

IL-505-B, and IL-1120)

Provide the following taxpayer information

—

Sales, service and use tax (ST-1)

— Name and address

—

Withholding income tax (IL-501)

— Federal employer identifi cation number (FEIN)

—

Gas tax (RLG-1 & RPU-50)

— Illinois business tax number (IBT no.)

—

Telecommunications tax (RT-2 & RPU-50)

— Social Security number (SSN) if paying Illinois individual income

—

Rental housing support program surcharge

taxes by EFT.

—

Tobacco tax (TP-1)

Step 3: Complete designated agent information

—

Liquor direct wine shippers (RL-26-W)

If a designated agent will be transferring payments, complete Step

—

Coin-operated amusement devise tax (RCOA-1)

3. If the designated agent is completing Form EFT-1 on behalf of a

—

Electricity excise tax (RPU-13 & RPU-50)

taxpayer, the taxpayer must sign Step 7, unless a signed Form IL-

—

Assistance charges for gas and electric (RPU-6 & RG-6)

2848-E is kept in the designated agent’s books and records.

—

Telecommunications infrastructure maintenance fee (RT-10)

If the ACH debit option will be used and the bank account is

the designated agent’s, an authorized offi cer of the agent must sign

Please see the specifi c web application to determine

in Step 3, Line 10 to authorize us to debit that account.

whether or not you must complete Form EFT-1.

Visit our web site for new applications at tax.illinois.gov.

Step 4: Identify your EFT contact person

An EFT contact person should be the person who will be initiating

Step 6: Check the authorized payments

and making the payment transfer. Include the telephone, fax and

Check which payments and fees you will pay by EFT.

e-mail address (if applicable).

Step 7: Sign and complete

Step 5: Check your ACH option

The signature of the taxpayer, authorized offi cer, or partner is re-

ACH credit option - an electronic transfer where you authorize your

quired, as well as the title and date (even if you are using a designat-

fi nancial institution to withdraw from your account and deposit into

ed agent). Fax Form EFT-1 at 217 524-8282 or mail Form EFT-1 to

our account using your fi nancial institution’s system. Detailed instruc-

tions will be forwarded when your Form EFT-1 is processed.

ELECTRONIC FUNDS TRANSFER DIVISION

ILLINOIS DEPARTMENT OF REVENUE

Contact your fi nancial institution for the ACH services

PO BOX 19015

available and fees that may be associated.

SPRINGFIELD IL 62794-9015

ACH debit option - an electronic transfer of funds from your account

into our account. You authorize our agent to initiate the transaction

on the date that you select. Detailed instructions will be forwarded

when your Form EFT-1 is processed.

This form is authorized by the Department of Revenue Law of the Civil Administrative Code. Disclosure of this information is required.

Failure to comply may result in a penalty. This form has been approved by the Forms Management Center.

IL-492-3255

EFT-1 (R-9/09)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1