Form Cg-112.3 - Schedule C - Sales, Transfers, And Returns Of Unstamped Cigarettes Outside New York State - 2001

ADVERTISEMENT

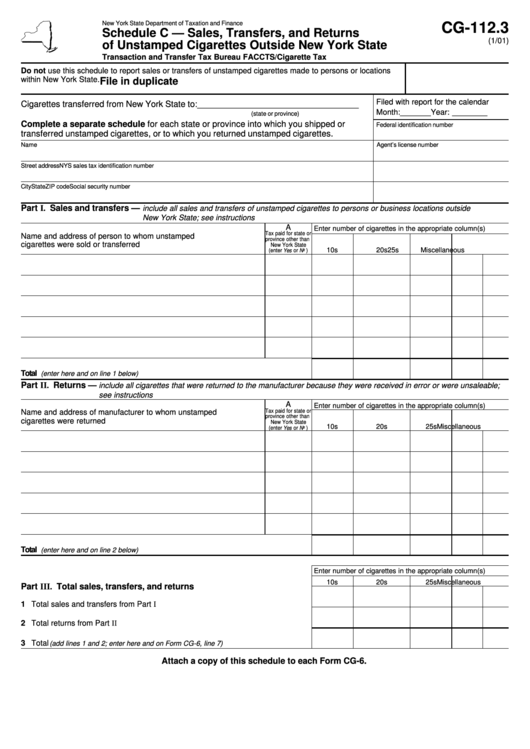

New York State Department of Taxation and Finance

CG-112.3

Schedule C — Sales, Transfers, and Returns

(1/01)

of Unstamped Cigarettes Outside New York State

Transaction and Transfer Tax Bureau FACCTS/Cigarette Tax

Do not use this schedule to report sales or transfers of unstamped cigarettes made to persons or locations

within New York State.

File in duplicate

Filed with report for the calendar

Cigarettes transferred from New York State to: __________________________________

Month: _______

Year: ________

(state or province)

Complete a separate schedule for each state or province into which you shipped or

Federal identification number

transferred unstamped cigarettes, or to which you returned unstamped cigarettes.

Name

Agent’s license number

Street address

NYS sales tax identification number

City

State

ZIP code

Social security number

Part I. Sales and transfers —

include all sales and transfers of unstamped cigarettes to persons or business locations outside

New York State; see instructions

A

Enter number of cigarettes in the appropriate column(s)

Tax paid for state or

Name and address of person to whom unstamped

province other than

cigarettes were sold or transferred

New York State

10s

20s

25s

Miscellaneous

(enter Yes or No )

Total

(enter here and on line 1 below) ......................................................................................

Part II. Returns —

include all cigarettes that were returned to the manufacturer because they were received in error or were unsaleable;

see instructions

A

Enter number of cigarettes in the appropriate column(s)

Tax paid for state or

Name and address of manufacturer to whom unstamped

province other than

cigarettes were returned

New York State

10s

20s

25s

Miscellaneous

(enter Yes or No )

Total

(enter here and on line 2 below) ......................................................................................

Enter number of cigarettes in the appropriate column(s)

10s

20s

25s

Miscellaneous

Part III. Total sales, transfers, and returns

1 Total sales and transfers from Part I .............................................................................

2 Total returns from Part II .................................................................................................

3 Total

(add lines 1 and 2; enter here and on Form CG-6, line 7)

....................................

Attach a copy of this schedule to each Form CG-6.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1