Instructions For Form 4720 - Return Of Certain Excise Taxes On Charities And Other Persons - Department Of The Treasury - 2007

ADVERTISEMENT

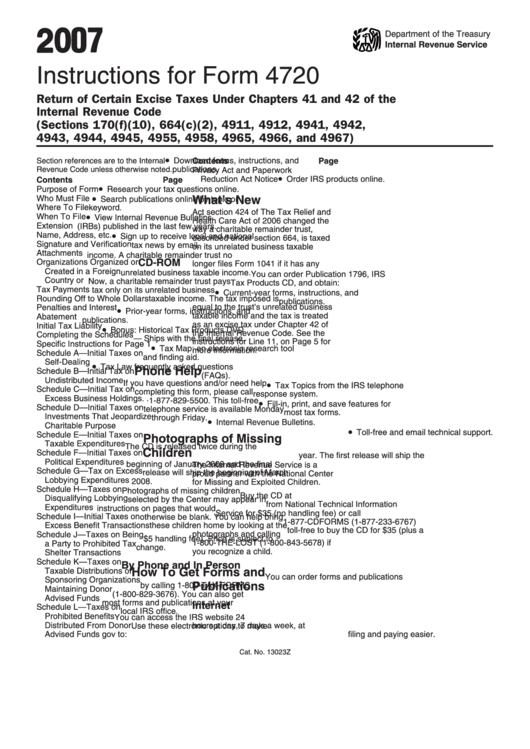

2 0 07

Department of the Treasury

Internal Revenue Service

Instructions for Form 4720

Return of Certain Excise Taxes Under Chapters 41 and 42 of the

Internal Revenue Code

(Sections 170(f)(10), 664(c)(2), 4911, 4912, 4941, 4942,

4943, 4944, 4945, 4955, 4958, 4965, 4966, and 4967)

•

Section references are to the Internal

Download forms, instructions, and

Contents

Page

Revenue Code unless otherwise noted.

publications.

Privacy Act and Paperwork

•

Reduction Act Notice . . . . . . . . . . 15

Order IRS products online.

Contents

Page

•

Purpose of Form . . . . . . . . . . . . . . . .2

Research your tax questions online.

•

Who Must File . . . . . . . . . . . . . . . . . .2

What’s New

Search publications online by topic or

Where To File . . . . . . . . . . . . . . . . . .3

keyword.

Act section 424 of The Tax Relief and

•

When To File . . . . . . . . . . . . . . . . . .3

View Internal Revenue Bulletins

Health Care Act of 2006 changed the

Extension . . . . . . . . . . . . . . . . . . . . .3

(IRBs) published in the last few years.

way a charitable remainder trust,

•

Name, Address, etc. . . . . . . . . . . . . .3

Sign up to receive local and national

described under section 664, is taxed

Signature and Verification . . . . . . . . .3

tax news by email.

on its unrelated business taxable

Attachments . . . . . . . . . . . . . . . . . . .3

income. A charitable remainder trust no

CD-ROM

Organizations Organized or

longer files Form 1041 if it has any

Created in a Foreign

unrelated business taxable income.

You can order Publication 1796, IRS

Country or U.S. Possession

. . . . .3

Now, a charitable remainder trust pays

Tax Products CD, and obtain:

Tax Payments . . . . . . . . . . . . . . . . . .3

•

tax only on its unrelated business

Current-year forms, instructions, and

Rounding Off to Whole Dollars . . . . .4

taxable income. The tax imposed is

publications.

equal to the trust’s unrelated business

Penalties and Interest . . . . . . . . . . . .4

•

Prior-year forms, instructions, and

taxable income and the tax is treated

Abatement . . . . . . . . . . . . . . . . . . . .4

publications.

as an excise tax under Chapter 42 of

Initial Tax Liability . . . . . . . . . . . . . . .4

•

Bonus: Historical Tax Products DVD

the Internal Revenue Code. See the

Completing the Schedules . . . . . . . . .4

— Ships with the final release.

instructions for Line 11, on Page 5 for

Specific Instructions for Page 1 . . . . .4

•

Tax Map: an electronic research tool

more information.

Schedule A — Initial Taxes on

and finding aid.

Self-Dealing . . . . . . . . . . . . . . . . . .6

•

Tax Law frequently asked questions

Phone Help

Schedule B — Initial Tax on

(FAQs).

Undistributed Income . . . . . . . . . . .6

•

If you have questions and/or need help

Tax Topics from the IRS telephone

Schedule C — Initial Tax on

completing this form, please call

response system.

Excess Business Holdings . . . . . . .7

1-877-829-5500. This toll-free

•

Fill-in, print, and save features for

Schedule D — Initial Taxes on

telephone service is available Monday

most tax forms.

Investments That Jeopardize

through Friday.

•

Internal Revenue Bulletins.

Charitable Purpose . . . . . . . . . . . .9

•

Toll-free and email technical support.

Schedule E — Initial Taxes on

Photographs of Missing

Taxable Expenditures . . . . . . . . . . 10

The CD is released twice during the

Children

Schedule F — Initial Taxes on

year. The first release will ship the

Political Expenditures . . . . . . . . . . 10

beginning of January 2008 and the final

The Internal Revenue Service is a

Schedule G — Tax on Excess

release will ship the beginning of March

proud partner with the National Center

Lobbying Expenditures . . . . . . . . . 11

2008.

for Missing and Exploited Children.

Schedule H — Taxes on

Photographs of missing children

Buy the CD at

Disqualifying Lobbying

selected by the Center may appear in

from National Technical Information

Expenditures . . . . . . . . . . . . . . . . 11

instructions on pages that would

Service for $35 (no handling fee) or call

Schedule I — Initial Taxes on

otherwise be blank. You can help bring

1-877-CDFORMS (1-877-233-6767)

Excess Benefit Transactions . . . . 12

these children home by looking at the

toll-free to buy the CD for $35 (plus a

photographs and calling

Schedule J — Taxes on Being

$5 handling fee). Price is subject to

1-800-THE-LOST (1-800-843-5678) if

a Party to Prohibited Tax

change.

you recognize a child.

Shelter Transactions . . . . . . . . . . 13

Schedule K — Taxes on

By Phone and In Person

Taxable Distributions of

How To Get Forms and

You can order forms and publications

Sponsoring Organizations

Publications

by calling 1-800-TAX-FORMS

Maintaining Donor

(1-800-829-3676). You can also get

Advised Funds . . . . . . . . . . . . . . . 14

most forms and publications at your

Internet

Schedule L — Taxes on

local IRS office.

Prohibited Benefits

You can access the IRS website 24

Distributed From Donor

Use these electronic options to make

hours a day, 7 days a week, at

Advised Funds . . . . . . . . . . . . . . . 14

gov to:

filing and paying easier.

Cat. No. 13023Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15