Instructions For Form 4720 - Return Of Certain Excise Taxes On Charities And Other Persons - Department Of The Treasury - 2006

ADVERTISEMENT

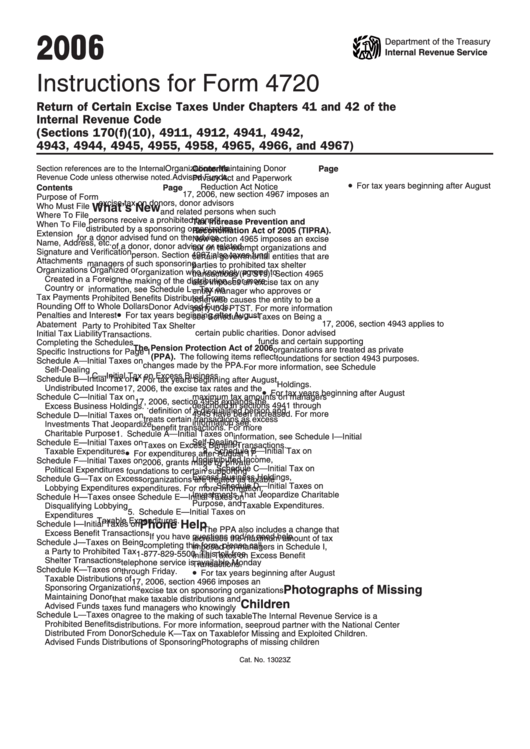

2006

Department of the Treasury

Internal Revenue Service

Instructions for Form 4720

Return of Certain Excise Taxes Under Chapters 41 and 42 of the

Internal Revenue Code

(Sections 170(f)(10), 4911, 4912, 4941, 4942,

4943, 4944, 4945, 4955, 4958, 4965, 4966, and 4967)

Organizations Maintaining Donor

Section references are to the Internal

Contents

Page

Revenue Code unless otherwise noted.

Advised Funds.

Privacy Act and Paperwork

•

For tax years beginning after August

Reduction Act Notice . . . . . . . . . . 15

Contents

Page

17, 2006, new section 4967 imposes an

Purpose of Form . . . . . . . . . . . . . . . .2

excise tax on donors, donor advisors

Who Must File . . . . . . . . . . . . . . . . . .2

What’s New

and related persons when such

Where To File . . . . . . . . . . . . . . . . . .3

persons receive a prohibited benefit

Tax Increase Prevention and

When To File . . . . . . . . . . . . . . . . . .3

distributed by a sponsoring organization

Reconciliation Act of 2005 (TIPRA).

Extension . . . . . . . . . . . . . . . . . . . . .3

for a donor advised fund on the advice

New section 4965 imposes an excise

Name, Address, etc. . . . . . . . . . . . . .3

of a donor, donor advisor or related

tax on tax-exempt organizations and

Signature and Verification . . . . . . . . .3

person. Section 4967 also taxes fund

certain governmental entities that are

Attachments . . . . . . . . . . . . . . . . . . .3

managers of such sponsoring

parties to prohibited tax shelter

Organizations Organized or

organization who knowingly agreed to

transactions (PTSTs). Section 4965

Created in a Foreign

the making of the distribution. For more

also imposes an excise tax on any

Country or U.S. Possession

. . . . .4

information, see Schedule L — Tax on

entity manager who approves or

Tax Payments . . . . . . . . . . . . . . . . . .4

Prohibited Benefits Distributed From

otherwise causes the entity to be a

Rounding Off to Whole Dollars . . . . .4

Donor Advised Funds.

party to a PTST. For more information

•

Penalties and Interest . . . . . . . . . . . .4

For tax years beginning after August

see Schedule J — Taxes on Being a

17, 2006, section 4943 applies to

Abatement . . . . . . . . . . . . . . . . . . . .4

Party to Prohibited Tax Shelter

certain public charities. Donor advised

Initial Tax Liability . . . . . . . . . . . . . . .4

Transactions.

funds and certain supporting

Completing the Schedules . . . . . . . . .4

The Pension Protection Act of 2006

organizations are treated as private

Specific Instructions for Page 1 . . . . .5

(PPA). The following items reflect

foundations for section 4943 purposes.

Schedule A — Initial Taxes on

changes made by the PPA.

For more information, see Schedule

Self-Dealing . . . . . . . . . . . . . . . . . .6

•

C — Initial Tax on Excess Business

Schedule B — Initial Tax on

For tax years beginning after August

Holdings.

Undistributed Income . . . . . . . . . . .7

17, 2006, the excise tax rates and the

•

For tax years beginning after August

Schedule C — Initial Tax on

maximum tax amounts on managers

17, 2006, section 4958 expands the

described in sections 4941 through

Excess Business Holdings . . . . . . .7

definition of a disqualified person and

4945 have been increased. For more

Schedule D — Initial Taxes on

treats certain transactions as excess

information see:

Investments That Jeopardize

benefit transactions. For more

Charitable Purpose . . . . . . . . . . . 10

1. Schedule A — Initial Taxes on

information, see Schedule I — Initial

Self-Dealing,

Schedule E — Initial Taxes on

Taxes on Excess Benefit Transactions.

•

2. Schedule B — Initial Tax on

Taxable Expenditures . . . . . . . . . . 10

For expenditures after August 17,

Undistributed Income,

Schedule F — Initial Taxes on

2006, grants made by private

3. Schedule C — Initial Tax on

Political Expenditures . . . . . . . . . . 11

foundations to certain supporting

Excess Business Holdings,

Schedule G — Tax on Excess

organizations are treated as taxable

4. Schedule D — Initial Taxes on

Lobbying Expenditures . . . . . . . . . 11

expenditures. For more information,

Investments That Jeopardize Charitable

Schedule H — Taxes on

see Schedule E — Initial Taxes on

Purpose, and

Taxable Expenditures.

Disqualifying Lobbying

5. Schedule E — Initial Taxes on

Expenditures . . . . . . . . . . . . . . . . 11

Taxable Expenditures.

Phone Help

Schedule I — Initial Taxes on

The PPA also includes a change that

Excess Benefit Transactions . . . . 12

If you have questions and/or need help

increases the maximum amount of tax

Schedule J — Taxes on Being

completing this form, please call

imposed on managers in Schedule I,

a Party to Prohibited Tax

1-877-829-5500. This toll-free

Initial Taxes on Excess Benefit

Shelter Transactions . . . . . . . . . . 13

telephone service is available Monday

Transactions.

Schedule K — Taxes on

•

through Friday.

For tax years beginning after August

Taxable Distributions of

17, 2006, section 4966 imposes an

Sponsoring Organizations

Photographs of Missing

excise tax on sponsoring organizations

Maintaining Donor

that make taxable distributions and

Children

Advised Funds . . . . . . . . . . . . . . . 14

taxes fund managers who knowingly

Schedule L — Taxes on

agree to the making of such taxable

The Internal Revenue Service is a

Prohibited Benefits

distributions. For more information, see

proud partner with the National Center

Distributed From Donor

Schedule K — Tax on Taxable

for Missing and Exploited Children.

Advised Funds . . . . . . . . . . . . . . . 14

Distributions of Sponsoring

Photographs of missing children

Cat. No. 13023Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15