Instructions For Form 4720 - Return Of Certain Excise Taxes On Charities And Other Persons -Department Of The Treasury - 2002

ADVERTISEMENT

02

2 0

Department of the Treasury

Internal Revenue Service

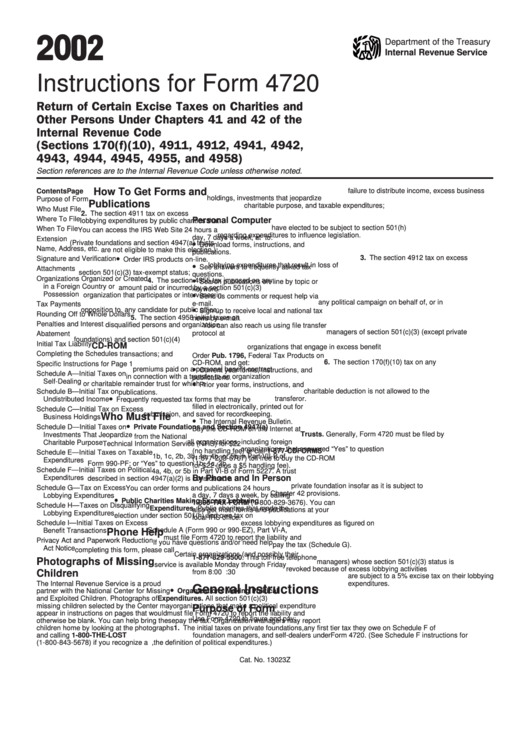

Instructions for Form 4720

Return of Certain Excise Taxes on Charities and

Other Persons Under Chapters 41 and 42 of the

Internal Revenue Code

(Sections 170(f)(10), 4911, 4912, 4941, 4942,

4943, 4944, 4945, 4955, and 4958)

Section references are to the Internal Revenue Code unless otherwise noted.

How To Get Forms and

failure to distribute income, excess business

Contents

Page

holdings, investments that jeopardize

Purpose of Form . . . . . . . . . . . . . . . . . . . 1

Publications

charitable purpose, and taxable expenditures;

Who Must File . . . . . . . . . . . . . . . . . . . . . 1

2. The section 4911 tax on excess

Where To File . . . . . . . . . . . . . . . . . . . . . 2

Personal Computer

lobbying expenditures by public charities that

have elected to be subject to section 501(h)

When To File . . . . . . . . . . . . . . . . . . . . . 2

You can access the IRS Web Site 24 hours a

regarding expenditures to influence legislation.

day, 7 days a week, at to:

Extension . . . . . . . . . . . . . . . . . . . . . . . . 2

•

(Private foundations and section 4947(a) trusts

Download forms, instructions, and

Name, Address, etc. . . . . . . . . . . . . . . . . . 2

are not eligible to make this election.);

publications.

•

3. The section 4912 tax on excess

Signature and Verification . . . . . . . . . . . . . 2

Order IRS products on-line.

•

lobbying expenditures that result in loss of

See answers to frequently asked tax

Attachments . . . . . . . . . . . . . . . . . . . . . . 2

section 501(c)(3) tax-exempt status;

questions.

•

Organizations Organized or Created

4. The section 4955 tax imposed on any

Search publications on-line by topic or

in a Foreign Country or U.S.

amount paid or incurred by a section 501(c)(3)

keyword.

•

Possession . . . . . . . . . . . . . . . . . . . . . 2

organization that participates or intervenes in

Send us comments or request help via

any political campaign on behalf of, or in

e-mail.

Tax Payments . . . . . . . . . . . . . . . . . . . . . 2

•

opposition to, any candidate for public office;

Sign up to receive local and national tax

Rounding Off to Whole Dollars . . . . . . . . . . 2

5. The section 4958 initial taxes on

news by e-mail.

Penalties and Interest . . . . . . . . . . . . . . . . 2

disqualified persons and organization

You can also reach us using file transfer

managers of section 501(c)(3) (except private

protocol at ftp.irs.gov.

Abatement . . . . . . . . . . . . . . . . . . . . . . . 2

foundations) and section 501(c)(4)

Initial Tax Liability . . . . . . . . . . . . . . . . . . 2

CD-ROM

organizations that engage in excess benefit

Completing the Schedules . . . . . . . . . . . . . 3

transactions; and

Order Pub. 1796, Federal Tax Products on

6. The section 170(f)(10) tax on any

CD-ROM, and get:

Specific Instructions for Page 1 . . . . . . . . . 3

•

premiums paid on a personal benefit contract

Current year forms, instructions, and

Schedule A — Initial Taxes on

in connection with a transfer to an organization

publications.

Self-Dealing . . . . . . . . . . . . . . . . . . . . . 4

•

or charitable remainder trust for which a

Prior year forms, instructions, and

Schedule B — Initial Tax on

charitable deduction is not allowed to the

publications.

•

transferor.

Undistributed Income . . . . . . . . . . . . . . 4

Frequently requested tax forms that may be

filled in electronically, printed out for

Schedule C — Initial Tax on Excess

submission, and saved for recordkeeping.

Who Must File

Business Holdings . . . . . . . . . . . . . . . . 4

•

The Internal Revenue Bulletin.

•

Schedule D — Initial Taxes on

Private Foundations and Section 4947(a)

Buy the CD-ROM on the Internet at

Trusts. Generally, Form 4720 must be filed by

Investments That Jeopardize

/cdorders from the National

all organizations, including foreign

Charitable Purpose . . . . . . . . . . . . . . . . 6

Technical Information Service (NTIS) for $22

organizations, that answered “Yes” to question

(no handling fee) or call 1-877-CDFORMS

Schedule E — Initial Taxes on Taxable

1b, 1c, 2b, 3b, 4a, 4b, or 5b in Part VII-B of

(1-877-233-6767) toll free to buy the CD-ROM

Expenditures . . . . . . . . . . . . . . . . . . . . 6

Form 990-PF; or “Yes” to question 1b, 1c, 3b,

for $22 (plus a $5 handling fee).

Schedule F — Initial Taxes on Political

4a, 4b, or 5b in Part VI-B of Form 5227. A trust

Expenditures . . . . . . . . . . . . . . . . . . . . 7

By Phone and In Person

described in section 4947(a)(2) is considered a

private foundation insofar as it is subject to

Schedule G — Tax on Excess

You can order forms and publications 24 hours

Chapter 42 provisions.

a day, 7 days a week, by calling

Lobbying Expenditures . . . . . . . . . . . . . 7

•

Public Charities Making Excess Lobbying

1-800-TAX-FORM (1-800-829-3676). You can

Schedule H — Taxes on Disqualifying

Expenditures. Public charities that made the

also get most forms and publications at your

Lobbying Expenditures . . . . . . . . . . . . . 7

election under section 501(h) and owe tax on

local IRS office.

Schedule I — Initial Taxes on Excess

excess lobbying expenditures as figured on

Schedule A (Form 990 or 990-EZ), Part VI-A,

Benefit Transactions . . . . . . . . . . . . . . . 7

Phone Help

must file Form 4720 to report the liability and

Privacy Act and Paperwork Reduction

If you have questions and/or need help

pay the tax (Schedule G).

Act Notice . . . . . . . . . . . . . . . . . . . . . . 8

completing this form, please call

Certain organizations (and possibly their

1-877-829-5500. This toll-free telephone

Photographs of Missing

managers) whose section 501(c)(3) status is

service is available Monday through Friday

revoked because of excess lobbying activities

Children

from 8:00 a.m. to 6:30 p.m. Eastern time.

are subject to a 5% excise tax on their lobbying

expenditures.

The Internal Revenue Service is a proud

General Instructions

•

partner with the National Center for Missing

Organizations Making Political

and Exploited Children. Photographs of

Expenditures. All section 501(c)(3)

missing children selected by the Center may

organizations that make a political expenditure

Purpose of Form

appear in instructions on pages that would

must file Form 4720 to report the liability and

Use Form 4720 to figure and pay:

otherwise be blank. You can help bring these

pay the tax. Organization managers may report

children home by looking at the photographs

1. The initial taxes on private foundations,

any first tier tax they owe on Schedule F of

and calling 1-800-THE-LOST

foundation managers, and self-dealers under

Form 4720. (See Schedule F instructions for

(1-800-843-5678) if you recognize a child.

sections 4941 through 4945 for self-dealing,

the definition of political expenditures.)

Cat. No. 13023Z

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8