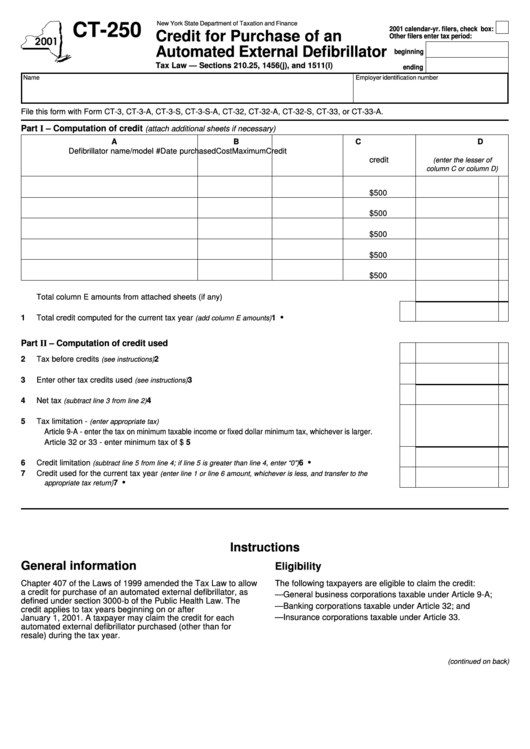

New York State Department of Taxation and Finance

CT-250

2001 calendar-yr. filers, check box:

Credit for Purchase of an

Other filers enter tax period:

Automated External Defibrillator

beginning

Tax Law — Sections 210.25, 1456(j), and 1511(l)

ending

Name

Employer identification number

File this form with Form CT-3, CT-3-A, CT-3-S, CT-3-S-A, CT-32, CT-32-A, CT-32-S, CT-33, or CT-33-A.

Part I – Computation of credit

(attach additional sheets if necessary)

A

B

C

D

E

Defibrillator name/model #

Date purchased

Cost

Maximum

Credit

credit

(enter the lesser of

column C or column D)

$500

$500

$500

$500

$500

Total column E amounts from attached sheets (if any) ................................................................................

•

1

Total credit computed for the current tax year

........................................................

1

(add column E amounts)

Part II – Computation of credit used

2

Tax before credits

..............................................................................................................

2

(see instructions)

3

Enter other tax credits used

..............................................................................................

3

(see instructions)

4

Net tax

.................................................................................................................

4

(subtract line 3 from line 2)

5

Tax limitation -

(enter appropriate tax)

Article 9-A - enter the tax on minimum taxable income or fixed dollar minimum tax, whichever is larger.

Article 32 or 33 - enter minimum tax of $250 ...........................................................................................

5

•

6

Credit limitation

............................................

6

(subtract line 5 from line 4; if line 5 is greater than line 4, enter “0”)

7

Credit used for the current tax year

(enter line 1 or line 6 amount, whichever is less, and transfer to the

•

.................................................................................................................................

7

appropriate tax return)

Instructions

General information

Eligibility

Chapter 407 of the Laws of 1999 amended the Tax Law to allow

The following taxpayers are eligible to claim the credit:

a credit for purchase of an automated external defibrillator, as

— General business corporations taxable under Article 9-A;

defined under section 3000-b of the Public Health Law. The

— Banking corporations taxable under Article 32; and

credit applies to tax years beginning on or after

— Insurance corporations taxable under Article 33.

January 1, 2001. A taxpayer may claim the credit for each

automated external defibrillator purchased (other than for

resale) during the tax year.

(continued on back)

1

1 2

2