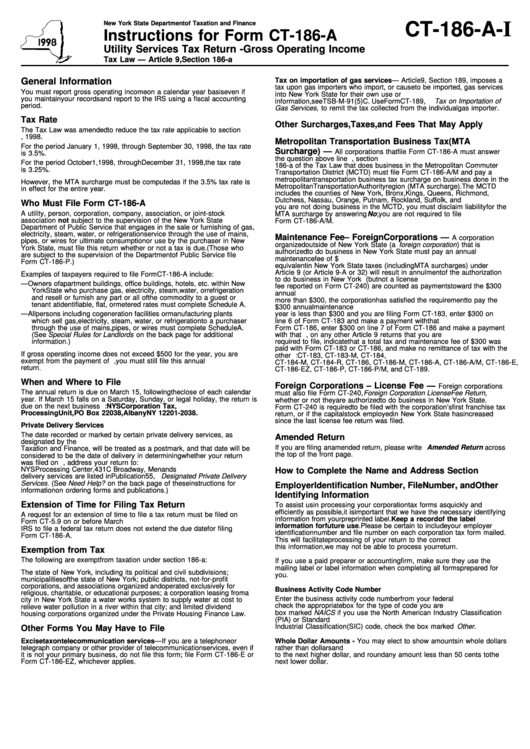

Instructions For Form Ct-186-A - Utility Services Tax Return - Gross Operating Income - New York State Department Of Taxation And Finance - 1998

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-186-A- I

Instructions for Form CT-186-A

Utility Services Tax Return - Gross Operating Income

Tax Law — Article 9, Section 186-a

General Information

Tax on importation of gas services — Article 9, Section 189, imposes a

tax upon gas importers who import, or cause to be imported, gas services

You must report gross operating income on a calendar year basis even if

into New York State for their own use or consumption. For additional

you maintain your records and report to the IRS using a fiscal accounting

information, see TSB-M-91(5)C. Use Form CT-189, Tax on Importation of

period.

Gas Services, to remit the tax collected from the individual gas importer.

Tax Rate

Other Surcharges, Taxes, and Fees That May Apply

The Tax Law was amended to reduce the tax rate applicable to section

186-a. The rate change is effective October 1, 1998.

Metropolitan Transportation Business Tax (MTA

For the period January 1, 1998, through September 30, 1998, the tax rate

Surcharge) —

All corporations that file Form CT-186-A must answer

is 3.5%.

the question above line A. Any business taxable under Article 9, section

For the period October 1, 1998, through December 31, 1998, the tax rate

186-a of the Tax Law that does business in the Metropolitan Commuter

is 3.25%.

Transportation District (MCTD) must file Form CT-186-A/M and pay a

metropolitan transportation business tax surcharge on business done in the

However, the MTA surcharge must be computed as if the 3.5% tax rate is

Metropolitan Transportation Authority region (MTA surcharge). The MCTD

in effect for the entire year.

includes the counties of New York, Bronx, Kings, Queens, Richmond,

Dutchess, Nassau, Orange, Putnam, Rockland, Suffolk, and Westchester. If

Who Must File Form CT-186-A

you are not doing business in the MCTD, you must disclaim liability for the

A utility, person, corporation, company, association, or joint-stock

MTA surcharge by answering No ; you are not required to file

association not subject to the supervision of the New York State

Form CT-186-A / M.

Department of Public Service that engages in the sale or furnishing of gas,

electricity, steam, water, or refrigeration service through the use of mains,

Maintenance Fee – Foreign Corporations —

A corporation

pipes, or wires for ultimate consumption or use by the purchaser in New

organized outside of New York State (a foreign corporation ) that is

York State, must file this return whether or not a tax is due. (Those who

authorized to do business in New York State must pay an annual

are subject to the supervision of the Department of Public Service file

maintenance fee of $300. Failure to pay the annual maintenance fee or its

Form CT-186-P.)

equivalent in New York State taxes (including MTA surcharges) under

Article 9 (or Article 9-A or 32) will result in annulment of the authorization

Examples of taxpayers required to file Form CT-186-A include:

to do business in New York State. Payment of such taxes (but not a license

— Owners of apartment buildings, office buildings, hotels, etc. within New

fee reported on Form CT-240) are counted as payments toward the $300

York State who purchase gas, electricity, steam, water, or refrigeration

annual maintenance fee. If the total of such taxes paid for the tax year is

and resell or furnish any part or all of the commodity to a guest or

more than $300, the corporation has satisfied the requirement to pay the

tenant at identifiable, flat, or metered rates must complete Schedule A.

$300 annual maintenance fee. If the total of such taxes paid for the tax

— All persons including cogeneration facilities or manufacturing plants

year is less than $300 and you are filing Form CT-183, enter $300 on

which sell gas, electricity, steam, water, or refrigeration to a purchaser

line 6 of Form CT-183 and make a payment with that form. If you are filing

through the use of mains, pipes, or wires must complete Schedule A.

Form CT-186, enter $300 on line 7 of Form CT-186 and make a payment

(See Special Rules for Landlords on the back page for additional

with that form. In addition, on any other Article 9 returns that you are

information.)

required to file, indicate that a total tax and maintenance fee of $300 was

paid with Form CT-183 or CT-186, and make no remittance of tax with the

If gross operating income does not exceed $500 for the year, you are

other returns. Article 9 returns include: CT-183, CT-183-M, CT-184,

exempt from the payment of tax. However, you must still file this annual

CT-184-M, CT-184-R, CT-186, CT-186-M, CT-186-A, CT-186-A/M, CT-186-E,

return.

CT-186-EZ, CT-186-P, CT-186-P/M, and CT-189.

When and Where to File

Foreign Corporations – License Fee —

Foreign corporations

The annual return is due on March 15, following the close of each calendar

must also file Form CT-240, Foreign Corporation License Fee Return,

year. If March 15 falls on a Saturday, Sunday, or legal holiday, the return is

whether or not they are authorized to do business in New York State.

due on the next business day. Mail your return to: NYS Corporation Tax,

Form CT-240 is required to be filed with the corporation’s first franchise tax

Processing Unit, PO Box 22038, Albany NY 12201-2038.

return, or if the capital stock employed in New York State has increased

since the last license fee return was filed.

Private Delivery Services

The date recorded or marked by certain private delivery services, as

Amended Return

designated by the U.S. Secretary of the Treasury or the Commissioner of

If you are filing an amended return, please write Amended Return across

Taxation and Finance, will be treated as a postmark, and that date will be

the top of the front page.

considered to be the date of delivery in determining whether your return

was filed on time. If you use one of these services, address your return to:

NYS Processing Center, 431C Broadway, Menands NY 12204. Designated

How to Complete the Name and Address Section

delivery services are listed in Publication 55, Designated Private Delivery

Services . (See Need Help? on the back page of these instructions for

Employer Identification Number, File Number, and Other

information on ordering forms and publications.)

Identifying Information

Extension of Time for Filing Tax Return

To assist us in processing your corporation tax forms as quickly and

efficiently as possible, it is important that we have the necessary identifying

A request for an extension of time to file a tax return must be filed on

information from your preprinted label. Keep a record of the label

Form CT-5.9 on or before March 15. An extension of time granted by the

information for future use. Please be certain to include your employer

IRS to file a federal tax return does not extend the due date for filing

identification number and file number on each corporation tax form mailed.

Form CT-186-A.

This will facilitate processing of your return to the correct account. Without

this information, we may not be able to process your return.

Exemption from Tax

The following are exempt from taxation under section 186-a:

If you use a paid preparer or accounting firm, make sure they use the

mailing label or label information when completing all forms prepared for

The state of New York, including its political and civil subdivisions;

you.

municipalities of the state of New York; public districts, not-for-profit

corporations, and associations organized and operated exclusively for

Business Activity Code Number

religious, charitable, or educational purposes; a corporation leasing from a

Enter the business activity code number from your federal return. Please

city in New York State a water works system to supply water at cost to

check the appropriate box for the type of code you are using. Check the

relieve water pollution in a river within that city; and limited dividend

box marked NAICS if you use the North American Industry Classification

housing corporations organized under the Private Housing Finance Law.

System. If you have entered a Principal Industrial Activity (PIA) or Standard

Industrial Classification (SIC) code, check the box marked Other .

Other Forms You May Have to File

Excise tax on telecommunication services — If you are a telephone or

Whole Dollar Amounts - You may elect to show amounts in whole dollars

telegraph company or other provider of telecommunication services, even if

rather than dollars and cents. Round an amount from 50 through 99 cents

it is not your primary business, do not file this form; file Form CT-186-E or

to the next higher dollar, and round any amount less than 50 cents to the

Form CT-186-EZ, whichever applies.

next lower dollar.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2