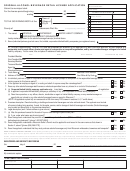

ALCOHOLIC BEVERAGE SUPPLIER LICENSE APPLICATION INFORMATION

“Supplier” means an alcoholic beverage manufacturer, importer, marketer, or wholesaler selling alcoholic

beverages to a wholesaler licensed in this state for purposes of resale.

Before a supplier may engage in the sale or shipment of alcoholic beverages to a licensed North Dakota

wholesaler, that supplier must fi rst procure a supplier license from the state tax commissioner. There is no

fee for this license, and the license will remain in effect until cancelled by the applicant.

This requirement does not apply to North Dakota manufacturers, domestic wineries, microbrew

pubs, or wholesalers already licensed by the Tax Commissioner.

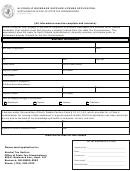

For any month in which a licensed supplier has made sales to a North Dakota wholesaler, that supplier

shall fi le a report with the tax commissioner no later than the thirtieth day of each calendar month covering

alcoholic beverages sold or shipped to a North Dakota wholesaler during the preceding calendar month.

Reports due in February will be due no later than the last day of the month. When the thirtieth day of the

calendar month falls on a Saturday, Sunday, or legal holiday, the due date is the fi rst working day after the

Saturday, Sunday, or legal holiday. The report must provide such detail and be in a format as prescribed

by the tax commissioner. The tax commissioner may require that the report be submitted in an electronic

format approved by the tax commissioner.

If a supplier fails to fi le the report as required by this section, there is imposed a penalty of twenty-fi ve

dollars per month for each calendar month or fraction of a month during which the delinquency continues

beginning with the month during which the report was due.

A supplier in violation of this section who fails to obtain a license, or fails to fi le the required reports, or

furnishes information required by this section that is false or misleading is guilty of a class A misdemeanor.

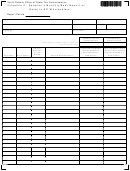

Suppliers selling beer to North Dakota wholesaler will be required to fi le a monthly Schedule C report.

Sales include all beer products shipped into North Dakota whether purchased under a North Dakota

account or that of another state.

Suppliers selling alcohol to North Dakota wholesalers will be required to fi le a monthly Schedule A report.

Sales include all alcohol products shipped into North Dakota whether purchased under a North Dakota

account or that of another state.

The North Dakota Offi ce of State Tax Commissioner internet web site is:

Supplier license application forms will be available at that web site under Alcohol\Forms.

For additional information, you may contact Anne Hutchison in the Alcohol Tax Section by telephone at

701-328-2702, by E-mail at ahutchison@state.nd.us, or E-mail our offi ce at alcoholtax@state.nd.us.

1

1 2

2 3

3 4

4 5

5 6

6