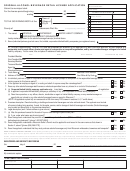

Supplier’s Monthly Liquor Report - Schedule A

Per North Dakota Century Code § 5-03-09, a supplier who ships alcoholic beverages to North Dakota wholesalers must complete a (Schedule A) report and send it to the

Offi ce of State Tax Commissioner on or before the 30th day of the month following the month during which a sale (or return) was made. The February due date is the last

day of February. If no sales were made, no report is necessary. If a supplier fails to fi le the required (Schedule A) report, there is imposed a penalty of twenty-fi ve dollars

per month for each calendar month or fraction of a month during which the delinquency continues beginning with the month during which the report was due. A supplier in

violation of this section or who furnishes information required by this section that is false or misleading is guilty of a class A misdemeanor.

Schedule A Instructions

1. Report Period: Enter the year and month of sales (or return) covered on the report in the YYYYMM format (i.e., 200507).

2. Supplier Name: Enter the name you have on your N.D. Supplier License.

3. FEIN: Enter the company assigned 9-character Federal ID number with no hyphens.

4. ND Supplier License #: Enter your 4-character N.D. Supplier License number.

5. Address, City, State, and Zip Code: Enter the supplier’s mailing address.

6. Prepared By: Enter the name of the contact person responsible for fi ling report.

7. Phone Number and E-mail Address: Enter the contact person’s number and e-mail address.

8. For each invoice, enter:

a. The invoice date,

b. The invoice number,

c. N.D. Liquor Wholesaler account number. Enter the 2-character number assigned to the N.D. Liquor Wholesaler who received product. A list of the N.D. Liquor

Wholesaler account numbers can be found on our web site at ndtaxdepartment.gov.

d. N.D. Liquor Wholesaler name,

e. The total volume for each of the product categories in liters rounded to 2 decimal places.

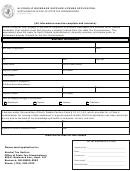

9. Total Volumes for Month:

a. Compute the grand total volume sold for the month, in liters, for each category. Enter those totals, in liters, in the space provided above the detailed columns.

b. Convert the liter totals to gallons for each category by using the conversion factor 0.26417. Enter those totals, in gallons, in the space provided above the detailed

columns.

c. When multiple pages are used to complete the schedule, report the grand total volumes on the fi rst page only.

For return/credit invoices, provide the same information as for sales invoices and enter volumes as credit (negative) amounts.

For purposes of this report, the following defi nitions apply:

1. “Alcohol” means neutral spirits distilled at or above one hundred ninety degrees proof, whether nor not such product is subsequently reduced, for nonindustrial use.

2. “Distilled spirits” means any alcoholic beverage that is not beer, wine, sparkling wine, or alcohol.

3. “Sparkling wine” means wine made effervescent with carbon dioxide (Include champagne in this category).

4. “Wine” means the alcoholic beverage obtained by fermentation of agricultural products containing natural or added sugar or such beverage fortifi ed with brandy and

containing not more than twenty-four percent alcohol by volume.

5. “Supplier” means an alcoholic beverage manufacturer, importer, marketer, or wholesaler selling alcoholic beverages to a wholesaler licensed in this state for purposes

of resale.

Contacts:

Mailing Address:

Technical Assistance, Taxpayer Assistance ...................(701) 328-2702

North Dakota Offi ce of State Tax Commissioner

FAX Number .................................................................(701) 328-1283

Alcohol Tax Section

E-mail ............................................................................alcoholtax@state.nd.us

600 E. Boulevard Ave. Dept. 127

Web Site Address ...........................................................

Bismarck, ND 58505-0599

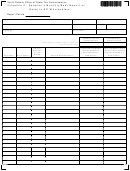

1

1 2

2 3

3 4

4 5

5 6

6