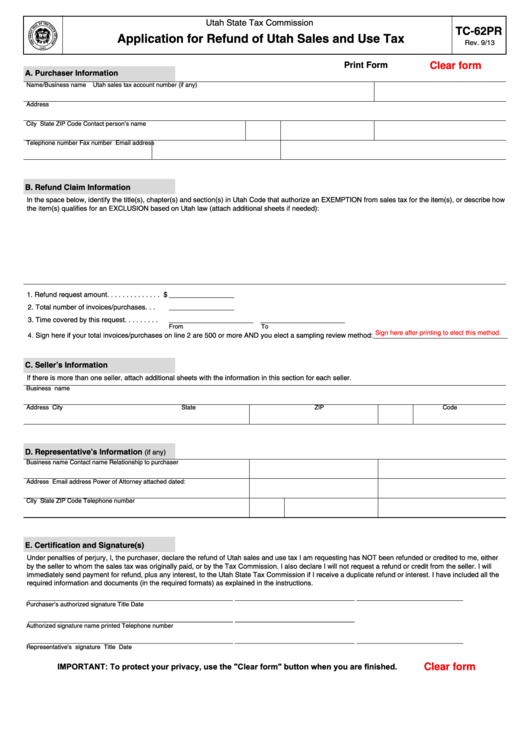

Utah State Tax Commission

TC-62PR

Application for Refund of Utah Sales and Use Tax

Rev. 9/13

Clear form

Print Form

A. Purchaser Information

Name/Business name

Utah sales tax account number (if any)

Address

City

State

ZIP Code

Contact person’s name

Telephone number

Fax number

Email address

B. Refund Claim Information

In the space below, identify the title(s), chapter(s) and section(s) in Utah Code that authorize an EXEMPTION from sales tax for the item(s), or describe how

the item(s) qualifies for an EXCLUSION based on Utah law (attach additional sheets if needed):

1. Refund request amount. . . . . . . . . . . . . . $ _ _ __ __ _ ___

2. Total number of invoices/purchases . . .

__ _ __ _ __ __

3. Time covered by this request . . . . . . . . .

__ _ __ _ __ ___ _ _

__ _ _ _______ _ _

From

To

Sign here after printing to elect this method.

4. Sign here if your total invoices/purchases on line 2 are 500 or more AND you elect a sampling review method: _____________________

C. Seller’s Information

If there is more than one seller, attach additional sheets with the information in this section for each seller.

Business name

Address

City

State

ZIP Code

D. Representative’s Information

(if any)

Business name

Contact name

Relationship to purchaser

Address

Email address

Power of Attorney attached dated:

City

State

ZIP Code

Telephone number

E. Certification and Signature(s)

Under penalties of perjury, I, the purchaser, declare the refund of Utah sales and use tax I am requesting has NOT been refunded or credited to me, either

by the seller to whom the sales tax was originally paid, or by the Tax Commission. I also declare I will not request a refund or credit from the seller. I will

immediately send payment for refund, plus any interest, to the Utah State Tax Commission if I receive a duplicate refund or interest. I have included all the

required information and documents (in the required formats) as explained in the instructions.

____ __ __ _ _ _ _ _ _____ __ _ __ _ __ __ _ _ _

_ __ ____ ___ ____ ___ _

__ ___ ___ _ _ _ _ _ _ _ _

Purchaser’s authorized signature

Title

Date

____ __ __ _ _ _ _ _ _____ __ _ __ _ __ __ _ _ _

_ __ ____ ___ ____ ___ _

Authorized signature name printed

Telephone number

____ __ __ _ _ _ _ _ _____ __ _ __ _ __ __ _ _ _

_ __ ____ ___ ____ ___ _

__ ___ ___ _ _ _ _ _ _ _ _

Representative's signature

Title

Date

IMPORTANT: To protect your privacy, use the "Clear form" button when you are finished.

Clear form

1

1