Form Dct -66 - Consent To Extend Time Limit For Assessment Of Tax

ADVERTISEMENT

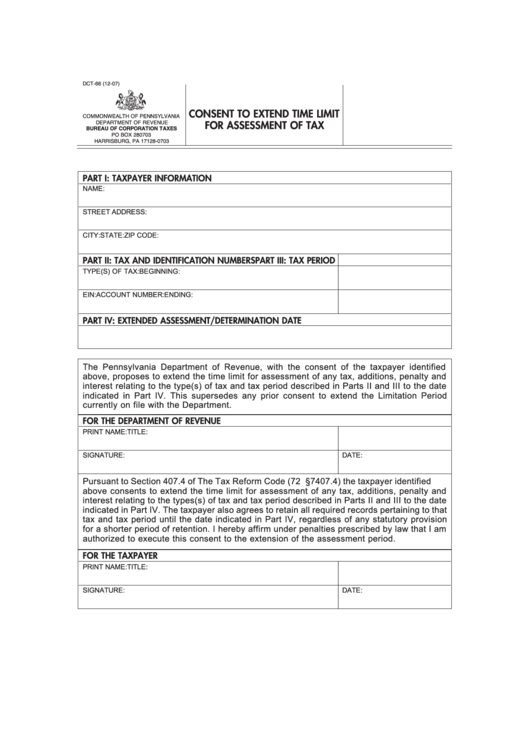

DCT-66 (12-07)

CONSENT TO EXTEND TIME LIMIT

COMMONWEALTH OF PENNSYLVANIA

DEPARTMENT OF REVENUE

FOR ASSESSMENT OF TAX

BUREAU OF CORPORATION TAXES

PO BOX 280703

HARRISBURG, PA 17128-0703

PART I: TAXPAYER INFORMATION

NAME:

STREET ADDRESS:

CITY:

STATE:

ZIP CODE:

PART II: TAX AND IDENTIFICATION NUMBERS

PART III: TAX PERIOD

TYPE(S) OF TAX:

BEGINNING:

EIN:

ACCOUNT NUMBER:

ENDING:

PART IV: EXTENDED ASSESSMENT/DETERMINATION DATE

The Pennsylvania Department of Revenue, with the consent of the taxpayer identified

above, proposes to extend the time limit for assessment of any tax, additions, penalty and

interest relating to the type(s) of tax and tax period described in Parts II and III to the date

indicated in Part IV. This supersedes any prior consent to extend the Limitation Period

currently on file with the Department.

FOR THE DEPARTMENT OF REVENUE

PRINT NAME:

TITLE:

SIGNATURE:

DATE:

Pursuant to Section 407.4 of The Tax Reform Code (72 P.S. §7407.4) the taxpayer identified

above consents to extend the time limit for assessment of any tax, additions, penalty and

interest relating to the types(s) of tax and tax period described in Parts II and III to the date

indicated in Part IV. The taxpayer also agrees to retain all required records pertaining to that

tax and tax period until the date indicated in Part IV, regardless of any statutory provision

for a shorter period of retention. I hereby affirm under penalties prescribed by law that I am

authorized to execute this consent to the extension of the assessment period.

FOR THE TAXPAYER

PRINT NAME:

TITLE:

SIGNATURE:

DATE:

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1