A

D

R

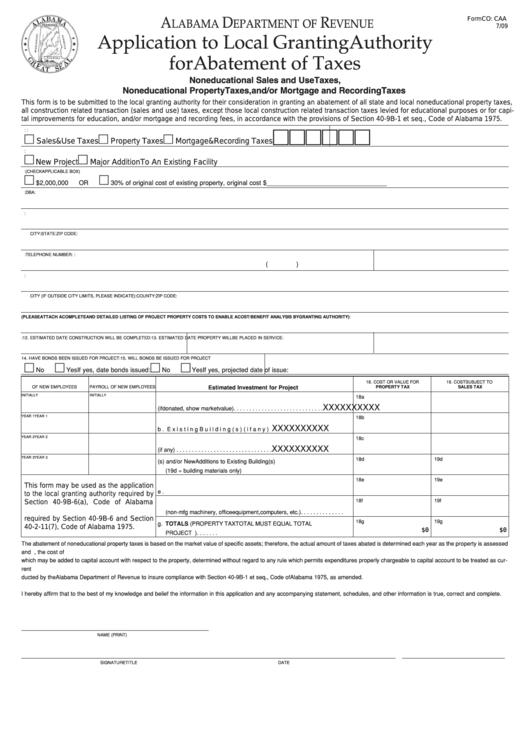

Form CO: CAA

LABAMA

EPARTMENT OF

EVENUE

7/09

Application to Local Granting Authority

for Abatement of Taxes

Noneducational Sales and Use Taxes,

Noneducational Property Taxes, and/or Mortgage and Recording Taxes

Reset Form

This form is to be submitted to the local granting authority for their consideration in granting an abatement of all state and local noneducational property taxes,

all construction related transaction (sales and use) taxes, except those local construction related transaction taxes levied for educational purposes or for capi-

tal improvements for education, and/or mortgage and recording fees, in accordance with the provisions of Section 40-9B-1 et seq., Code of Alabama 1975.

1. TYPE OF ABATEMENT APPLYING FOR:

2. PROJECT NAICS CODE:

Sales & Use Taxes

Property Taxes

Mortgage & Recording Taxes

3. TYPE OF PROJECT:

New Project

Major Addition To An Existing Facility

4. DOES MAJOR ADDITION EQUAL THE LESSER OF: (CHECK APPLICABLE BOX)

$2,000,000

OR

30% of original cost of existing property, original cost $__________________________________

5. PROJECT APPLICANT:

DBA:

6. ADDRESS OF APPLICANT:

CITY:

STATE:

ZIP CODE:

7. NAME OF CONTACT PERSON:

TELEPHONE NUMBER:

8. DATE COMPANY ORGANIZED:

(

)

9. PHYSICAL LOCATION OF PROJECT:

CITY (IF OUTSIDE CITY LIMITS, PLEASE INDICATE):

COUNTY:

ZIP CODE:

10. BRIEF DESCRIPTION OF PROJECT (PLEASE ATTACH A COMPLETE AND DETAILED LISTING OF PROJECT PROPERTY COSTS TO ENABLE A COST/BENEFIT ANALYSIS BY GRANTING AUTHORITY):

11. ESTIMATED DATE CONSTRUCTION WILL BEGIN:

12. ESTIMATED DATE CONSTRUCTION WILL BE COMPLETED:

13. ESTIMATED DATE PROPERTY WILL BE PLACED IN SERVICE:

14. HAVE BONDS BEEN ISSUED FOR PROJECT:

15. WILL BONDS BE ISSUED FOR PROJECT

No

Yes If yes, date bonds issued:

No

Yes If yes, projected date of issue:

16. ESTIMATED NUMBER

17. ESTIMATED ANNUAL

18. COST OR VALUE FOR

19. COST SUBJECT TO

OF NEW EMPLOYEES

PAYROLL OF NEW EMPLOYEES

Estimated Investment for Project

PROPERTY TAX

SALES TAX

INITIALLY

INITIALLY

18a

XXXXXXXXXX

a. Land (if donated, show market value). . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YEAR 1

YEAR 1

18b

XXXXXXXXXX

b. Existing Building(s) (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YEAR 2

YEAR 2

18c

XXXXXXXXXX

c. Existing Personal Property (if any) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

YEAR 3

YEAR 3

18d

19d

d. New Building(s) and/or New Additions to Existing Building(s)

(19d = building materials only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

18e

19e

This form may be used as the application

e. New Manufacturing Machinery . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

to the local granting authority required by

18f

19f

Section 40-9B-6(a), Code of Alabama

f. Other New Personal Property

1975. The information requested here is

(non-mfg machinery, office equipment, computers, etc.) . . . . . . . . . . . . . .

required by Section 40-9B-6 and Section

18g

19g

g. TOTALS (PROPERTY TAX TOTAL MUST EQUAL TOTAL

40-2-11(7), Code of Alabama 1975.

$0

$0

PROJECT INVESTMENT. SALES TAX TOTAL WILL BE LESS.) . . . . . . .

The abatement of noneducational property taxes is based on the market value of specific assets; therefore, the actual amount of taxes abated is determined each year as the property is assessed

and valued. An abatement of noneducational sales and use taxes shall apply only to tangible personal property and taxable services incorporated into private use industrial property, the cost of

which may be added to capital account with respect to the property, determined without regard to any rule which permits expenditures properly chargeable to capital account to be treated as cur-

rent expenses. No abatement of sales and use taxes shall extend beyond the date private use industrial property is placed in service. A verification inspection of qualifying property will be con-

ducted by the Alabama Department of Revenue to insure compliance with Section 40-9B-1 et seq., Code of Alabama 1975, as amended.

I hereby affirm that to the best of my knowledge and belief the information in this application and any accompanying statement, schedules, and other information is true, correct and complete.

_____________________________________________________

NAME (PRINT)

_____________________________________________________

_____________________________________________________ _____________________________

SIGNATURE

TITLE

DATE

1

1 2

2 3

3