K-Cns 010 Instruction - Kansas Department Of Labor

ADVERTISEMENT

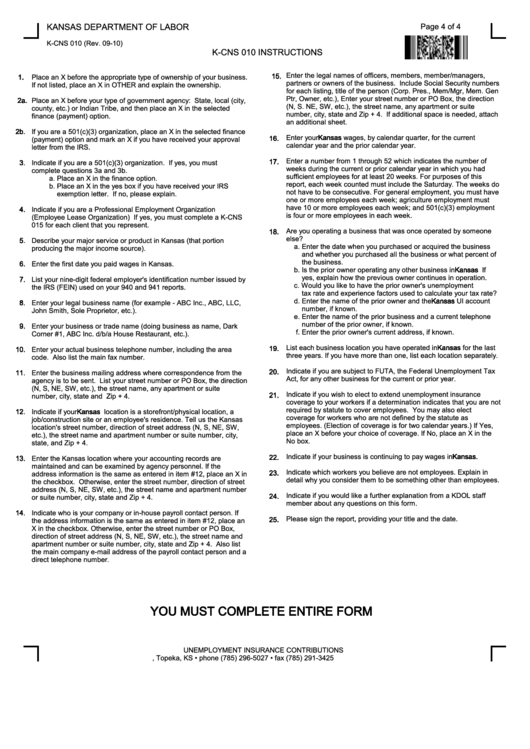

KANSAS DEPARTMENT OF LABOR

Page 4 of 4

K-CNS 010 (Rev. 09-10)

K-CNS 010 INSTRUCTIONS

Enter the legal names of officers, members, member/managers,

15.

1.

Place an X before the appropriate type of ownership of your business.

partners or owners of the business. Include Social Security numbers

If not listed, place an X in OTHER and explain the ownership.

for each listing, title of the person (Corp. Pres., Mem/Mgr, Mem. Gen

Ptr, Owner, etc.), Enter your street number or PO Box, the direction

2a.

Place an X before your type of government agency: State, local (city,

(N, S. NE, SW, etc.), the street name, any apartment or suite

county, etc.) or Indian Tribe, and then place an X in the selected

number, city, state and Zip + 4. If additional space is needed, attach

finance (payment) option.

an additional sheet.

2b.

If you are a 501(c)(3) organization, place an X in the selected finance

Enter your Kansas wages, by calendar quarter, for the current

16.

(payment) option and mark an X if you have received your approval

calendar year and the prior calendar year.

letter from the IRS.

Enter a number from 1 through 52 which indicates the number of

17.

3.

Indicate if you are a 501(c)(3) organization. If yes, you must

weeks during the current or prior calendar year in which you had

complete questions 3a and 3b.

sufficient employees for at least 20 weeks. For purposes of this

a. Place an X in the finance option.

report, each week counted must include the Saturday. The weeks do

b. Place an X in the yes box if you have received your IRS

not have to be consecutive. For general employment, you must have

exemption letter. If no, please explain.

one or more employees each week; agriculture employment must

have 10 or more employees each week; and 501(c)(3) employment

4.

Indicate if you are a Professional Employment Organization

is four or more employees in each week.

(Employee Lease Organization) If yes, you must complete a K-CNS

015 for each client that you represent.

Are you operating a business that was once operated by someone

18.

else?

5.

Describe your major service or product in Kansas (that portion

a. Enter the date when you purchased or acquired the business

producing the major income source).

and whether you purchased all the business or what percent of

the business.

6.

Enter the first date you paid wages in Kansas.

b. Is the prior owner operating any other business in Kansas If

yes, explain how the previous owner continues in operation.

7.

List your nine-digit federal employer's identification number issued by

c. Would you like to have the prior owner's unemployment

the IRS (FEIN) used on your 940 and 941 reports.

tax rate and experience factors used to calculate your tax rate?

d. Enter the name of the prior owner and the Kansas UI account

8.

Enter your legal business name (for example - ABC Inc., ABC, LLC,

number, if known.

John Smith, Sole Proprietor, etc.).

e. Enter the name of the prior business and a current telephone

number of the prior owner, if known.

9.

Enter your business or trade name (doing business as name, Dark

f. Enter the prior owner's current address, if known.

Corner #1, ABC Inc. d/b/a House Restaurant, etc.).

List each business location you have operated in Kansas for the last

19.

10.

Enter your actual business telephone number, including the area

three years. If you have more than one, list each location separately.

code. Also list the main fax number.

Indicate if you are subject to FUTA, the Federal Unemployment Tax

20.

11.

Enter the business mailing address where correspondence from the

Act, for any other business for the current or prior year.

agency is to be sent. List your street number or PO Box, the direction

(N, S, NE, SW, etc.), the street name, any apartment or suite

Indicate if you wish to elect to extend unemployment insurance

21.

number, city, state and Zip + 4.

coverage to your workers if a determination indicates that you are not

required by statute to cover employees. You may also elect

12.

Indicate if your Kansas location is a storefront/physical location, a

coverage for workers who are not defined by the statute as

job/construction site or an employee's residence. Tell us the Kansas

employees. (Election of coverage is for two calendar years.) If Yes,

location's street number, direction of street address (N, S, NE, SW,

place an X before your choice of coverage. If No, place an X in the

etc.), the street name and apartment number or suite number, city,

No box.

state, and Zip + 4.

Indicate if your business is continuing to pay wages in Kansas.

22.

13.

Enter the Kansas location where your accounting records are

maintained and can be examined by agency personnel. If the

Indicate which workers you believe are not employees. Explain in

23.

address information is the same as entered in item #12, place an X in

detail why you consider them to be something other than employees.

the checkbox. Otherwise, enter the street number, direction of street

address (N, S, NE, SW, etc.), the street name and apartment number

Indicate if you would like a further explanation from a KDOL staff

24.

or suite number, city, state and Zip + 4.

member about any questions on this form.

14.

Indicate who is your company or in-house payroll contact person. If

Please sign the report, providing your title and the date.

25.

the address information is the same as entered in item #12, place an

X in the checkbox. Otherwise, enter the street number or PO Box,

direction of street address (N, S, NE, SW, etc.), the street name and

apartment number or suite number, city, state and Zip + 4. Also list

the main company e-mail address of the payroll contact person and a

direct telephone number.

YOU MUST COMPLETE ENTIRE FORM

UNEMPLOYMENT INSURANCE CONTRIBUTIONS

P.O. Box 400, Topeka, KS • phone (785) 296-5027 • fax (785) 291-3425

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1