Form K-Cns 100 - Quarterly Wage Report & Unemployment Tax Return - Kansas Department Of Labor

ADVERTISEMENT

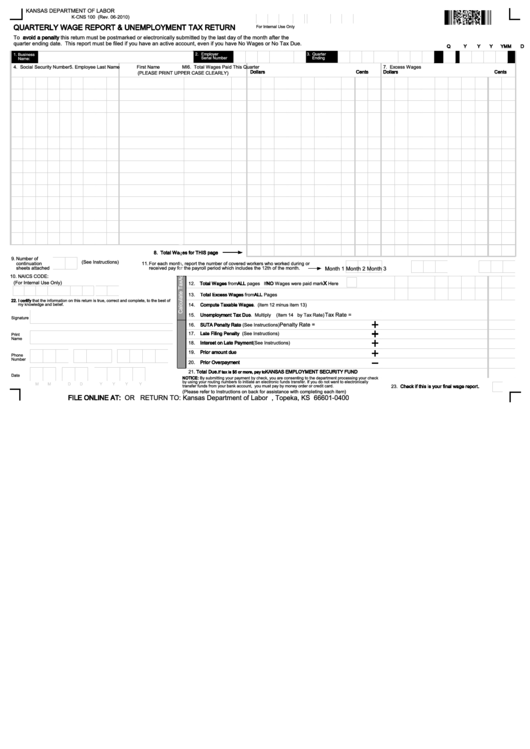

KANSAS DEPARTMENT OF LABOR

K-CNS 100 (Rev. 06-2010)

QUARTERLY WAGE REPORT & UNEMPLOYMENT TAX RETURN

For Internal Use Only

To avoid a penalty this return must be postmarked or electronically submitted by the last day of the month after the

quarter ending date. This report must be filed if you have an active account, even if you have No Wages or No Tax Due.

M

M

D

D

Y

Y

Y

Y

Q

Y

Y

Y

Y

2.

Employer

3.

Quarter

1.

Business

Serial Number

Ending

Name:

4. Social Security Number

5. Employee Last Name

First Name

MI

6. Total Wages Paid This Quarter

7. Excess Wages

Dollars

Cents

Dollars

Cents

(PLEASE PRINT UPPER CASE CLEARLY)

8. Total Wages for THIS page

9.

Number of

(See Instructions)

continuation

11.

For each month, report the number of covered workers who worked during or

sheets attached

received pay for the payroll period which includes the 12th of the month.

Month 1

Month 2

Month 3

10. NAICS CODE:

(For Internal Use Only)

X

12. Total Wages from ALL pages If NO Wages were paid mark

Here

13.

Total Excess Wages from ALL Pages

22.

I certify that the information on this return is true, correct and complete, to the best of

my knowledge and belief.

14.

Compute Taxable Wages. (item 12 minus item 13)

Tax Rate =

15.

Unemployment Tax Due. Multiply

(Item 14 by Tax Rate)

Signature

Penalty Rate =

16.

SUTA Penalty Rate (See Instructions)

17.

Late Filing Penalty

(See Instructions)

Print

Name

18.

Interest on Late Payment (See Instructions)

19.

Prior amount due

Phone

Number

20.

Prior Overpayment

21. Total Due.

KANSAS EMPLOYMENT SECURITY FUND

If tax is $5 or more, pay to

Date

NOTICE: By submitting your payment by check, you are consenting to the department processing your check

by using your routing numbers to initiate an electronic funds transfer. If you do not want to electronically

M

M

D

D

Y

Y

Y

Y

transfer funds from your bank account, you must pay by money order or credit card.

23. Check if this is your final wage report.

(Please refer to Instructions on back for assistance with completing each item)

FILE ONLINE AT: OR RETURN TO: Kansas Department of Labor P.O. Box 400, Topeka, KS 66601-0400

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1 2

2