Form 150-206-677 - Withholding Tax Percentage Formula - 1998

ADVERTISEMENT

Information Circular

April 1998

Withholding Tax

Percentage Formula

Computer formula

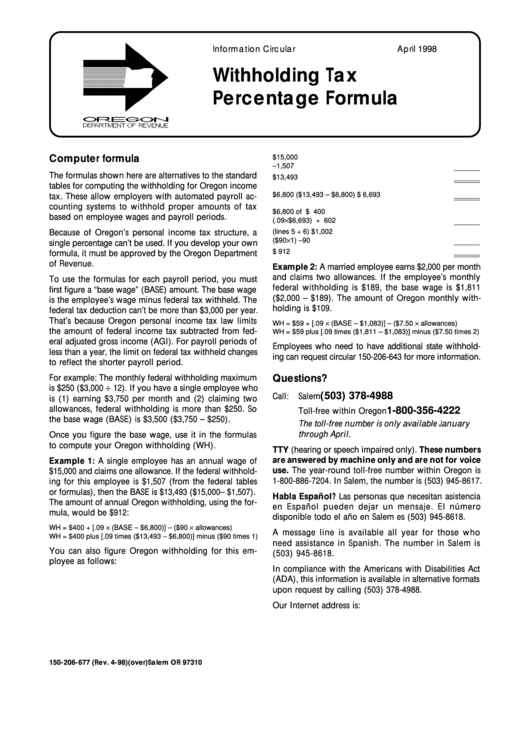

1. Wage ........................................................................... $ 15,000

2. Less federal withholding .............................................. – 1,507

The formulas shown here are alternatives to the standard

3. BASE ........................................................................... $ 13,493

tables for computing the withholding for Oregon income

4. Amount of BASE over $6,800 ($13,493 – $6,800) ...... $ 6,693

tax. These allow employers with automated payroll ac-

counting systems to withhold proper amounts of tax

5. Tax on first $6,800 of BASE ........................................ $

400

based on employee wages and payroll periods.

6. Tax on excess (.09 × $6,693) ...................................... +

602

7. Total tax from rates (lines 5 + 6) .................................. $ 1,002

Because of Oregon’s personal income tax structure, a

8. Less personal allowances credit ($90 × 1) .................. –

90

single percentage can’t be used. If you develop your own

9. Net tax to be withheld .................................................. $

912

formula, it must be approved by the Oregon Department

of Revenue.

Example 2: A married employee earns $2,000 per month

and claims two allowances. If the employee’s monthly

To use the formulas for each payroll period, you must

federal withholding is $189, the base wage is $1,811

first figure a “base wage” (BASE) amount. The base wage

($2,000 – $189). The amount of Oregon monthly with-

is the employee’s wage minus federal tax withheld. The

holding is $109.

federal tax deduction can’t be more than $3,000 per year.

That’s because Oregon personal income tax law limits

WH = $59 + [.09 × (BASE – $1,083)] – ($7.50 × allowances)

the amount of federal income tax subtracted from fed-

WH = $59 plus [.09 times ($1,811 – $1,083)] minus ($7.50 times 2)

eral adjusted gross income (AGI). For payroll periods of

Employees who need to have additional state withhold-

less than a year, the limit on federal tax withheld changes

ing can request circular 150-206-643 for more information.

to reflect the shorter payroll period.

Questions?

For example: The monthly federal withholding maximum

is $250 ($3,000 ÷ 12). If you have a single employee who

(503) 378-4988

Call:

Salem

is (1) earning $3,750 per month and (2) claiming two

allowances, federal withholding is more than $250. So

1-800-356-4222

Toll-free within Oregon

the base wage (BASE) is $3,500 ($3,750 – $250).

The toll-free number is only available January

through April.

Once you figure the base wage, use it in the formulas

to compute your Oregon withholding (WH).

TTY (hearing or speech impaired only). These numbers

are answered by machine only and are not for voice

Example 1: A single employee has an annual wage of

use. The year-round toll-free number within Oregon is

$15,000 and claims one allowance. If the federal withhold-

1-800-886-7204. In Salem, the number is (503) 945-8617.

ing for this employee is $1,507 (from the federal tables

or formulas), then the BASE is $13,493 ($15,000 – $1,507).

Habla Español? Las personas que necesitan asistencia

The amount of annual Oregon withholding, using the for-

en Español pueden dejar un mensaje. El número

mula, would be $912:

disponible todo el año en Salem es (503) 945-8618.

WH = $400 + [.09 × (BASE – $6,800)] – ($90 × allowances)

A message line is available all year for those who

WH = $400 plus [.09 times ($13,493 – $6,800)] minus ($90 times 1)

need assistance in Spanish. The number in Salem is

You can also figure Oregon withholding for this em-

(503) 945-8618.

ployee as follows:

In compliance with the Americans with Disabilities Act

(ADA), this information is available in alternative formats

upon request by calling (503) 378-4988.

Our Internet address is:

150-206-677 (Rev. 4-98)

(over)

Salem OR 97310

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2