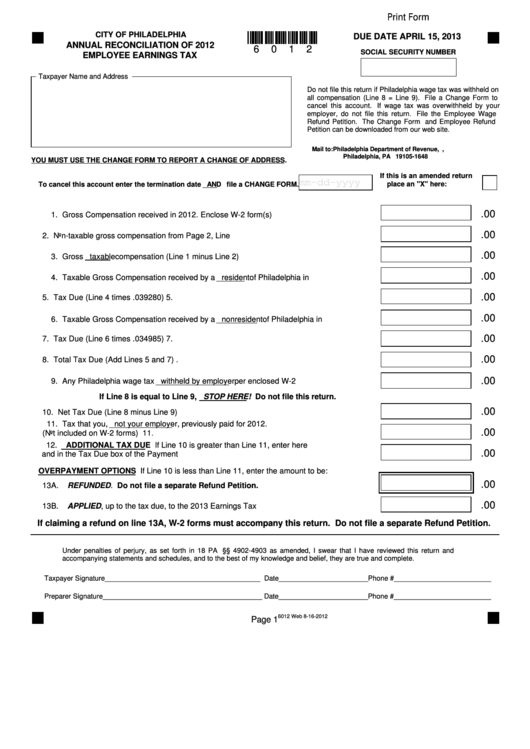

Print Form

CITY OF PHILADELPHIA

DUE DATE APRIL 15, 2013

ANNUAL RECONCILIATION OF 2012

6

0

1

2

SOCIAL SECURITY NUMBER

EMPLOYEE EARNINGS TAX

Taxpayer Name and Address

Do not file this return if Philadelphia wage tax was withheld on

all compensation (Line 8 = Line 9). File a Change Form to

cancel this account. If wage tax was overwithheld by your

employer, do not file this return. File the Employee Wage

Refund Petition. The Change Form and Employee Refund

Petition can be downloaded from our web site.

Mail to:

Philadelphia Department of Revenue, P.O. Box 1648,

Philadelphia, PA 19105-1648

YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS.

If this is an amended return

mm-dd-yyyy

place an "X" here:

To cancel this account enter the termination date AND file a CHANGE FORM.

.00

1. Gross Compensation received in 2012. Enclose W-2 form(s)..........................................1.

.00

2. Non-taxable gross compensation from Page 2, Line 5......................................................2.

.00

3. Gross taxable compensation (Line 1 minus Line 2)...........................................................3.

.00

4. Taxable Gross Compensation received by a resident of Philadelphia in 2012..................4.

.00

5. Tax Due (Line 4 times .039280).........................................................................................5.

.00

6. Taxable Gross Compensation received by a nonresident of Philadelphia in 2012............6.

.00

7. Tax Due (Line 6 times .034985).........................................................................................7.

.00

8. Total Tax Due (Add Lines 5 and 7).....................................................................................8.

.00

9. Any Philadelphia wage tax withheld by employer per enclosed W-2 forms.......................9.

If Line 8 is equal to Line 9, STOP HERE! Do not file this return.

.00

10. Net Tax Due (Line 8 minus Line 9)...................................................................................10.

11. Tax that you, not your employer, previously paid for 2012.

.00

(Not included on W-2 forms)........................................................................................... 11.

12. ADDITIONAL TAX DUE If Line 10 is greater than Line 11, enter here

.00

and in the Tax Due box of the Payment Coupon..............................................................12.

OVERPAYMENT OPTIONS If Line 10 is less than Line 11, enter the amount to be:

.00

13A. REFUNDED. Do not file a separate Refund Petition................................................13A.

.00

13B. APPLIED, up to the tax due, to the 2013 Earnings Tax Return....................................13B.

If claiming a refund on line 13A, W-2 forms must accompany this return. Do not file a separate Refund Petition.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return and

accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

6012 Web 8-16-2012

Page 1

1

1