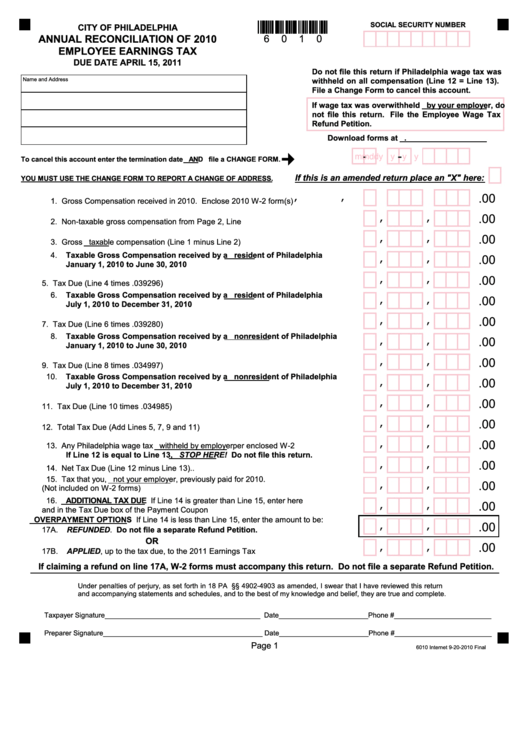

Annual Reconciliation Of 2010 Employee Earnings Tax - City Of Philadelphia

ADVERTISEMENT

SOCIAL SECURITY NUMBER

CITY OF PHILADELPHIA

6

0

1

0

ANNUAL RECONCILIATION OF 2010

EMPLOYEE EARNINGS TAX

DUE DATE APRIL 15, 2011

Do not file this return if Philadelphia wage tax was

withheld on all compensation (Line 12 = Line 13).

Name and Address

File a Change Form to cancel this account.

If wage tax was overwithheld by your employer, do

not file this return. File the Employee Wage Tax

Refund Petition.

Download forms at

-

-

m m

d d

y y y y

To cancel this account enter the termination date AND file a CHANGE FORM.

If this is an amended return place an "X" here:

YOU MUST USE THE CHANGE FORM TO REPORT A CHANGE OF ADDRESS.

,

,

.00

1. Gross Compensation received in 2010. Enclose 2010 W-2 form(s)........................1.

,

,

.00

2. Non-taxable gross compensation from Page 2, Line 5.............................................2.

.00

,

,

3. Gross taxable compensation (Line 1 minus Line 2)..................................................3.

4. Taxable Gross Compensation received by a resident of Philadelphia

.00

,

,

January 1, 2010 to June 30, 2010...........................................................................4.

,

,

.00

5. Tax Due (Line 4 times .039296)................................................................................5.

6. Taxable Gross Compensation received by a resident of Philadelphia

,

,

.00

July 1, 2010 to December 31, 2010 ........................................................................6.

.00

,

,

7. Tax Due (Line 6 times .039280)................................................................................7.

8. Taxable Gross Compensation received by a nonresident of Philadelphia

.00

,

,

January 1, 2010 to June 30, 2010...........................................................................8.

.00

,

,

9. Tax Due (Line 8 times .034997)................................................................................9.

10. Taxable Gross Compensation received by a nonresident of Philadelphia

,

,

.00

July 1, 2010 to December 31, 2010.......................................................................10.

,

,

.00

11. Tax Due (Line 10 times .034985)............................................................................11.

.00

,

,

12. Total Tax Due (Add Lines 5, 7, 9 and 11)...............................................................12.

.00

,

,

13. Any Philadelphia wage tax withheld by employer per enclosed W-2 forms............13.

If Line 12 is equal to Line 13, STOP HERE! Do not file this return.

,

,

.00

14. Net Tax Due (Line 12 minus Line 13).....................................................................14.

15. Tax that you, not your employer, previously paid for 2010.

,

,

.00

(Not included on W-2 forms).................................................................................. 15.

16. ADDITIONAL TAX DUE If Line 14 is greater than Line 15, enter here

.00

,

,

and in the Tax Due box of the Payment Coupon below..........................................16.

OVERPAYMENT OPTIONS If Line 14 is less than Line 15, enter the amount to be:

.00

,

,

17A. REFUNDED. Do not file a separate Refund Petition.......................................17A.

OR

.00

,

,

17B. APPLIED, up to the tax due, to the 2011 Earnings Tax Return............................17B.

If claiming a refund on line 17A, W-2 forms must accompany this return. Do not file a separate Refund Petition.

Under penalties of perjury, as set forth in 18 PA C.S. §§ 4902-4903 as amended, I swear that I have reviewed this return

and accompanying statements and schedules, and to the best of my knowledge and belief, they are true and complete.

Taxpayer Signature________________________________________ Date_______________________Phone #_________________________

Preparer Signature_________________________________________ Date_______________________Phone #_________________________

Page 1

6010 Internet 9-20-2010 Final

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1