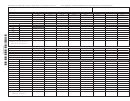

Form NOL Montana Net Operating Loss for Year 2009

Page 2

SSN/FEIN _______________________

NOL Carryover - Schedule B

This application is filed to carry

Enter net operating loss (Schedule A, Line

This is for the calendar year _________,

back:

25) $ ____________

or other tax year beginning_______,2009,

ending _______,20____

Complete one column before going to the next

_____ preceding tax year

_____ preceding tax year

_____ preceding tax year

column. You start with the earliest carryback year.

ending _______

ending _______

ending _______

1. Enter NOL deduction as a positive number

(see instructions).

2. Enter Montana taxable income before 2009

NOL carryback (see instructions). Estates and

trusts, increase this amount by the sum of the

charitable deduction and income distribution

deduction.

3. Enter net capital loss deduction (see

instructions).

4. Enter section 1202 exclusion as a positive

number.

5. Domestic production activities deduction.

6. Enter adjustment to Montana adjusted gross

income (see instructions).

7. Enter adjustment to Montana itemized

deductions (see instructions).

8. Individuals, enter deduction for exemptions.

Estates and trusts, enter exemption amount.

9. Modified taxable income. Add lines 2 through

8. If the result is zero or less, enter zero.

10. Subtract line 9 from line 1 and enter result. If

the result is zero or less, enter zero. This is

your NOL carryover (see instructions).

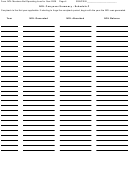

Adjustments to Itemized Deductions

(Individuals Only)

Complete lines 11 through 38 for the carryback

year(s) for which you itemized deductions.

11. Enter Montana adjusted gross income before

2009 NOL carryback.

12. Add lines 3 through 6 above and enter result.

13. Modified adjusted gross income. Add lines 11

and 12 and enter result.

14. Enter medical expenses from Form 2,

Schedule III after 7.5% adjustment (or as

previously adjusted). Do not include medical or

long-term care insurance premium payments.

15. Enter medical expenses from Form 2,

Schedule III before 7.5% adjustment (or as

previously adjusted). Do not include medical or

long-term care insurance premium payments.

16. Multiply line 13 by 7.5% (0.075) and enter

result.

17. Subtract line 16 from line 15 and enter result.

If the result is zero or less, enter zero.

18. Subtract line 17 from line 14 and enter result.

19. Qualified mortgage insurance premiums

from Form 2, Schedule III (or as previously

adjusted)

20. Refigured qualified mortgage insurance

premiums (see instructions)

21. Subtract line 20 from line 19

1

1 2

2 3

3 4

4