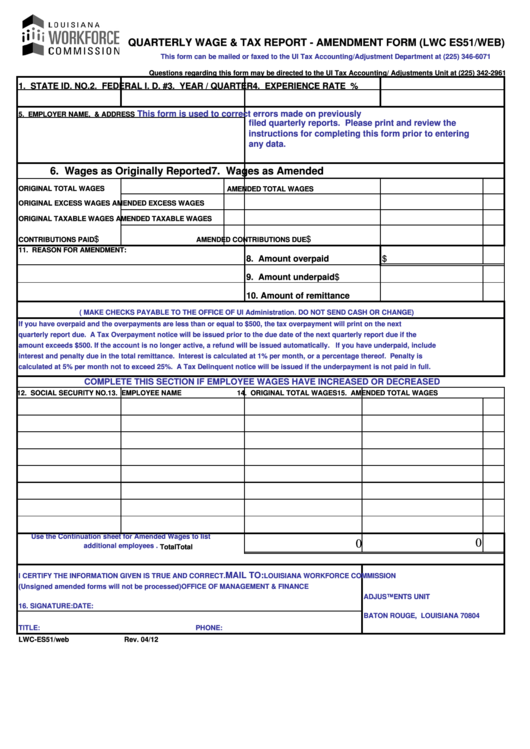

QUARTERLY WAGE & TAX REPORT - AMENDMENT FORM (LWC ES51/WEB)

This form can be mailed or faxed to the UI Tax Accounting/Adjustment Department at (225) 346-6071

Questions regarding this form may be directed to the UI Tax Accounting/ Adjustments Unit at (225) 342-2961

1. STATE ID. NO.

2. FEDERAL I. D. #

3. YEAR / QUARTER

4. EXPERIENCE RATE %

This form is used to correct errors made on previously

5. EMPLOYER NAME, D.B.A. & ADDRESS

filed quarterly reports. Please print and review the

instructions for completing this form prior to entering

any data.

6. Wages as Originally Reported

7. Wages as Amended

ORIGINAL TOTAL WAGES

AMENDED TOTAL WAGES

ORIGINAL EXCESS WAGES

AMENDED EXCESS WAGES

ORIGINAL TAXABLE WAGES

AMENDED TAXABLE WAGES

$

$

CONTRIBUTIONS PAID

AMENDED CONTRIBUTIONS DUE

11. REASON FOR AMENDMENT:

8. Amount overpaid

$

9. Amount underpaid

$

10. Amount of remittance

( MAKE CHECKS PAYABLE TO THE OFFICE OF UI Administration. DO NOT SEND CASH OR CHANGE)

If you have overpaid and the overpayments are less than or equal to $500, the tax overpayment will print on the next

quarterly report due. A Tax Overpayment notice will be issued prior to the due date of the next quarterly report due if the

amount exceeds $500. If the account is no longer active, a refund will be issued automatically. If you have underpaid, include

interest and penalty due in the total remittance. Interest is calculated at 1% per month, or a percentage thereof. Penalty is

calculated at 5% per month not to exceed 25%. A Tax Delinquent notice will be issued if the underpayment is not paid in full.

COMPLETE THIS SECTION IF EMPLOYEE WAGES HAVE INCREASED OR DECREASED

12. SOCIAL SECURITY NO.

13. EMPLOYEE NAME

14. ORIGINAL TOTAL WAGES

15. AMENDED TOTAL WAGES

Use the Continuation sheet for Amended Wages to list

0

0

additional employees .

Total

Total

MAIL TO:

I CERTIFY THE INFORMATION GIVEN IS TRUE AND CORRECT.

LOUISIANA WORKFORCE COMMISSION

(Unsigned amended forms will not be processed)

OFFICE OF MANAGEMENT & FINANCE

ADJUSTMENTS UNIT

16. SIGNATURE:

DATE:

P.O. BOX 94100

BATON ROUGE, LOUISIANA 70804

TITLE:

PHONE:

LWC-ES51/web

Rev. 04/12

1

1