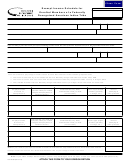

Part II

Household income

List your household income and the household income of the person you care for in the space below. Household income is the taxable

and nontaxable income of both spouses (living in the same household). See the Elderly Rental Assistance (ERA) Form 90R instructions

for more information on household income.

Your

Household income of

Type of income

household income

person you care for

1. Wages, salaries, and other pay for work .......................

1a.

1b.

2. Interest, dividends (total taxable and nontaxable) ........

2a.

2b.

3. Business net income (loss limited to $1,000) ................

3a.

3b.

4. Total gain on property sales (loss limited to $1,000) .....

4a.

4b.

5. Social Security, SSI, and Railroad Retirement ..............

5a.

5b.

6. Pensions, annuities (taxable and nontaxable) ...............

6a.

6b.

7. Children, Adult, and Families (public assistance) .........

7a.

7b.

8. Gifts and grants over $500 ............................................

8a.

8b.

9. Other (specify) ................................................................

9a.

9b.

10. Total household income ............................................. 10a.

10b.

If your household income is $17,500 or more, or if the person you care for has household income of more than $7,500, you are not

eligible for the credit.

11. You may claim food, clothing, medical, and transportation expenses you pay or incur for the person you care for. The expenses

must be paid or incurred during the period of care certified by the Seniors and People with Disabilities Division. Amounts you

pay for lodging don’t qualify. Subtract any reimbursement you received from insurance or from the person you care for when you

figure the costs you paid.

A. Food ................................................................................................................. $

B. Clothing (includes cost of purchase, cleaning, and repairing) ....................... $

C. Medical care (includes doctor fees, medicine, special equipment, etc.) ....... $

D. Transportation (includes transportation for medical and personal needs) .... $

12. Total expenses you paid (add the amounts on lines A, B, C, and D) ........................................... 12.

Note: The expenses you paid for the person you care for are considered a gift. The amount

you paid over $500 must be included in their household income. If the amount on line 12 is

more than $500, include the excess on line 8b.

13. Multiply the amount on line 12 x .08 (8 percent) .......................................................................... 13.

$250

14. Maximum credit ............................................................................................................................ 14.

15. Allowable credit (lesser of line 13 or line 14). Enter result here and on “Other credits”

line of your tax return. Identify using code 718 and enter your credit amount ............................ 15.

Low income credit, page 2 of 2

150-101-024 (Rev. 12-08)

Do not attach this form to your Oregon return. Keep it with your tax records.

1

1 2

2