Clear Form

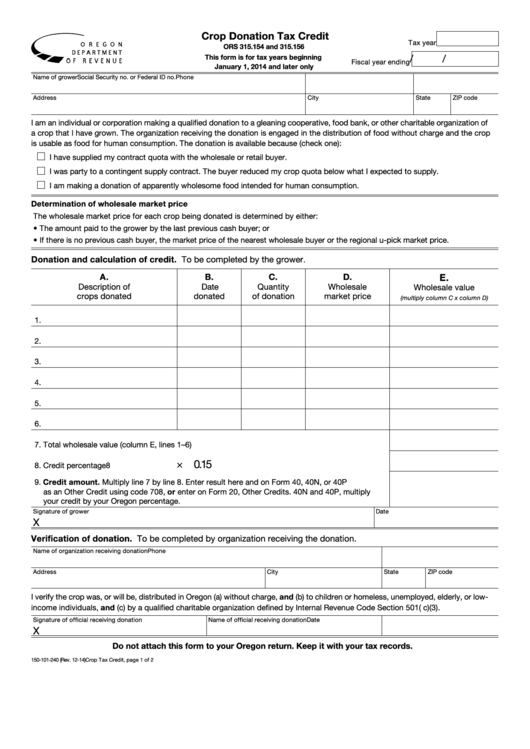

Crop Donation Tax Credit

Tax year

ORS 315.154 and 315.156

/

/

This form is for tax years beginning

Fiscal year ending

January 1, 2014 and later only

Name of grower

Social Security no. or Federal ID no.

Phone

Address

City

State

ZIP code

I am an individual or corporation making a qualified donation to a gleaning cooperative, food bank, or other charitable organization of

a crop that I have grown. The organization receiving the donation is engaged in the distribution of food without charge and the crop

is usable as food for human consumption. The donation is available because (check one):

I have supplied my contract quota with the wholesale or retail buyer.

I was party to a contingent supply contract. The buyer reduced my crop quota below what I expected to supply.

I am making a donation of apparently wholesome food intended for human consumption.

Determination of wholesale market price

The wholesale market price for each crop being donated is determined by either:

• The amount paid to the grower by the last previous cash buyer; or

• If there is no previous cash buyer, the market price of the nearest wholesale buyer or the regional u-pick market price.

Donation and calculation of credit. To be completed by the grower.

E.

A.

B.

C.

D.

Description of

Date

Quantity

Wholesale

Wholesale value

crops donated

donated

of donation

market price

(multiply column C x column D)

1.

2.

3.

4.

5.

6.

7. Total wholesale value (column E, lines 1–6) .......................................................................................7

× 0.15

8. Credit percentage ..............................................................................................................................8

9. Credit amount. Multiply line 7 by line 8. Enter result here and on Form 40, 40N, or 40P

as an Other Credit using code 708, or enter on Form 20, Other Credits. 40N and 40P, multiply

your credit by your Oregon percentage. ...........................................................................................9

Signature of grower

Date

X

Verification of donation. To be completed by organization receiving the donation.

Name of organization receiving donation

Phone

Address

City

State

ZIP code

I verify the crop was, or will be, distributed in Oregon (a) without charge, and (b) to children or homeless, unemployed, elderly, or low-

income individuals, and (c) by a qualified charitable organization defined by Internal Revenue Code Section 501( c)(3).

Signature of official receiving donation

Name of official receiving donation

Date

X

Do not attach this form to your Oregon return. Keep it with your tax records.

150-101-240 (Rev. 12-14)

Crop Tax Credit, page 1 of 2

1

1 2

2