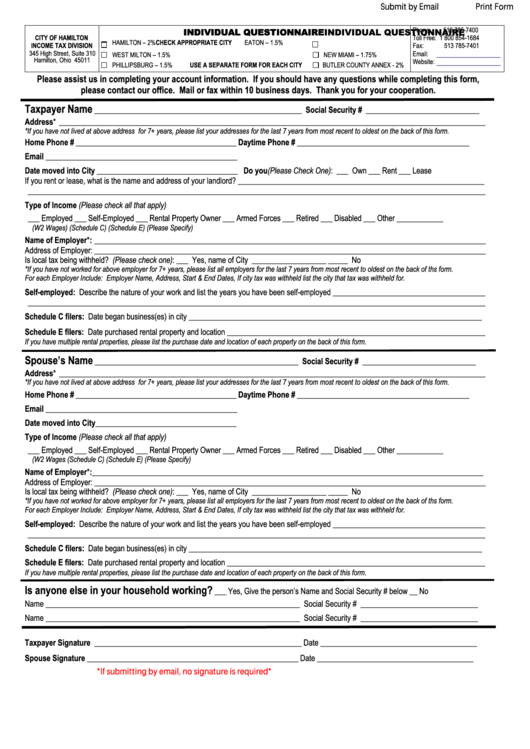

Submit by Email

Print Form

Phone:

513 785-7400

INDIVIDUAL QUESTIONNAIRE

INDIVIDUAL QUESTIONNAIRE

INDIVIDUAL QUESTIONNAIRE

INDIVIDUAL QUESTIONNAIRE

CITY OF HAMILTON

Toll Free: 1 800 854-1684

HAMILTON – 2%

CHECK APPROPRIATE CITY

EATON – 1.5%

INCOME TAX DIVISION

Fax:

513 785-7401

345 High Street, Suite 310

Email:

citytax@ci.hamilton.oh.us

WEST MILTON – 1.5%

NEW MIAMI – 1.75%

Hamilton, Ohio 45011

Website:

PHILLIPSBURG – 1.5%

USE A SEPARATE FORM FOR EACH CITY

BUTLER COUNTY ANNEX - 2%

Please assist us in completing your account information. If you should have any questions while completing this form,

please contact our office. Mail or fax within 10 business days. Thank you for your cooperation.

Taxpayer Name

_____________________________________________________

Social Security # _____________________________

Address* _____________________________________________________________________________________________________________

*If you have not lived at above address for 7+ years, please list your addresses for the last 7 years from most recent to oldest on the back of this form.

Home Phone # _________________________________________

Daytime Phone # ____________________________________________

Email _________________________________________________

Date moved into City ____________________________________

Do you (Please Check One):

___ Own

___ Rent

___ Lease

If you rent or lease, what is the name and address of your landlord? _______________________________________________________________

_____________________________________________________________________________________________________________________

Type of Income (Please check all that apply)

___ Employed ___ Self-Employed

___ Rental Property Owner ___ Armed Forces ___ Retired

___ Disabled

___ Other ____________

(W2 Wages)

(Schedule C)

(Schedule E)

(Please Specify)

Name of Employer*: ____________________________________________________________________________________________________

Address of Employer: ____________________________________________________________________________________________________

Is local tax being withheld? (Please check one):

___ Yes, name of City ___________________

_____ No

*If you have not worked for above employer for 7+ years, please list all employers for the last 7 years from most recent to oldest on the back of ths form.

For each Employer Include: Employer Name, Address, Start & End Dates, If city tax was withheld list the city that tax was withheld for.

Self-employed: Describe the nature of your work and list the years you have been self-employed _______________________________________

_____________________________________________________________________________________________________________________

Schedule C filers: Date began business(es) in city ___________________________________________________________________________

Schedule E filers: Date purchased rental property and location __________________________________________________________________

If you have multiple rental properties, please list the purchase date and location of each property on the back of this form.

Spouse’s Name

____________________________________________________

Social Security # _____________________________

Address* _____________________________________________________________________________________________________________

*If you have not lived at above address for 7+ years, please list your addresses for the last 7 years from most recent to oldest on the back of this form.

Home Phone # _________________________________________

Daytime Phone # ____________________________________________

Email _________________________________________________

Date moved into City ____________________________________

Type of Income (Please check all that apply)

___ Employed ___ Self-Employed

___ Rental Property Owner ___ Armed Forces ___ Retired

___ Disabled

___ Other ____________

(W2 Wages

(Schedule C)

(Schedule E)

(Please Specify)

Name of Employer*: ____________________________________________________________________________________________________

Address of Employer: ____________________________________________________________________________________________________

Is local tax being withheld? (Please check one):

___ Yes, name of City ___________________

_____ No

*If you have not worked for above employer for 7+ years, please list all employers for the last 7 years from most recent to oldest on the back of ths form.

For each Employer Include: Employer Name, Address, Start & End Dates, If city tax was withheld list the city that tax was withheld for.

Self-employed: Describe the nature of your work and list the years you have been self-employed _______________________________________

_____________________________________________________________________________________________________________________

Schedule C filers: Date began business(es) in city ___________________________________________________________________________

Schedule E filers: Date purchased rental property and location __________________________________________________________________

If you have multiple rental properties, please list the purchase date and location of each property on the back of this form.

Is anyone else in your household working?

___ Yes, Give the person’s Name and Social Security # below

__ No

Name _________________________________________________________________

Social Security # ______________________________

Name _________________________________________________________________

Social Security # ______________________________

Taxpayer Signature _____________________________________________________

Date ________________________________________

Spouse Signature ______________________________________________________

Date ________________________________________

*If submitting by email, no signature is required*

1

1