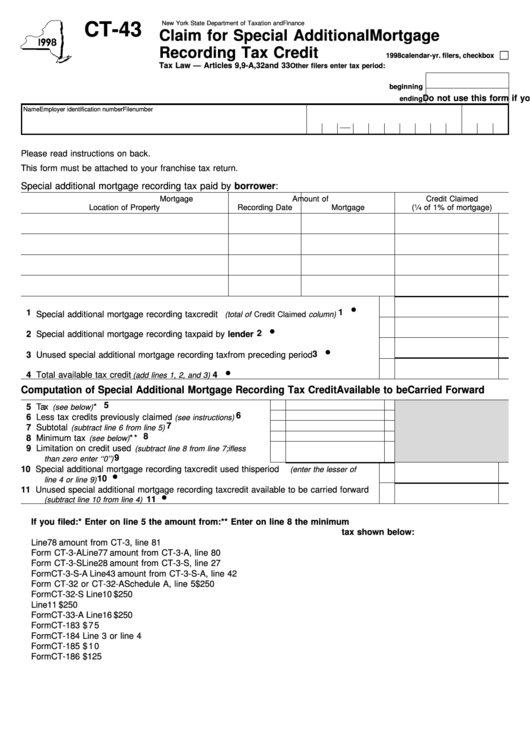

New York State Department of Taxation and Finance

CT-43

Claim for Special Additional Mortgage

Recording Tax Credit

□

1998 calendar-yr. filers, check box

Tax Law — Articles 9, 9-A, 32 and 33

Other filers enter tax period:

beginning

Do not use this form if you file Form CT-43.1.

ending

Name

Employer identification number

File number

Please read instructions on back.

This form must be attached to your franchise tax return.

Special additional mortgage recording tax paid by borrower:

Mortgage

Amount of

Credit Claimed

Location of Property

Recording Date

Mortgage

(

1

⁄

of 1% of mortgage)

4

. . . . . . . . . . . 1 ●

1 Special additional mortgage recording tax credit

(total of Credit Claimed column)

2 ●

2 Special additional mortgage recording tax paid by lender . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3 Unused special additional mortgage recording tax from preceding period . . . . . . . . . . . . . . . . 3 ●

4 ●

4 Total available tax credit

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(add lines 1, 2, and 3)

Computation of Special Additional Mortgage Recording Tax Credit Available to be Carried Forward

* . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

5 Tax

(see below)

. . . . . . . . . 6

6 Less tax credits previously claimed

(see instructions)

7

7 Subtotal

. . . . . . . . . . . . . . . . . . . . . . . . . . . . .

(subtract line 6 from line 5)

** . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

8 Minimum tax

(see below)

9 Limitation on credit used

(subtract line 8 from line 7; if less

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

than zero enter ‘‘0’’)

10 Special additional mortgage recording tax credit used this period

(enter the lesser of

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10 ●

line 4 or line 9)

11 Unused special additional mortgage recording tax credit available to be carried forward

. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11 ●

(subtract line 10 from line 4)

If you filed:

* Enter on line 5 the amount from:

** Enter on line 8 the minimum

tax shown below:

Form CT-3 . . . . . . . . . . . . . . . . . . . . Line 78 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . amount from CT-3, line 81

Form CT-3-A. . . . . . . . . . . . . . . . . . Line 77 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . amount from CT-3-A, line 80

Form CT-3-S. . . . . . . . . . . . . . . . . . Line 28 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . amount from CT-3-S, line 27

Form CT-3-S-A . . . . . . . . . . . . . . . Line 43 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . amount from CT-3-S-A, line 42

Form CT-32 or CT-32-A. . . . . . Schedule A, line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $250

Form CT-32-S . . . . . . . . . . . . . . . . Line 10 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $250

Form CT-33. . . . . . . . . . . . . . . . . . . Line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $250

Form CT-33-A . . . . . . . . . . . . . . . . Line 16 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $250

Form CT-183 . . . . . . . . . . . . . . . . . Line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 75

Form CT-184 . . . . . . . . . . . . . . . . . Line 3 or line 4 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

-0-

Form CT-185 . . . . . . . . . . . . . . . . . Line 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $ 10

Form CT-186 . . . . . . . . . . . . . . . . . Line 5 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . $125

1

1