Form Dtf-619 - Claim For Qetc Facilities, Operations, And Training Credit - 2011

ADVERTISEMENT

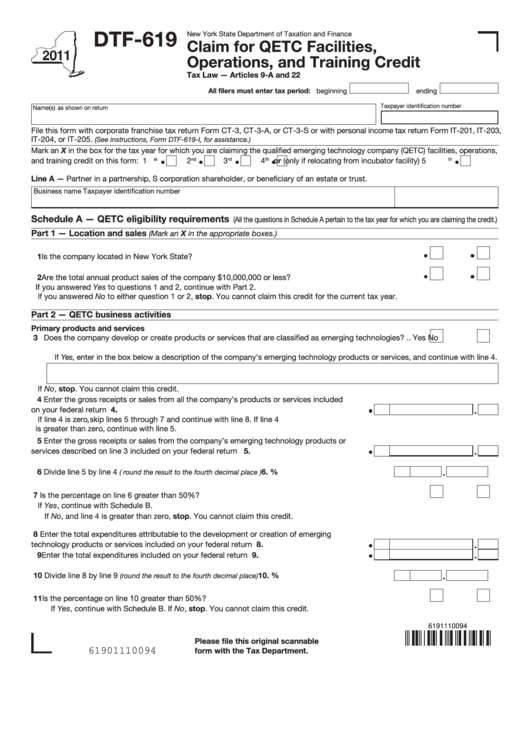

DTF-619

New York State Department of Taxation and Finance

Claim for QETC Facilities,

Operations, and Training Credit

Tax Law — Articles 9-A and 22

All filers must enter tax period:

beginning

ending

Taxpayer identification number

Name(s) as shown on return

File this form with corporate franchise tax return Form CT-3, CT-3-A, or CT-3-S or with personal income tax return Form IT-201, IT-203,

IT-204, or IT-205.

(See instructions, Form DTF-619-I, for assistance.)

Mark an X in the box for the tax year for which you are claiming the qualified emerging technology company (QETC) facilities, operations,

or (only if relocating from incubator facility) 5

and training credit on this form:

1

2

3

4

st

nd

rd

th

th

Line A — Partner in a partnership, S corporation shareholder, or beneficiary of an estate or trust.

Business name

Taxpayer identification number

Schedule A — QETC eligibility requirements

(All the questions in Schedule A pertain to the tax year for which you are claiming the credit.)

Part 1 — Location and sales

(Mark an X in the appropriate boxes.)

1 Is the company located in New York State? ................................................................................................ Yes

No

2 Are the total annual product sales of the company $10,000,000 or less? ................................................... Yes

No

If you answered Yes to questions 1 and 2, continue with Part 2.

If you answered No to either question 1 or 2, stop. You cannot claim this credit for the current tax year.

Part 2 — QETC business activities

Primary products and services

3 Does the company develop or create products or services that are classified as emerging technologies? .. Yes

No

If Yes, enter in the box below a description of the company’s emerging technology products or services, and continue with line 4.

If No, stop. You cannot claim this credit.

4 Enter the gross receipts or sales from all the company’s products or services included

on your federal return .............................................................................................................

4.

If line 4 is zero, skip lines 5 through 7 and continue with line 8. If line 4

is greater than zero, continue with line 5.

5 Enter the gross receipts or sales from the company’s emerging technology products or

services described on line 3 included on your federal return ................................................

5.

6 Divide line 5 by line 4

6.

%

...........................................................

( round the result to the fourth decimal place )

7 Is the percentage on line 6 greater than 50%? ............................................................................................... Yes

No

If Yes, continue with Schedule B.

If No, and line 4 is greater than zero, stop. You cannot claim this credit.

8 Enter the total expenditures attributable to the development or creation of emerging

technology products or services included on your federal return ..........................................

8.

9 Enter the total expenditures included on your federal return .....................................................

9.

10 Divide line 8 by line 9

............................................................ 10.

%

(round the result to the fourth decimal place)

11 Is the percentage on line 10 greater than 50%? ............................................................................................. Yes

No

If Yes, continue with Schedule B. If No, stop. You cannot claim this credit.

6191110094

Please file this original scannable

form with the Tax Department.

61901110094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4