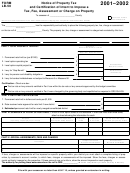

Instructions for Form LB-50

Notice of Property Tax and Cer ti fi ca tion of Intent to

Impose a Tax, Fee, Assessment, or Charge on Prop er ty

Form LB-50 is used to certify and categorize the tax ing dis-

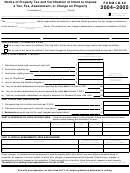

Line 2. If you are certifying a local option levy for op er a -

trict’s prop er ty tax and other charges to the coun ty as ses sor.

tions [ORS 310-060(2)(b)], you may en ter a dol lar amount or

No tice of tax is due to the county as ses sor by July 15, un less

rate in box 2. If you certify a rate, en ter the rate per $1,000

a written ex ten sion of time to certify has been grant ed.

of assessed val ue. The rate en tered may be up to the max-

i mum rate ap proved by the voters. The rate can not ex ceed

If you are doing a biennial budget, you must certify tax es

the rate the budget committee ap proved as the local op tion

each year you wish to levy. You must do a separate cer ti -

rate for bud get year 2007–08.

fi ca tion each year of the two-year budget period.

You may enter a dollar amount to be levied if the vot ers ap-

proved a fixed-dollar levy. The amount cannot ex ceed the

General instructions

amount approved by the vot ers, or the bud get com mit tee.

In the spaces at the top of this form, fill in:

Line 3. If you are certifying a local option levy for cap i tal

projects [ORS 310.060(2)(c)], you may en ter a dol lar amount

• The name of the county being sent the cer ti fi ca tion.

or rate in box 3. If you cer ti fy a rate, en ter the rate per $1,000

• The name of the taxing district and the name of the

of assessed value. The rate en tered may be up to the max-

coun ty where the district is lo cat ed,

i mum rate ap proved by the vot ers. The rate can not ex ceed

• The mailing address of the district, including city and ZIP

the rate the budget com mit tee ap proved as a capital project

code, and

local option rate for bud get year 2007–08.

• The name, title, and daytime telephone num ber of a bud-

You may enter a dollar amount to be levied if the vot ers ap-

get contact person. This person should be some one who

proved a fixed-dollar levy. The amount can not ex ceed the

is available for con tact after the doc u ment is sub mit ted

amount approved by the vot ers, and the bud get com mit tee.

to the assessor. E-mail is optional but encouraged.

Line 4. Enter the amount being levied for 2007–08 to pay for

Note: Oregon law (ORS 310.060) allows taxing dis tricts (for

“Gap Bonds” in box 4. Gap bonds are certain bonds or debt

good and sufficient reasons) to re quest in writing an ex-

obligations that were declared as such in 1997–98. If your

ten sion of time to certify tax es. The writ ten re quest for ex-

dis trict did not declare gap bonds in 1997–98, the dis trict

ten sion must be giv en to the coun ty as ses sor by July 15.

cannot claim them this year.

Line 5. Enter the amount being levied for 2007–08 to pay for

Certification

qualifying pension and disability ob li ga tions in box 5. The

Check boxes. ORS 294.435 does not allow a dis trict to cer ti fy

City of Portland is the only entity that may use this line.

ad valorem property taxes at an amount or rate great er than

Lines 6a, 6b, and 6c. See the back of Form LB-50 for the

that ap proved by the budget com mit tee, unless an amend ed

worksheet to use in figuring lines 6a, 6b, and 6c.

budget summary is re pub lished by the gov ern ing body

and a second budget hearing is held. One of these box es

The worksheet uses the amount of principal and interest

must be checked. If the amount or rate being cer ti fied is not

expenditures for each bond issue to arrive at a ratio. This

great er than that ap proved by the budget com mit tee check

ra tio is then used to allocate the total levy on line 6c be-

that box. If the budget was re pub lished, and the amount or

tween bonds is sued before and after October 6, 2001.

rate is with in the amount re pub lished check that box.

Line 6a. Enter the amount levied that is used to repay prin-

ci pal and interest on bonds approved by the vot ers pri or

The assessor’s office will not accept your tax cer ti fi ca tion

to October 6, 2001.

documents unless one of these boxes is checked.

Line 6b. Enter the amount levied that is used to repay prin-

ci pal and interest on bonds approved by the vot ers on or

Part I: Total property tax levy

af ter Oc to ber 6, 2001.

Line 1. You may en ter an amount or rate in box 1. If you

Line 6c. Enter the total dollar amount levied to pay for prin-

cer ti fy a rate, en ter the rate per $1,000 of as sessed value to

ci pal and interest not subject to the lim i ta tions of Mea sure

be used by the as ses sor in ex tend ing your tax es in 2007–08.

50 (section 11, Article XI) or Measure 5 (sec tion 11b, Ar ti cle

The rate en tered may be up to your max i mum rate lim it.

XI) in box 6c. Bond levies are always a dollar amount. This

If you are cer ti fy ing a rate, it can not ex ceed the rate the

line is the total of lines 6a and 6b.

bud get com mit tee ap proved for bud get year 2007–08, un-

less the bud get was re pub lished.

The total debt service levy must be the same as the resolu-

tion imposing tax.

Or you may enter the dollar amount to be raised by ad va-

Lines 1–5 are categorized as being subject to the Mea sure

lo rem prop er ty taxes for 2007–08. This amount can not ex-

5 general government limitation. Lines 6a, 6b, and 6c are

ceed the amount your per ma nent rate will ac tu al ly raise.

categorized as excluded from Measure 5 lim i ta tion.

150-504-050 (Rev. 12-06) Web

1

1 2

2 3

3 4

4