1. Ad valorem assessments.

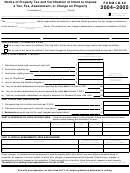

Part II: Rate limit certification

2. Other taxes, fees, charges, and special assessments, such

Most districts had a permanent rate lim it es tab lished in

as for water, irrigation, road, drain age, etc., which may

1997–98 for op er at ing tax es. Some new districts have had

be placed on the roll.

per ma nent rate limits es tab lished by voters. Other dis tricts

Taxing districts such as counties and cities may have

will have a new permanent rate because of a merger or

charg es that fall into this area. Some spe cial dis tricts, such

con sol i da tion.

as irrigation, water and some road dis tricts, may also im-

Part II of this form is designed to notify the as ses sor of your

pose a special as sess ment on the prop er ties with in their

permanent rate limit.

bound aries. Some non gov ern men tal en ti ties may also

Line 7. Enter the district’s permanent rate lim it per $1,000

have spe cif ic stat u to ry authority to place charg es on the

of assessed value. The rate should be car ried four plac es

roll. These cer ti fied charges may be cal cu lat ed on an ad

to the right of the dec i mal point. If you do not know your

va lo rem basis or on an oth er unit of measurement, such as

per ma nent rate lim it, con tact your coun ty as ses sor, or the

by prop er ty, acre, or front age foot. Your options are usually

De part ment of Rev e nue, Fi nance and Tax a tion Team.

governed by statute.

Line 8. If you are a new district that just had its permanent

rate limit established by the voters, enter the date of the

Identify by category

elec tion in which your rate limit was approved. You only

For every item described in Part IV, show the total amount

need to complete this line for the first year your new per-

in the column for the appropriate category. These cat e -

ma nent rate limit is certified. If you use line 8, include a

go ries are:

copy of the ballot measure with your certification.

General government. Generally, these are tax es im posed

Line 9. If your district went through a merger or con sol i-

by a unit of gov ern ment whose main pur pose is to per form

da tion in 2006–07, show your estimated permanent rate

gov ern men tal operations other than ed u ca tion al services.

lim it on this line. Before taxes are extended on the roll for

2007–08, the assessor will calculate a permanent rate limit

Excluded from limitation. These are taxes, fees, charg es,

for your district using actual values. You will be no ti fied of

and spe cial as sess ments not limited by Measure 5.

the ac tu al new permanent rate limit. If your es ti mat ed rate

If you have questions about the correct cat e go ry of your

is high er than the actual per ma nent rate lim it, the as ses sor

tax, consult your legal counsel and/or the statewide or ga -

will use the actual rate. If your es ti mat ed rate is less than

ni za tion representing your district.

the ac tu al permanent rate lim it, the assessor will use the

es ti mat ed rate.

Use a separate line for each category. For ex am ple, a dis-

trict may have a portion for op er a tions and main te nance

Part III: Schedule of local option taxes

which would be under the Gen er al Gov ern ment cat e go ry.

This would be on one line. The dis trict may have a por-

Complete this schedule if you have one or more vot er-ap-

tion to pay for ex clud ed bond ed debt. This would be on a

proved local option taxes. For each local option tax, list the

sep a rate line.

purpose of the tax (operating or capital project), the date

vot ers ap proved it, the first year the tax can be im posed, the

List the specific charge(s) on the available line(s) under the

final year the tax will be imposed and the dollar amount or

heading, “Description.”

rate au tho rized to be imposed each year.

Describe the tax, i.e., ad valorem, sewer as sess ment, or

The information you provide in this schedule sup ports the

spe cif ic unit of measurement. De ter mine the to tal of each

local option tax amounts on lines 2 and 3 in Part I.

type of charge. Place the total dollar fig ure in the ap pro -

pri ate cat e go ry.

Part IV: Special assessments, fees,

Attach a complete listing of properties, by as ses sor’s ac-

and charges

count number, to which fees, charg es, and as sess ments

Who must use this portion of the form. Those dis tricts and

are imposed. Show the amount of the fees, charg es, or

non gov ern men tal en ti ties who ex er cise their op tion to place

as sess ments which are im posed uni form ly on the prop-

their tax es (other than those certified on lines 1–6) or oth er

er ties, i.e., each prop er ty will pay the same dollar amount.

charg es on the tax roll must cer ti fy to their coun ty as ses sor

If the fees, charg es, or as sess ments are not uni form, i.e., the

by July 15, 2007, by com plet ing this part of the form.

amounts are cal cu lat ed dif fer ent ly for each prop er ty, show

the amount imposed on each prop er ty.

If your district is imposing any of the fol low ing items, you

must declare them on this portion of the form:

If your district is using Part IV, you must enter the ORS

number that gives the district the authority to place the

items on the tax roll in the space provided.

150-504-050 (Rev. 12-06) Web

1

1 2

2 3

3 4

4