Form Wv/mft-50 - West Virginia Supplier/permissive Supplier Report Page 2

ADVERTISEMENT

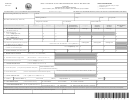

WORKSHEET A - TAXABLE INVOICED GALLONS

Dyed Diesel &

Aviation

Aviation

Clear Kerosene/

Gasoline

Gasohol

Undyed Diesel

Propane

Dyed Kerosene

Gasoline

Jet Fuel

Other

Total Gallons sold WV Tax Collected -

Gallons @.11

Gallons @.11

Gallons @.11

Gallons @.11

1.

Unlicensed Distributors and Licensed

Suppliers.

(Schedule 5A and Schedule 5E)

Total Gallons sold WV Tax Collected

-

Gallons@.2050

Gallons@.2050

Gallons@.2050

2.

ENTER EXEMPT MOTOR FUEL SOLD FOR TAXABLE PURPOSE (ON-HIGHWAY) ONLY

Unlicensed Distributors, and

Licensed Suppliers. (Schedule 5H)

Gallons @.11

Gallons @.11

Gallons @.11

Gallons @.11

Total Gallons sold WV Tax Collected

-

3.

Licensed Distributor, Licensed Importer and

Licensed Exporter. (Schedules 5D & 7B)

Total Gallons sold WV Tax Collected

.

Gallons @.2050

Gallons @.2050

Gallons @.2050

4

ENTER EXEMPT MOTOR FUEL SOLD FOR TAXABLE PURPOSE (ON-HIGHWAY) ONLY

Licensed Distributor and Licensed Importer.

(Schedule 5G)

CALCULATION OF DISTRIBUTOR DISCOUNT

Multiply Line 3 by .2050

$

$

$

$

5.

Multiply Line 4 by .2050

$

$

$

6.

Multiply Lines 3 and 4 by .11

$

$

$

$

$

$

$

7.

. Add Lines 5, 6, and 7

$

$

$

$

$

$

$

$

8

Add Line 8 all columns and enter total

9.

$

. Multiply Line 9 by .0075 and TRANSFER TOTAL TO FRONT OF REPORT – LINE 9

$

10

GROSS TAXABLE GALLONS

11.

Add Lines 1, 2, 3 and 4)

(

.

(Schedule 1)

Tax Paid Receipts

12.

NET TAXABLE GALLONS.

13.

(Subtract Line 12 from Line 11)

By Product Type -Transfer to Line 1

on front of report.

WORKSHEET B - TOTAL DISBURSEMENTS

GROSS TAXABLE GALLONS

1.

(Worksheet A Line 11)

Total Gallons Exported –

2.

Destination State Tax Collected

(Schedule 7A)

TOTAL GALLONS DISBURSED.

3.

(Add Lines 1 and 2)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2