Tax Certificate Request Instructions

ADVERTISEMENT

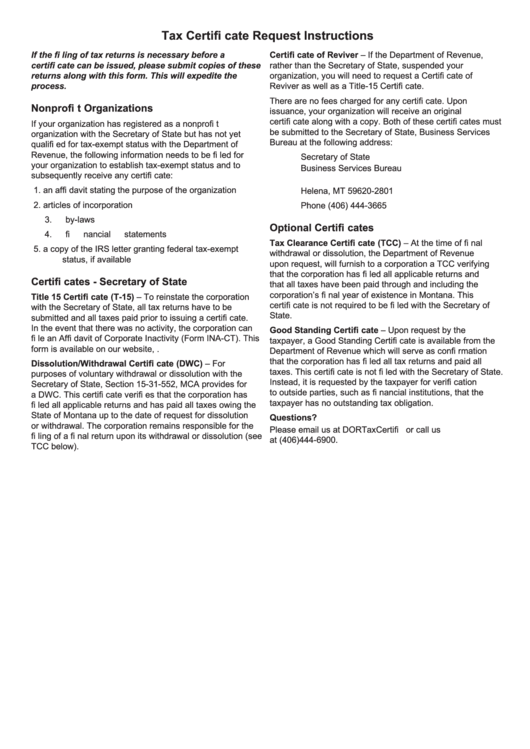

Tax Certifi cate Request Instructions

If the fi ling of tax returns is necessary before a

Certifi cate of Reviver – If the Department of Revenue,

certifi cate can be issued, please submit copies of these

rather than the Secretary of State, suspended your

returns along with this form. This will expedite the

organization, you will need to request a Certifi cate of

process.

Reviver as well as a Title-15 Certifi cate.

There are no fees charged for any certifi cate. Upon

Nonprofi t Organizations

issuance, your organization will receive an original

certifi cate along with a copy. Both of these certifi cates must

If your organization has registered as a nonprofi t

be submitted to the Secretary of State, Business Services

organization with the Secretary of State but has not yet

Bureau at the following address:

qualifi ed for tax-exempt status with the Department of

Revenue, the following information needs to be fi led for

Secretary of State

your organization to establish tax-exempt status and to

Business Services Bureau

subsequently receive any certifi cate:

P.O. Box 202801

1.

an affi davit stating the purpose of the organization

Helena, MT 59620-2801

2.

articles of incorporation

Phone (406) 444-3665

3.

by-laws

Optional Certifi cates

4.

fi nancial statements

Tax Clearance Certifi cate (TCC) – At the time of fi nal

5.

a copy of the IRS letter granting federal tax-exempt

withdrawal or dissolution, the Department of Revenue

status, if available

upon request, will furnish to a corporation a TCC verifying

that the corporation has fi led all applicable returns and

Certifi cates - Secretary of State

that all taxes have been paid through and including the

corporation’s fi nal year of existence in Montana. This

Title 15 Certifi cate (T-15) – To reinstate the corporation

certifi cate is not required to be fi led with the Secretary of

with the Secretary of State, all tax returns have to be

State.

submitted and all taxes paid prior to issuing a certifi cate.

In the event that there was no activity, the corporation can

Good Standing Certifi cate – Upon request by the

fi le an Affi davit of Corporate Inactivity (Form INA-CT). This

taxpayer, a Good Standing Certifi cate is available from the

form is available on our website, mt.gov/revenue.

Department of Revenue which will serve as confi rmation

that the corporation has fi led all tax returns and paid all

Dissolution/Withdrawal Certifi cate (DWC) – For

taxes. This certifi cate is not fi led with the Secretary of State.

purposes of voluntary withdrawal or dissolution with the

Instead, it is requested by the taxpayer for verifi cation

Secretary of State, Section 15-31-552, MCA provides for

to outside parties, such as fi nancial institutions, that the

a DWC. This certifi cate verifi es that the corporation has

taxpayer has no outstanding tax obligation.

fi led all applicable returns and has paid all taxes owing the

State of Montana up to the date of request for dissolution

Questions?

or withdrawal. The corporation remains responsible for the

Please email us at DORTaxCertifi cates@mt.gov or call us

fi ling of a fi nal return upon its withdrawal or dissolution (see

at (406)444-6900.

TCC below).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Legal

1

1