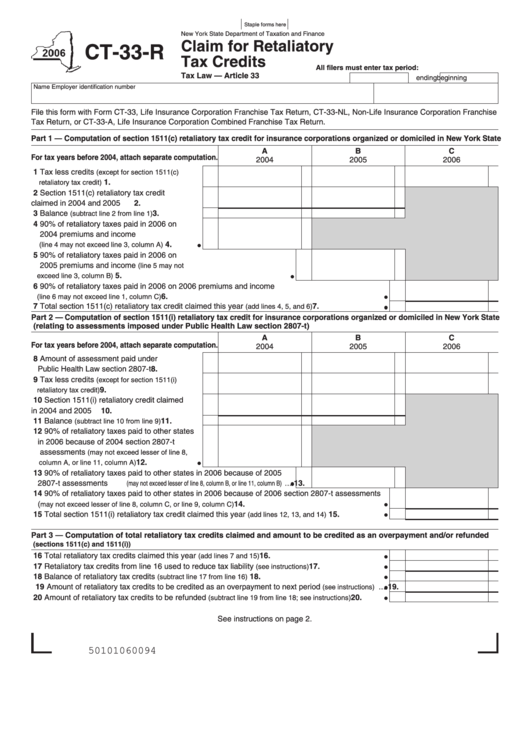

Form Ct-33-R - Claim For Retaliatory Tax Credits

ADVERTISEMENT

Staple forms here

New York State Department of Taxation and Finance

Claim for Retaliatory

CT-33-R

Tax Credits

All filers must enter tax period:

Tax Law — Article 33

beginning

ending

Name

Employer identification number

File this form with Form CT-33, Life Insurance Corporation Franchise Tax Return, CT-33-NL, Non-Life Insurance Corporation Franchise

Tax Return, or CT-33-A, Life Insurance Corporation Combined Franchise Tax Return.

Part 1 — Computation of section 1511(c) retaliatory tax credit for insurance corporations organized or domiciled in New York State

A

B

C

For tax years before 2004, attach separate computation.

2004

2005

2006

1 Tax less credits

(except for section 1511(c)

.....................................

1.

retaliatory tax credit)

2 Section 1511(c) retaliatory tax credit

2.

claimed in 2004 and 2005 .........................

3 Balance

3.

.................

(subtract line 2 from line 1)

4 90% of retaliatory taxes paid in 2006 on

2004 premiums and income

4.

........

(line 4 may not exceed line 3, column A)

5 90% of retaliatory taxes paid in 2006 on

2005 premiums and income

(line 5 may not

.........................................................................

5.

exceed line 3, column B)

6 90% of retaliatory taxes paid in 2006 on 2006 premiums and income

..............................................................................................

6.

(line 6 may not exceed line 1, column C)

7 Total section 1511(c) retaliatory tax credit claimed this year

............................

7.

(add lines 4, 5, and 6)

Part 2 — Computation of section 1511(i) retaliatory tax credit for insurance corporations organized or domiciled in New York State

(relating to assessments imposed under Public Health Law section 2807-t)

A

B

C

For tax years before 2004, attach separate computation.

2004

2005

2006

8 Amount of assessment paid under

8.

Public Health Law section 2807-t..............

9 Tax less credits

(except for section 1511(i)

.....................................

9.

retaliatory tax credit)

10 Section 1511(i) retaliatory credit claimed

in 2004 and 2005 ...................................... 10.

11 Balance

............... 11.

(subtract line 10 from line 9)

12 90% of retaliatory taxes paid to other states

in 2006 because of 2004 section 2807-t

assessments

(may not exceed lesser of line 8,

....................

12.

column A, or line 11, column A)

13 90% of retaliatory taxes paid to other states in 2006 because of 2005

13.

2807-t assessments

...

(may not exceed lesser of line 8, column B, or line 11, column B)

14 90% of retaliatory taxes paid to other states in 2006 because of 2006 section 2807-t assessments

(

.............................................................

14.

may not exceed lesser of line 8, column C, or line 9, column C)

15 Total section 1511(i) retaliatory tax credit claimed this year

........................

15.

(add lines 12, 13, and 14)

Part 3 — Computation of total retaliatory tax credits claimed and amount to be credited as an overpayment and/or refunded

(sections 1511(c) and 1511(i))

16 Total retaliatory tax credits claimed this year

.......................................................

16.

(add lines 7 and 15)

17 Retaliatory tax credits from line 16 used to reduce tax liability

................................

17.

(see instructions)

18 Balance of retaliatory tax credits

............................................................

18.

(subtract line 17 from line 16)

19 Amount of retaliatory tax credits to be credited as an overpayment to next period

19.

...

(see instructions)

20 Amount of retaliatory tax credits to be refunded

20.

.............

(subtract line 19 from line 18; see instructions)

See instructions on page 2.

50101060094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1