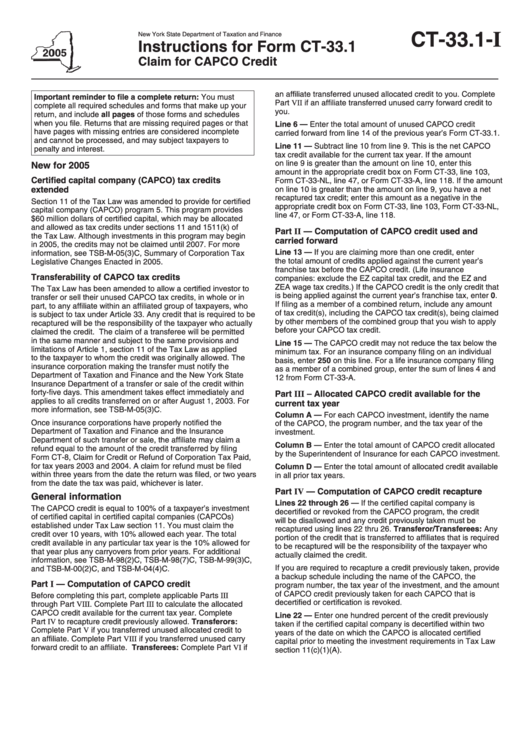

Instructions For Form Ct-33.1 - Claim For Capco Credit - New York State Department Of Taxation And Finance - 2005

ADVERTISEMENT

CT-33.1- I

New York State Department of Taxation and Finance

Instructions for Form CT-33.1

Claim for CAPCO Credit

an affiliate transferred unused allocated credit to you. Complete

Important reminder to file a complete return: You must

Part VII if an affiliate transferred unused carry forward credit to

complete all required schedules and forms that make up your

you.

return, and include all pages of those forms and schedules

when you file. Returns that are missing required pages or that

Line 6 — Enter the total amount of unused CAPCO credit

have pages with missing entries are considered incomplete

carried forward from line 14 of the previous year’s Form CT-33.1.

and cannot be processed, and may subject taxpayers to

Line 11 — Subtract line 10 from line 9. This is the net CAPCO

penalty and interest.

tax credit available for the current tax year. If the amount

on line 9 is greater than the amount on line 10, enter this

New for 2005

amount in the appropriate credit box on Form CT-33, line 103,

Certified capital company (CAPCO) tax credits

Form CT-33-NL, line 47, or Form CT-33-A, line 118. If the amount

extended

on line 10 is greater than the amount on line 9, you have a net

recaptured tax credit; enter this amount as a negative in the

Section 11 of the Tax Law was amended to provide for certified

appropriate credit box on Form CT-33, line 103, Form CT-33-NL,

capital company (CAPCO) program 5. This program provides

line 47, or Form CT-33-A, line 118.

$60 million dollars of certified capital, which may be allocated

and allowed as tax credits under sections 11 and 1511(k) of

Part II — Computation of CAPCO credit used and

the Tax Law. Although investments in this program may begin

carried forward

in 2005, the credits may not be claimed until 2007. For more

Line 13 — If you are claiming more than one credit, enter

information, see TSB-M-05(3)C, Summary of Corporation Tax

the total amount of credits applied against the current year’s

Legislative Changes Enacted in 2005.

franchise tax before the CAPCO credit. (Life insurance

Transferability of CAPCO tax credits

companies: exclude the EZ capital tax credit, and the EZ and

ZEA wage tax credits.) If the CAPCO credit is the only credit that

The Tax Law has been amended to allow a certified investor to

is being applied against the current year’s franchise tax, enter 0.

transfer or sell their unused CAPCO tax credits, in whole or in

If filing as a member of a combined return, include any amount

part, to any affiliate within an affiliated group of taxpayers, who

of tax credit(s), including the CAPCO tax credit(s), being claimed

is subject to tax under Article 33. Any credit that is required to be

by other members of the combined group that you wish to apply

recaptured will be the responsibility of the taxpayer who actually

before your CAPCO tax credit.

claimed the credit. The claim of a transferee will be permitted

in the same manner and subject to the same provisions and

Line 15 — The CAPCO credit may not reduce the tax below the

limitations of Article 1, section 11 of the Tax Law as applied

minimum tax. For an insurance company filing on an individual

to the taxpayer to whom the credit was originally allowed. The

basis, enter 250 on this line. For a life insurance company filing

insurance corporation making the transfer must notify the

as a member of a combined group, enter the sum of lines 4 and

Department of Taxation and Finance and the New York State

12 from Form CT-33-A.

Insurance Department of a transfer or sale of the credit within

forty-five days. This amendment takes effect immediately and

Part III – Allocated CAPCO credit available for the

applies to all credits transferred on or after August 1, 2003. For

current tax year

more information, see TSB-M-05(3)C.

Column A — For each CAPCO investment, identify the name

Once insurance corporations have properly notified the

of the CAPCO, the program number, and the tax year of the

Department of Taxation and Finance and the Insurance

investment.

Department of such transfer or sale, the affiliate may claim a

Column B — Enter the total amount of CAPCO credit allocated

refund equal to the amount of the credit transferred by filing

by the Superintendent of Insurance for each CAPCO investment.

Form CT-8, Claim for Credit or Refund of Corporation Tax Paid,

for tax years 2003 and 2004. A claim for refund must be filed

Column D — Enter the total amount of allocated credit available

within three years from the date the return was filed, or two years

in all prior tax years.

from the date the tax was paid, whichever is later.

Part IV — Computation of CAPCO credit recapture

General information

Lines 22 through 26 — If the certified capital company is

The CAPCO credit is equal to 100% of a taxpayer’s investment

decertified or revoked from the CAPCO program, the credit

of certified capital in certified capital companies (CAPCOs)

will be disallowed and any credit previously taken must be

established under Tax Law section 11. You must claim the

recaptured using lines 22 thru 26. Transferor/Transferees: Any

credit over 10 years, with 10% allowed each year. The total

portion of the credit that is transferred to affiliates that is required

credit available in any particular tax year is the 10% allowed for

to be recaptured will be the responsibility of the taxpayer who

that year plus any carryovers from prior years. For additional

actually claimed the credit.

information, see TSB-M-98(2)C, TSB-M-98(7)C, TSB-M-99(3)C,

If you are required to recapture a credit previously taken, provide

and TSB-M-00(2)C, and TSB-M-04(4)C.

a backup schedule including the name of the CAPCO, the

Part I — Computation of CAPCO credit

program number, the tax year of the investment, and the amount

of CAPCO credit previously taken for each CAPCO that is

Before completing this part, complete applicable Parts III

decertified or certification is revoked.

through Part VIII. Complete Part III to calculate the allocated

CAPCO credit available for the current tax year. Complete

Line 22 — Enter one hundred percent of the credit previously

Part IV to recapture credit previously allowed. Transferors:

taken if the certified capital company is decertified within two

Complete Part V if you transferred unused allocated credit to

years of the date on which the CAPCO is allocated certified

an affiliate. Complete Part VIII if you transferred unused carry

capital prior to meeting the investment requirements in Tax Law

forward credit to an affiliate. Transferees: Complete Part VI if

section 11(c)(1)(A).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2