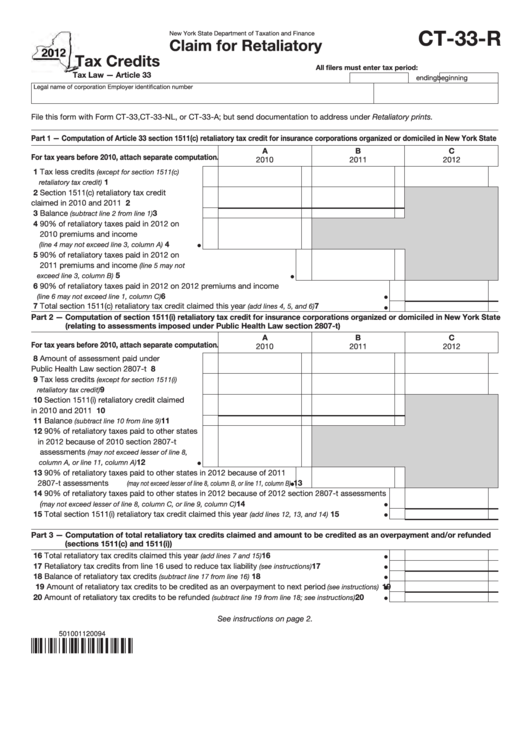

Form Ct-33-R - Claim For Retaliatory Tax Credits - 2012

ADVERTISEMENT

CT-33-R

New York State Department of Taxation and Finance

Claim for Retaliatory

Tax Credits

All filers must enter tax period:

Tax Law — Article 33

beginning

ending

Legal name of corporation

Employer identification number

File this form with Form CT-33, CT-33-NL, or CT-33-A; but send documentation to address under Retaliatory prints.

Part 1 — Computation of Article 33 section 1511(c) retaliatory tax credit for insurance corporations organized or domiciled in New York State

A

B

C

For tax years before 2010, attach separate computation.

2010

2011

2012

1 Tax less credits

(except for section 1511(c)

1

.....................................

retaliatory tax credit)

2 Section 1511(c) retaliatory tax credit

claimed in 2010 and 2011 ........................

2

3 Balance

.................

3

(subtract line 2 from line 1)

4 90% of retaliatory taxes paid in 2012 on

2010 premiums and income

........

4

(line 4 may not exceed line 3, column A)

5 90% of retaliatory taxes paid in 2012 on

2011 premiums and income

(line 5 may not

.........................................................................

5

exceed line 3, column B)

6 90% of retaliatory taxes paid in 2012 on 2012 premiums and income

..............................................................................................

6

(line 6 may not exceed line 1, column C)

7 Total section 1511(c) retaliatory tax credit claimed this year

............................

7

(add lines 4, 5, and 6)

Part 2 — Computation of section 1511(i) retaliatory tax credit for insurance corporations organized or domiciled in New York State

(relating to assessments imposed under Public Health Law section 2807-t)

A

B

C

For tax years before 2010, attach separate computation.

2010

2011

2012

8 Amount of assessment paid under

Public Health Law section 2807-t ............

8

9 Tax less credits

(except for section 1511(i)

9

.....................................

retaliatory tax credit)

10 Section 1511(i) retaliatory credit claimed

in 2010 and 2011 ...................................... 10

11 Balance

............... 11

(subtract line 10 from line 9)

12 90% of retaliatory taxes paid to other states

in 2012 because of 2010 section 2807-t

assessments

(may not exceed lesser of line 8,

12

....................

column A, or line 11, column A)

13 90% of retaliatory taxes paid to other states in 2012 because of 2011

2807-t assessments

13

(may not exceed lesser of line 8, column B, or line 11, column B)

14 90% of retaliatory taxes paid to other states in 2012 because of 2012 section 2807-t assessments

(

............................................................

14

may not exceed lesser of line 8, column C, or line 9, column C)

15 Total section 1511(i) retaliatory tax credit claimed this year

........................

15

(add lines 12, 13, and 14)

Part 3 — Computation of total retaliatory tax credits claimed and amount to be credited as an overpayment and/or refunded

(sections 1511(c) and 1511(i))

16 Total retaliatory tax credits claimed this year

.......................................................

16

(add lines 7 and 15)

17 Retaliatory tax credits from line 16 used to reduce tax liability

17

...............................

(see instructions)

18 Balance of retaliatory tax credits

............................................................

18

(subtract line 17 from line 16)

19 Amount of retaliatory tax credits to be credited as an overpayment to next period

19

(see instructions)

20 Amount of retaliatory tax credits to be refunded

20

............

(subtract line 19 from line 18; see instructions)

See instructions on page 2.

501001120094

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2