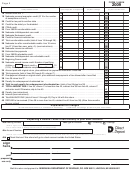

FORM 1040XN

Page 2

2009

(A) As Reported or Adjusted

(B) Net Change

(C) Correct Amount

Computation of Tax

18 Amount from line 17 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 18

18

19 Nebraska personal exemption credit ($118 x the number

of exemptions on line 4) . . . . . . . . . . . . . . . . . . . . . . . . . . . 19

19

20 Credit for tax paid to another state . . . . . . . . . . . . . . . . . . . 20

20

21 Credit for the elderly or the disabled . . . . . . . . . . . . . . . . . . 21

21

22 CDAA credit . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 22

22

23 Form 3800N nonrefundable credit . . . . . . . . . . . . . . . . . . . . 23

23

24 Nebraska child/dependent care credit . . . . . . . . . . . . . . . . 24

24

25 Nebraska Endowment credit . . . . . . . . . . . . . . . . . . . . . . . . 25

25

26 Credit for financial institution tax . . . . . . . . . . . . . . . . . . . . . 26

26

27 Total nonrefundable credits (total of lines 19 through 26) . . 27

27

28 Nebraska tax after nonrefundable credits . Line 18 minus

line 27 (if less than zero, enter -0-) (see instructions) . . . . . 28

28

29 Nebraska income tax withheld . . . . . . . . . . . . . . . . . . . . . . 29

29

30 Estimated tax payments . . . . . . . . . . . . . . . . . . . . . . . . . . . 30

30

31 Form 3800N refundable credit . . . . . . . . . . . . . . . . . . . . . . . 31

31

32 Nebraska child/dependent care refundable credit . . . . . . . . 32

32

33 Beginning Farmer credit . . . . . . . . . . . . . . . . . . . . . . . . . . . 33

33

34 Nebraska earned income credit . Number of qualifying

children

Federal credit

x .10

97

98

(10%) . Partial-year residents complete lines 74 and 75 . . . 34

34

35 Amount paid with original return, plus additional tax payments made after it was filed . . . . . . . . . . . . . . . . . . . 35

36 Total payments (total of lines 29 through 35, column C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 36

37 Overpayment allowed on original return, plus additional overpayments of tax allowed after it was filed . . . . . . 37

38 Line 36 minus line 37 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 38

39 Penalty for underpayment of estimated tax . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 39

40 Total tax and penalty for underpayment of estimated tax. (total of line 28 plus line 39) . . . . . . . . . . . . . . . . 40

41 TOTAL AMOUNT DUE. If line 38, column C is less than line 40, subtract line 38 from line 40, column C

and enter result . Otherwise, skip to line 45 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 41

42 Penalty (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 42

43 Interest (see instructions) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 43

44 Total BALANCE DUE (total of lines 41 through 43) . Pay in full with this return . . . . . . . . . . . . . . . . . . . . . . . . . . 44

45 REFUND to be received (If line 38 is more than line 40, subtract line 40 from line 38) (Allow three months

for your refund) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 45

Explanation of Changes

• Attach additional sheets or schedules if necessary.

• Reference net change (Column B) and line number.

Expecting a Refund? Have it sent directly to your bank account!

46a Routing Number

46b Type of Account

1 = Checking

2 = Savings

(Enter 9 digits, first two digits must be 01 through 12, or 21 through 32;

use an actual check or savings account number, not a deposit slip)

46c Account Number

(Can be up to 17 characters . Omit hyphens, spaces, and special symbols . Enter from left to right and leave any unused boxes blank .)

46d

Check this box if this refund will go to a bank account outside the United States .

Under penalties of perjury, I declare that, as taxpayer or preparer, I have examined this return and to the best of my knowledge and belief, it is correct and complete .

sign

here

Your Signature

Date

E-Mail Address

(

)

Spouse’s Signature (if filing jointly, both must sign)

Daytime Phone

paid

preparer’s

Preparer’s Signature

Date

Preparer’s Social Security Number or PTIN

use only

(

)

Print Firm’s Name (or yours if self-employed), Address and Zip Code

EIN

Daytime Phone

Mail this return and payment to: NEBRASKA DEPARTMENT OF REVENUE, P.O. BOX 98911, LINCOLN, NE 68509-8911

1

1 2

2 3

3